Kelowna Homebuyers: How the New Stress Test Impacts Your Mortgage Approval & What You’ll Pay if Interest Rates Go Up

This article explains how the new stress test rule will lower your mortgage approval maximum. Then we run the numbers to show you how potential interest rate increases will affect your monthly mortgage payments.

The CMHC Mortgage Stress Test

To get approved for a home mortgage in Canada, all homebuyers need to pass the CMHC stress test. The stress evaluates how well you can manage financial shocks to your mortgage situation such as reductions in your household income or increases to your mortgage rate.

To pass the test, you need to prove that you can afford your monthly mortgage payments at the benchmark rate, which is increasing from 4.79% to 5.25% on June 1st, 2021. Let’s see how this 0.46 percentage point increase affects Kelowna homebuyers.

Right now the Bank of Canada is afraid that Canadian households will not be able to afford their monthly mortgage payments if interest rates go up, which could lead to a wave of mortgage defaults similar to the 1980s

How the Benchmark Rate Increase Affects Buyers

Before the June 1st, 2021 change, a Kelowna homebuyer with a household income of $125,000 paying 20% down could afford a maximum home price of $671,292 at the benchmark rate of 4.79%. When the benchmark rate rises to 5.25% on June 1st, the same homebuyer with a $125,000 income would be able to afford a maximum purchase price of $645,753; a decrease in the maximum purchase price of $25,539 or ~4%*.

*Figures via ratehub.ca mortgage calculator

The Benchmark Rate for Uninsured Mortgages

Your mortgage is considered uninsured if your down payment is less than 20%. For uninsured mortgages, CMHC calculates your stress test using the higher number of either 5.25% or your mortgage rate plus 2%.

How Interest Rate Increases Affect Your Payments

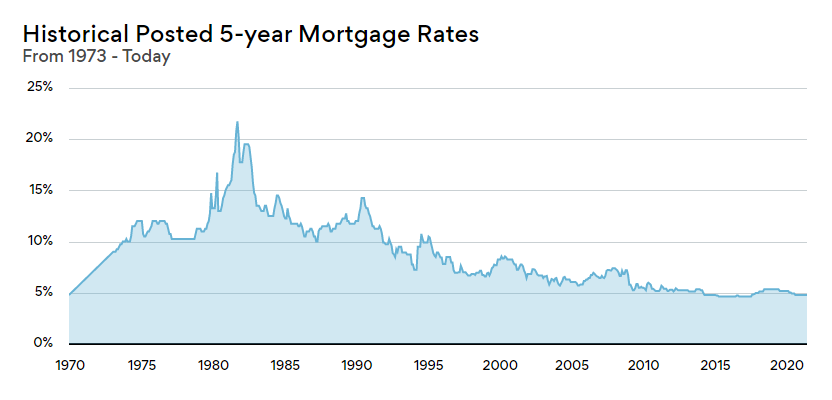

While many economists are predicting low rates for the long-term, we’ve seen the 5-year fixed rate in Canada rise to 19.2% in the 1980s, which forced many households into mortgage default.

Canadian 5-year Mortgage Rates Since 1970. Source: Ratehub.ca

But for the purpose of illustration, let’s see how increases in the mortgage rate will affect Kelowna’s 2020 and 2021 homebuyers.

Check out our 2023 mortage rate forecast.

