2025 Guide to Capital Gains Tax When Selling Your House in BC

Selling your home in Kelowna is a huge milestone. It’s often one of the most exciting financial moves you’ll ever make. But let's be honest, the words "capital gains tax" can cast a bit of a shadow on the celebration.

When it comes to the capital gains tax selling house, I’ve got good news for you right up front: this tax only ever applies to the profit you make from the sale. Even better, thanks to a powerful exemption for homeowners in BC, there's a very good chance you won't have to pay it at all.

Understanding Capital Gains On a Home Sale

Let's demystify this. Taxes can feel overwhelmingly complex, but the core idea of a capital gain is actually pretty straightforward. Whenever you sell an asset—whether it's stocks, a business, or your property—for more than you originally paid, that profit is considered a capital gain.

The Canada Revenue Agency (CRA) views that profit as taxable income. For countless families here in Kelowna, West Kelowna, and right across the Okanagan, their home is their single largest and most valuable asset. Given the incredible appreciation we’ve seen in the Okanagan real estate market, many long-time homeowners are sitting on some pretty significant gains. It's a challenge, but also a huge opportunity.

Calculating Your Capital Gain

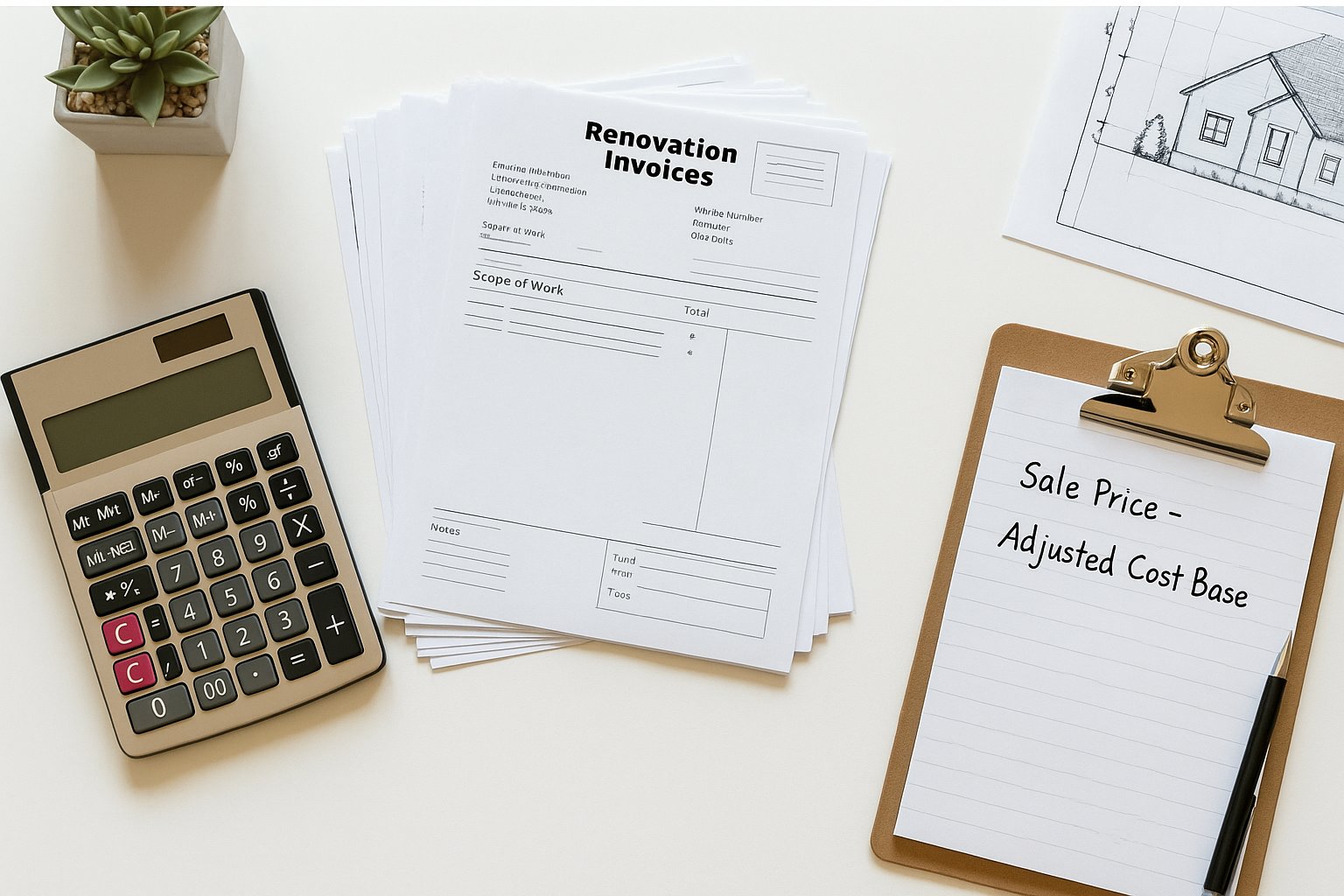

So, how do you figure out what your gain actually is? The formula itself is simple. You take the final sale price of your home and subtract something called its "adjusted cost base."

