BOOMERS: EXITING THE RAT RACE IN 2018

A 2018 RETIREMENT RESCUE PLAN

By AJ Hazzi

CHANGE YOUR OUTLOOK

Frustrated Canadian Baby Boomers are now finding themselves staring straight down the barrel of retirement. Financial planners have told them they’ll need to bank at least two million dollars to enjoy their golden years in comfort. Based on the returns offered by products in the financial services industry today, that assessment is unfortunately quite accurate.

Accepting this new paradigm can be downright discouraging for the majority of Boomers who have their net worth tied up in low-yield savings accounts and expensive primary residences. On the bright side, there’s an alternative route to financial independence.

After years of steady growth in our major urban centres, there’s never been a more sensible time to downsize your primary residence, shrink your footprint, and experience the freedom of exiting the rat race in style. This article outlines a strategy you can employ to earn a passive lifelong income while watching your net worth continue to grow past your retirement years.

WORRY NOT

Concerned about getting off that straight and narrow path with only a fraction of what you’ve been told you’ll need to retire? Hesitant about the legacy you’re hoping to leave your kids and grand-kids? Assuming 15-25 years of runway and very conservative growth expectations, I can say with confidence that $500K investment will be more than sufficient to make an “elegant exit” into retirement, and you’ll watch it grow into a sum of money large enough to provide multi-generational wealth for your loved ones.

SO WHERE DO WE START?

I’ve had the pleasure of consulting with a number of Boomers who have used their nest eggs to make strategic real estate investments and generate passive investment returns. Now I’m going to share a real world example of how I’ve been able to help individuals and couples design investment strategies that take less than six months to a year to execute – with no financial expertise or MBA required on their part.

.........................................................................................................................................................

CASE STUDY: TOM

This case study is a real-life story about a frustrated and highly risk-averse investor, who for the sake of privacy I will refer to as Tom. Following the conventional “wisdom”, he had whittled down most of his mortgage and was only a few years away from retiring and owning his home.

His risk aversion allowed him to build up a $500,000 nest egg, half in Registered Retirement Funds (RRSP) and the other half in low risk equities, government bonds, and GICs. His portfolio was returning a modest 4%, or $20,000 per year. On top of his expected annual $10,500 Canada Pension Plan, Tom was now facing the impending reality of living on a fixed income of $30,500 per year... for the next 20-40 years.

By most people's standards, he made it - with a net worth of $1.2 million (Includes 700k equity in primary residence), Tom had secured a safe future for himself and his family. The only thing keeping he and his wife up at night was the fact that they busted their humps to get to this point in life, but still wanted to live comfortably, spoil their grand-kids, and be free to check off their bucket list items. They knew Tom’s fixed income wouldn’t be adequate and wondered what else they could do through Tom’s final working years to improve the outcome of their golden years.

After reading a few of my articles, Tom came into my office and asked if I had any bright ideas to help him on his quest. He confided that he’d always been afraid of buying rental properties due to the risks. He’d heard horror stories of tenants stealing, doing the midnight dash, or just leaving places in terrible shape. Since Tom still worked full-time, he didn't have the time to run ads, screen tenants, handle maintenance, or chase down rent payments.

What he did like about his portfolio was that it offered a completely passive, hands-off income. We spent the next hour going over his personal finances, and I outlined an investment vehicle that provides handsome returns while eliminating the major risks associated with owning investment properties. Tom asked me to sketch up a plan for he and his wife over the next few days, and I welcomed the challenge.

STEP 1

I shared an opportunity in a limited partnership called Cash Offer LP that can offer 5 times higher returns than his current low-risk portfolio.