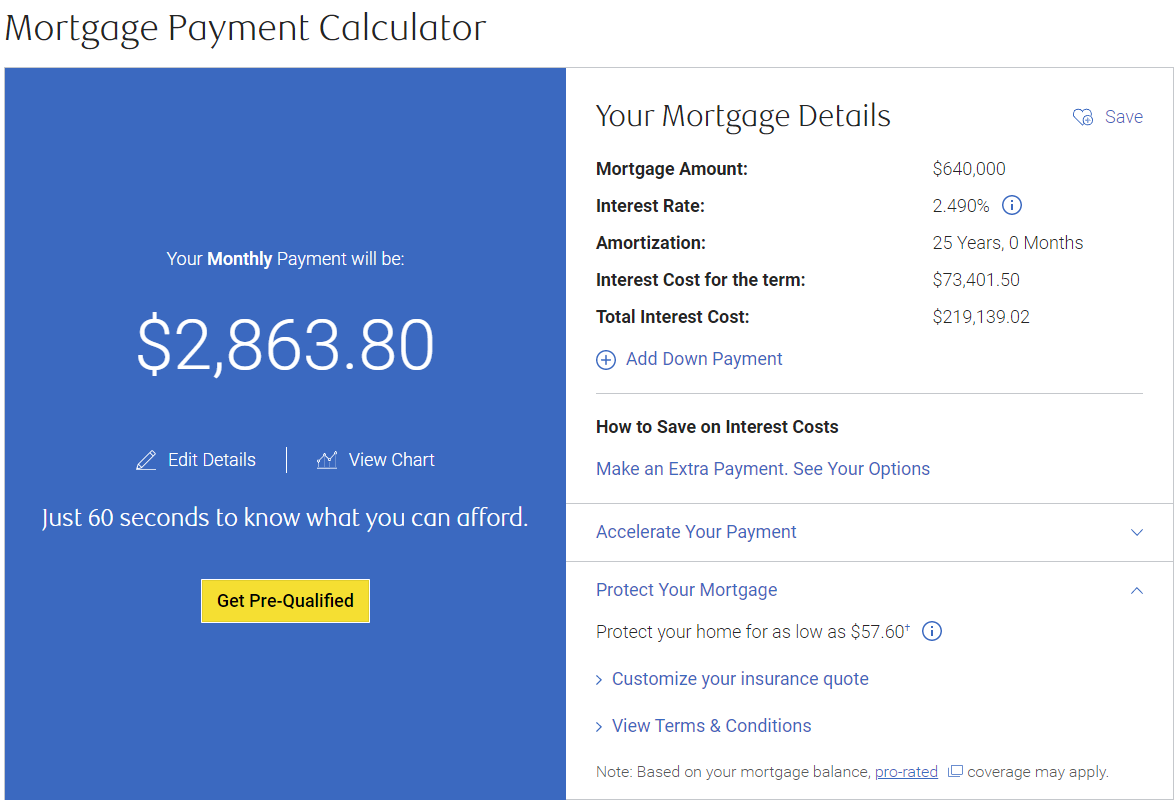

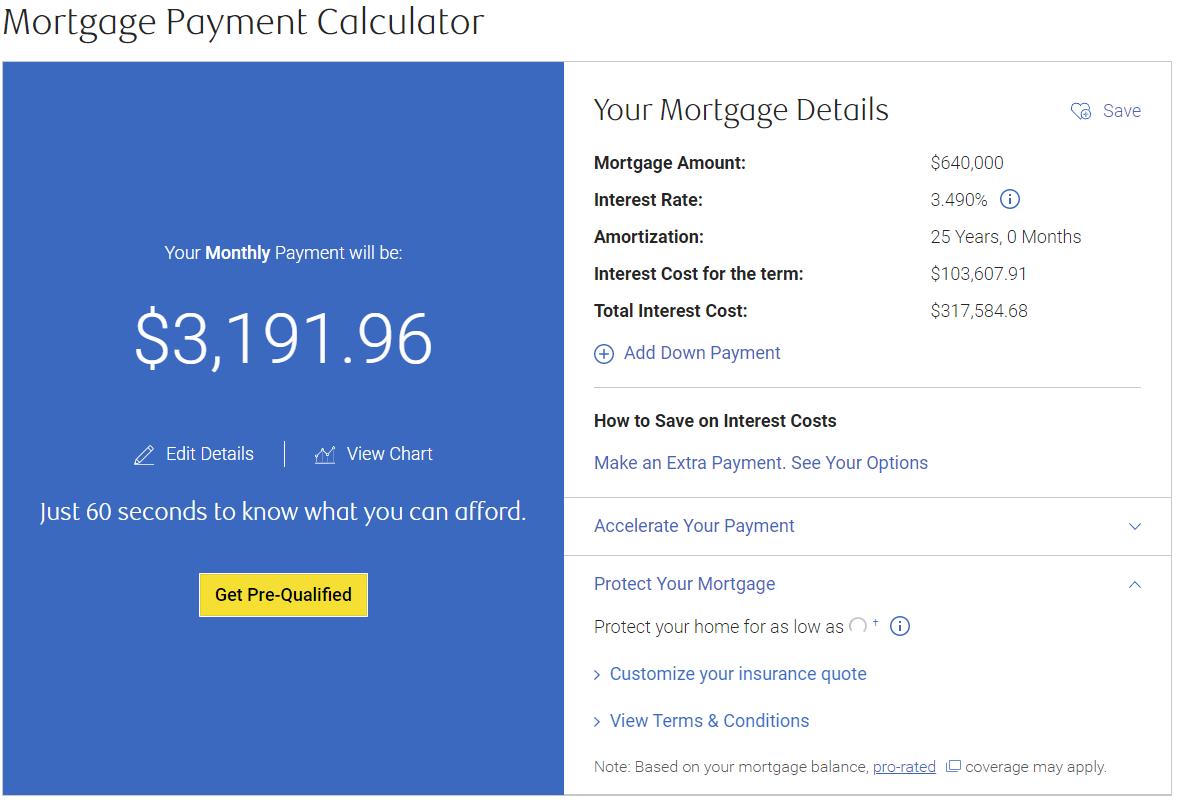

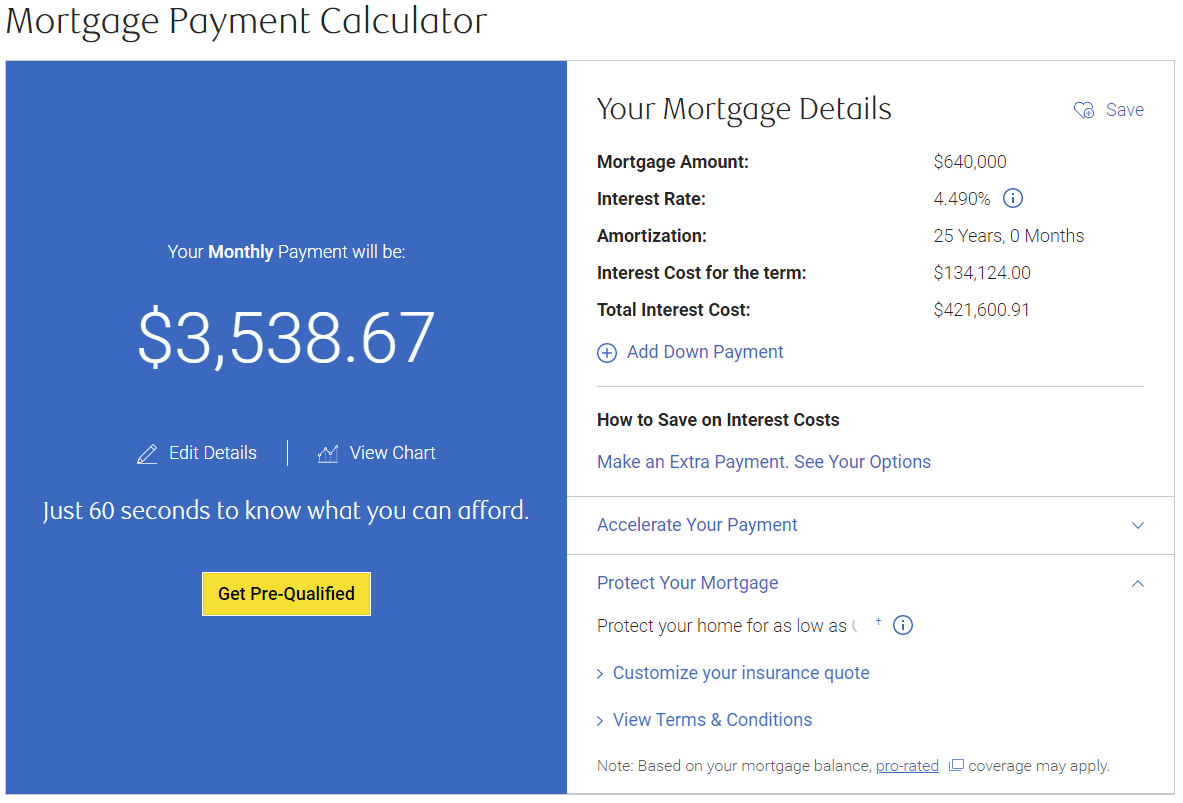

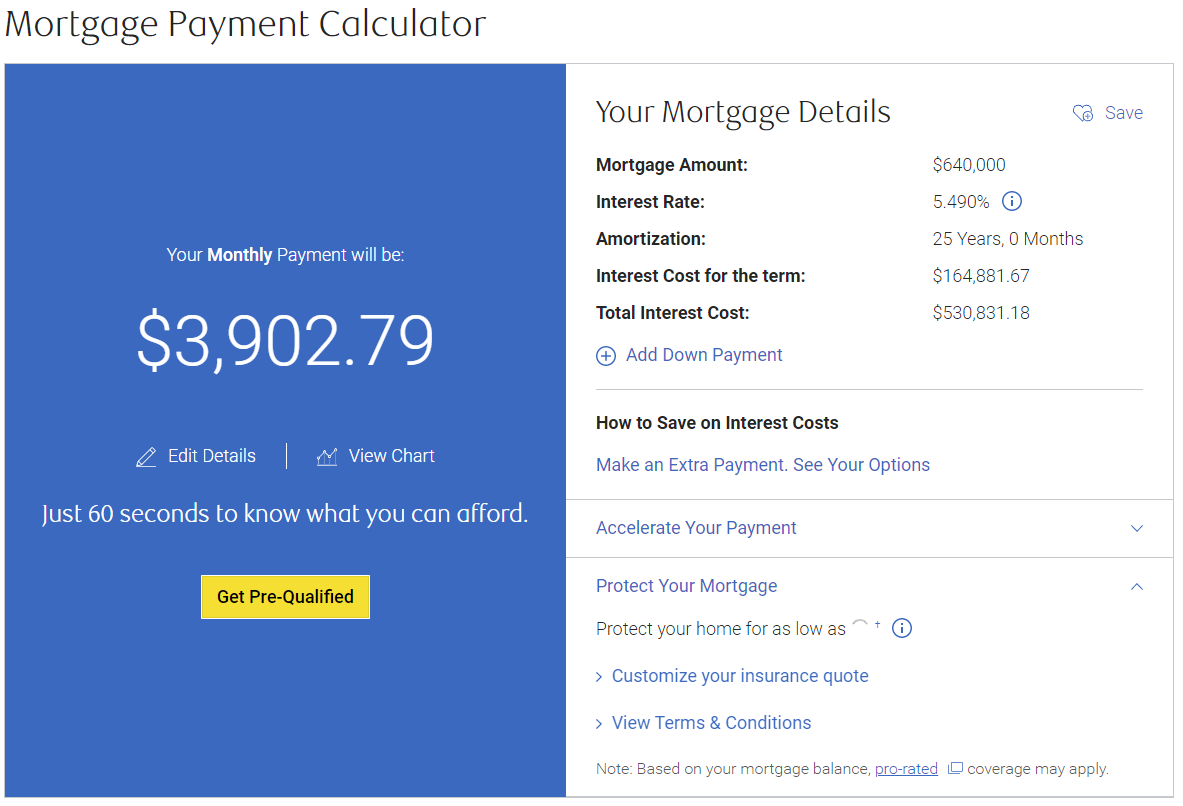

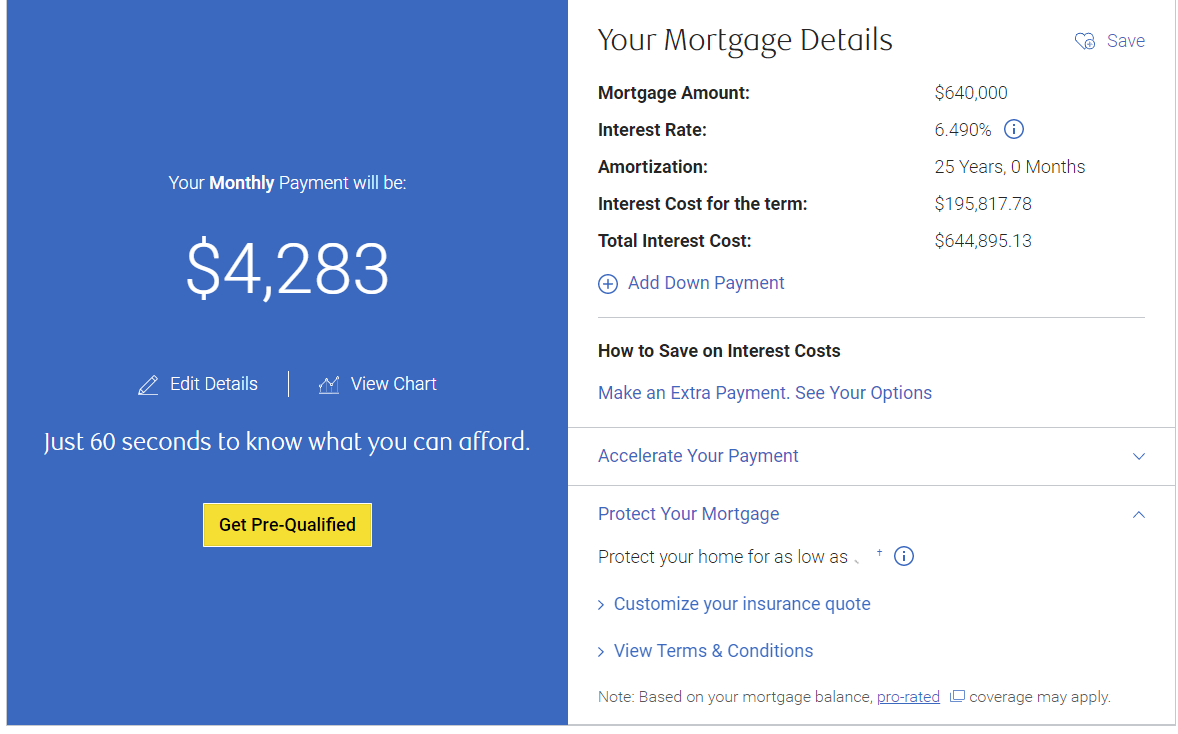

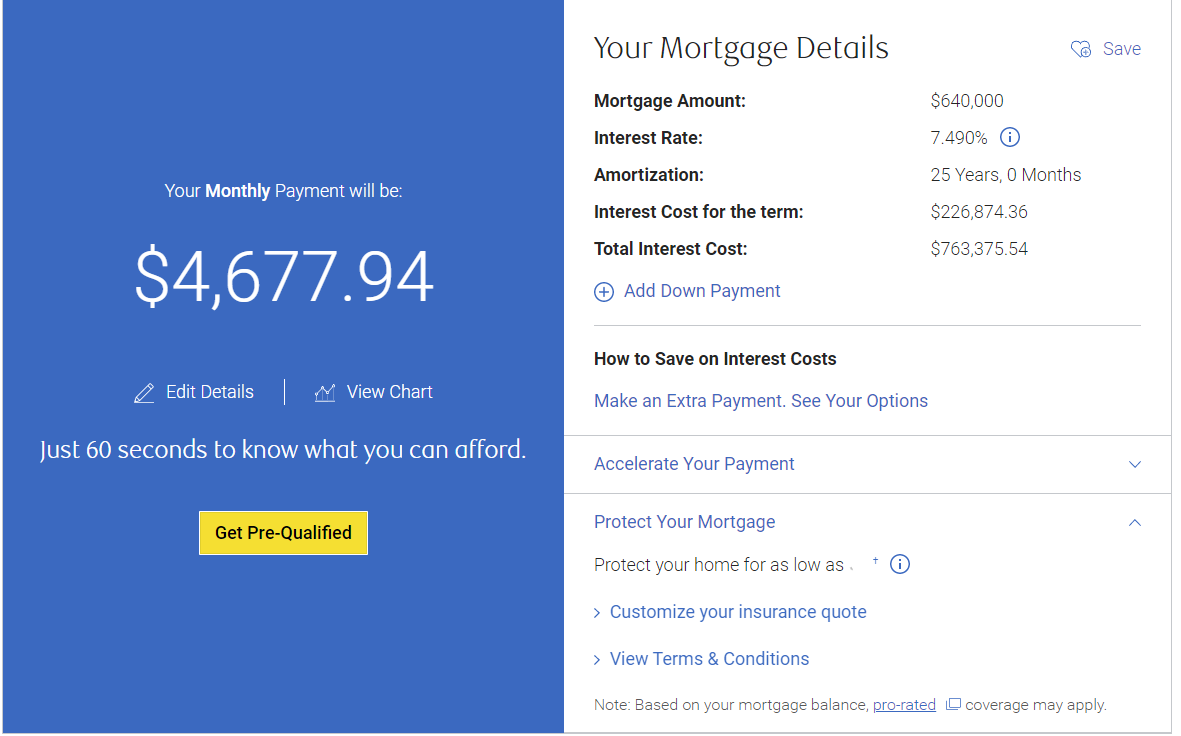