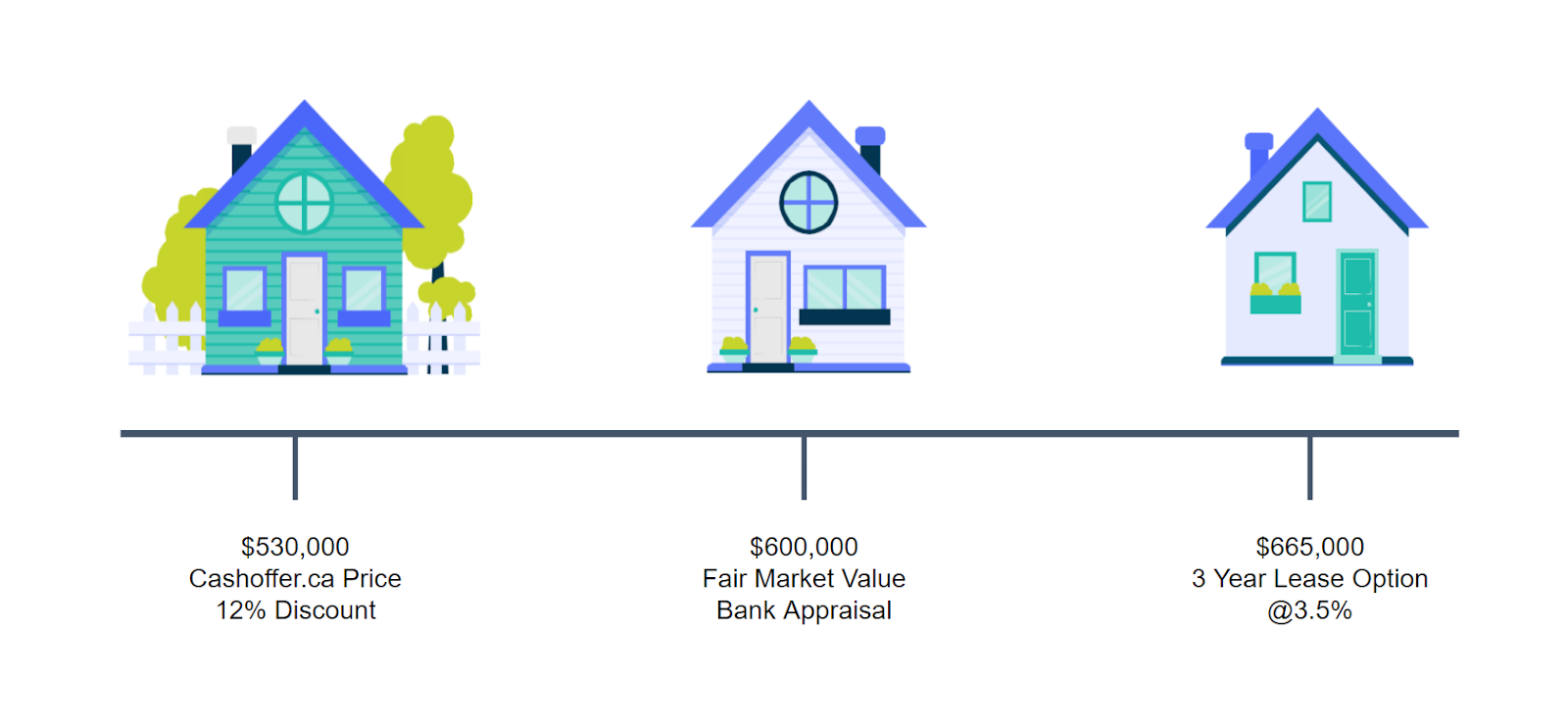

The fund’s strategy is simple: accredited investors like Tom pool their capital to make cash offers on homes at a discount of at least 10% from market value. Next, the partnership makes low hanging cosmetic improvements to increase property values, and then markets them as rent-to-own opportunities for the thousands of home-buyers that cannot qualify for a mortgage in today’s tight lending environment.

Next, the home is refinanced at 75% loan to value, and those funds are reinvested into additional properties that also become R2O Properties, managed by a team of seasoned real estate professionals who are mutually invested in Cash Offer LP. This combined strategy of buying at a discount with cash, making high return renovations, and then selling at a premium using a rent to own strategy generates outstanding profits.

Since the partnership has its own lending arrangement in place, this means Tom can access 4 to 1 leverage and the higher real estate returns without taking on any debt or providing a personal guarantee.

What he appreciated most is having his investment capital diversified over dozens of homes that produce a completely hands-off income. With his 250k investment in Cash Offer LP, Tom can comfortably expect to double his investment funds over the next 3-5 Years.

STEP 2

To make this next move, let’s turn our attention to another source of capital – his primary residence, valued at $800,000. The funds in home equity are essentially frozen, and it’s time to put them to work. Tom conservatively has $300,000 in home equity, which he can access on a line of credit for less than $10,000 in interest per year.

The plan for this chunk of equity is to purchase a multi-family investment property like an 8-plex. I found a suitable property listed at $1,200,000 which means he would need $300,000 for a 25% down payment. After management costs, interest, and expenses, renting out the 8-plex would produce a $30,000 cash flow every year.

STEP 3

The last puzzle piece in Tom's journey from barely-registering returns into the land of double digits is putting his RRSP on steroids.

I illustrated how Tom could invest his $250k in RRSP funds into a new, self-directed account to essentially become his own bank with the freedom to lend money to the real estate market privately for an expected 8-12% percent annual return. With his new plan, he can bank an additional $20,000 per year on his $250k in registered funds.

Now let's see what Tom’s financial picture looks like 3 years down the road when he decides to ditch work and focus his attention on that golden bucket list. After 3 years, his Cash Offer investment now sits at $500k and he’s banking a combined 16% return per year in capital gains and rental income.

Cash Offer LP investment - 16% ROI $80,000

8-Plex bought with $300k home equity - 10% ROI $30,000

RRSP's in a well-managed REIT - 8% ROI $20,000

Canada Pension Plan max amount: $10,500

Tom's Annual Pre-tax Earnings: $140,500 per year

Not only is this more money than Tom has ever made, the best part is that he won't be doing the heavy lifting and won’t have to trade in his time. Each hard-earned dollar in home equity and RRSPs has been given the healthy quota of returning an average 12.5% per annum, and on top of that, his apartment building is appreciating in value.

To replicate a $140k annual return with his old portfolio bringing in 3.5%, Tom would need close to 4 million dollars.

Helping Tom to see his nest egg’s potential was the best part of this entire process. After 20 years of investment compounding - as our once 55 year old investor approaches 75 years young and looks towards succession planning - he will have a debt-free portfolio worth approximately $4,000,000 generating a passive retirement income of $500,000 per year.

How’s that for a legacy? He left my office filled with hope and excited for the future.

If you’d like to know more about syndicated real estate investments like Cash Offer LP and other ways to earn double digit returns in the real estate market, email [email protected] or give us a call at 250-717-3133.