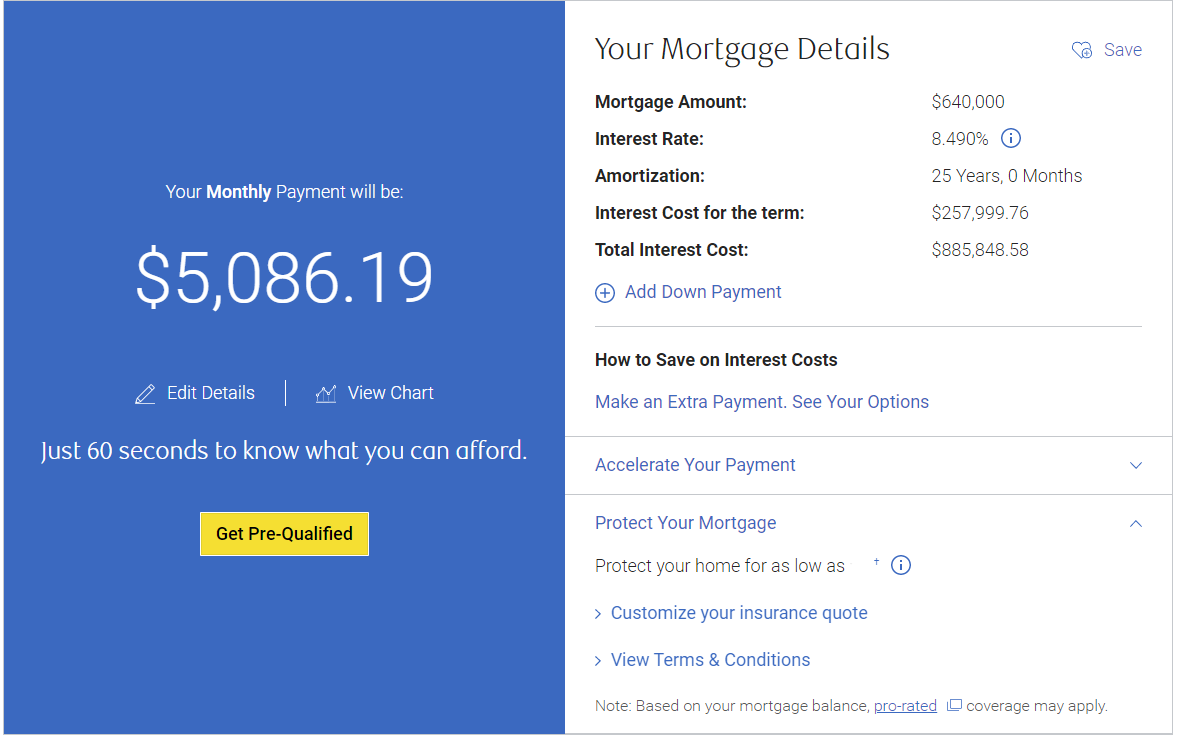

The table below is based on a detached single-family home at the average price of $800 thousand using 20% down with 25-year amortization.

Fixed 5-year Rate | Mortgage Amount | Monthly Payment | Monthly Payment Increase from Previous Rate | Total Interest Cost | Total Interest Increase from Previous Rate |

2.49 | $640,000.00 | $2,863.80 | - | $219,139.02 | - |

3.49 | $640,000.00 | $3,191.96 | $328.16 | $317,584.68 | $98,445.66 |

4.49 | $640,000.00 | $3,538.67 | $346.71 | $421,600.91 | $104,016.23 |

5.59 | $640,000.00 | $3,902.79 | $364.12 | $530,831.18 | $109,230.27 |

6.59 | $640,000.00 | $4,283.00 | $380.21 | $644,895.13 | $114,063.95 |

7.59 | $640,000.00 | $4,677.94 | $394.94 | $763,375.54 | $118,480.41 |

8.59 | $640,000.00 | $5,086.19 | $408.25 | $885,848.58 | $122,473.04 |

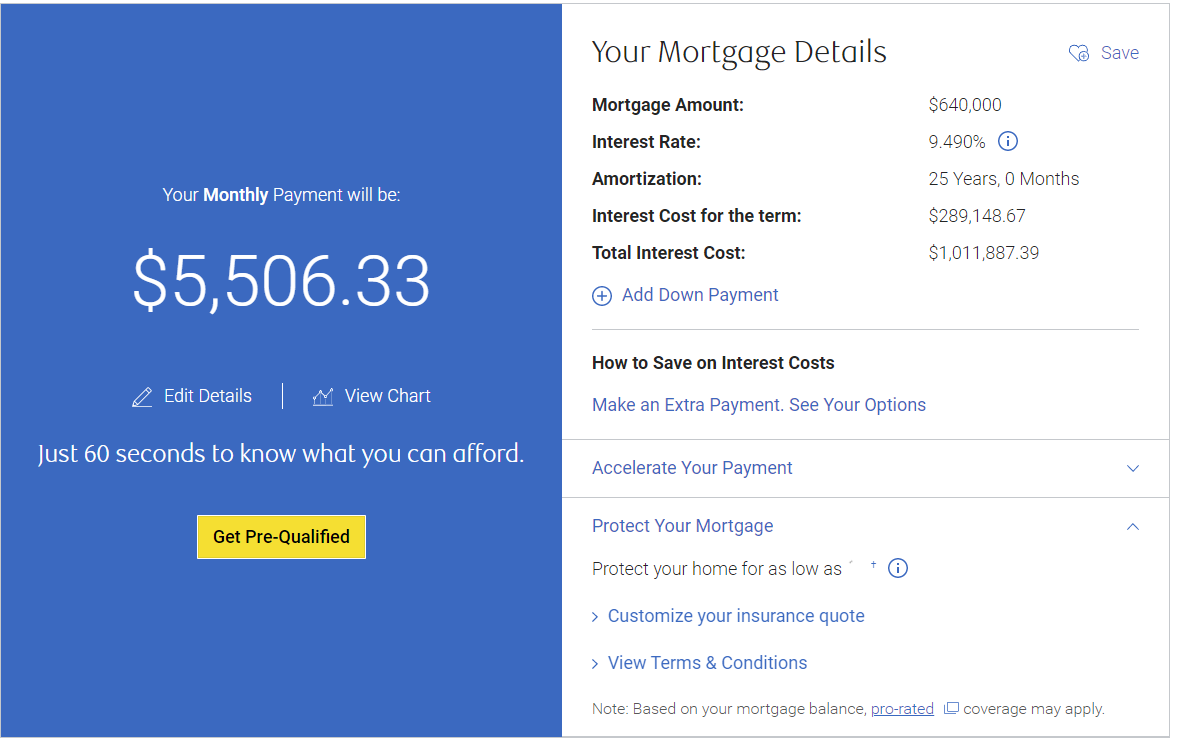

9.59 | $640,000.00 | $5,506.33 | $420.14 | $1,011,887.39 | $126,038.81 |

Figures taken from the RBC Mortgage Payment Calculator based on a $640,000 mortgage principle.

As we can see in the table above, each percentage point increase in the fixed 5-year rate translates into an increase in monthly payments of approximately $328 to $420, and an increase in total interest of $98,445 to $126,038.

Due to the magnitude of outstanding global debt, it’s highly unlikely rates will ever rise this fast again; it would be far too punishing for western economies. It’s also worth mentioning that interest rates typically rise by half or quarter percentage points.

But it’s always important to prepare for unforeseen events.

To make sure you create a manageable financial situation for your household, Vantage West Realtors can connect you with a curated list of Kelowna’s most experienced mortgage brokers, insurance agents, and financial advisors.

Contact us today.

Phone: 250-717-3133

Email: [email protected]

The Mortgage Stress Test for a $800K Home:

$800,000 | 15% down | $680,000 mortgage

Fixed 5-year 2.49%

Fixed 5-year 3.49%

Fixed 5-year 4.49%

Fixed 5-year 5.49%

Fixed 5-year 6.49%

Fixed 5-year 7.49%

Fixed 5-year 8.49%

Fixed 5-year 9.49%

Thinking about buying in the Okanagan?

We'd love to help you find your dream home.