Your Adjusted Cost Base (ACB) is the price you paid for the house, plus any eligible costs you racked up when you bought it (like legal fees and land transfer tax), and—this is a big one—the cost of any major capital improvements you made along the way.

What counts as a major improvement? Think of projects that add real, lasting value, not just routine maintenance. We're talking about things like:

Finishing an unfinished basement: This adds a huge chunk of liveable square footage and boosts value.

A complete kitchen renovation: A full overhaul is a classic example of a capital improvement.

Adding a new deck or garage: These are substantial additions that increase the property's worth.

This is why keeping meticulous records of these expenses is so important. Every dollar you can legitimately add to your cost base is a dollar less in potential capital gains. For instance, say you bought a home in Penticton for $400,000. You then spent $50,000 on a new kitchen and had $10,000 in closing costs when you purchased it. Your adjusted cost base is $460,000.

Getting this calculation right is the first crucial step in understanding where you stand. Our clients, like a family in Glenmore who we recently helped, find that a well-documented ACB makes tax time so much smoother. For most homeowners, the next step involves the Principal Residence Exemption, which we'll dive into next. Nailing these fundamentals will help you navigate the financial side of selling your Okanagan home with confidence.

Key Home Sale Tax Terms

Getting a handle on the terminology can make the whole process feel less intimidating. Here’s a quick-reference table to help you keep these key terms straight.

Term Simple Explanation

Capital Gain | The profit you make when you sell your home for more than its total cost. |

Adjusted Cost Base (ACB) | The original purchase price plus buying costs (legal fees, etc.) and the cost of major improvements (like a new roof or kitchen). |

Proceeds of Disposition | The sale price of your home, minus any costs associated with selling it (like real estate commissions and legal fees). |

Principal Residence | Generally, the home you own and "ordinarily inhabit" during the year. You can only designate one principal residence per family unit per year. |

Principal Residence Exemption (PRE) | A powerful tax rule that can eliminate or reduce the capital gains tax you owe on the sale of your principal residence. |

Think of this table as your cheat sheet. Knowing what these terms mean will empower you to understand exactly how your home sale is treated by the CRA.

Your Guide to the Principal Residence Exemption

Here’s the best news for most homeowners in BC. The Canadian government has a powerful tool called the Principal Residence Exemption (PRE) that can often completely eliminate the capital gains tax you’d otherwise owe when selling your house.

This exemption is the government's way of acknowledging that for most of us, our home is where we build our life, not just an investment to be taxed. This is the single most important factor in the capital gains tax selling house conversation for homeowners.

But like any tax rule, it comes with specific criteria. The CRA has a clear definition of what qualifies, and it’s about more than just having an address.

What Qualifies as Your Principal Residence

To use the full exemption, your home must have been your principal residence for every year you owned it. The CRA has a few key conditions to figure out if your property actually qualifies.

The main idea is that you have to "ordinarily inhabit" the home. This doesn't mean you can't go on vacation, but it does need to be your primary home—the hub of your daily life.

A few key factors the CRA looks at include:

You, your spouse or common-law partner, or your children lived in it at some point during the year.

You designated the property as your principal residence on your tax forms.

You are a resident of Canada.

That last point is crucial for anyone considering a move or who spends significant time outside the country. Your residency status plays a big role in your eligibility.

The "One Property Per Year" Rule

Here’s a rule that trips some people up, especially in the Okanagan where owning a family home in Kelowna and a cabin on the lake near Vernon is common. A family unit (that's you, your spouse or common-law partner, and your children under 18) can only designate one property as their principal residence for any given year.

You can't claim your city house and your weekend getaway for the same year. This requires a strategic choice, often with the help of an accountant, to determine which property’s appreciation will give you the most benefit from the exemption.

For example, if you've owned a home in Penticton for ten years and a cabin for five, you’ll need to decide which property to designate for those five overlapping years. Typically, you would designate the property with the higher average capital gain per year to maximize your tax savings.

How the Exemption Calculation Works

Let's imagine you're selling your family home in West Kelowna. You bought it 10 years ago, lived there the entire time, and it's the only property you own. In this straightforward case, the PRE can cover 100% of your capital gain. You’ll still need to report the sale to the CRA, but your tax bill will be zero.

The formula the CRA uses even gives you a bit of a bonus. It's often called the "plus one" rule. Here’s the formula:

(Number of years you designate the home as your principal residence + 1) ÷ (Total years you owned the property)

This "plus one" year helps cover situations where you might sell one principal residence and buy another in the same year, ensuring there isn't a taxable gap. So, if you owned and lived in your home for 10 years, the calculation would be (10 + 1) / 10, meaning 110% of your gain is exempt—more than enough to cover it all.

Understanding the Principal Residence Exemption is the key to unlocking major tax savings when selling your Okanagan home. It's designed to help homeowners, and with a bit of knowledge, you can ensure you take full advantage of it.

When Capital Gains Tax Might Apply to Your Sale

The Principal Residence Exemption is a fantastic benefit for Canadian homeowners, but it’s not a free pass in every situation. Knowing when you might face a tax bill is crucial—planning ahead is always the smartest move when you’re dealing with an asset as significant as your Okanagan home.

So, let's walk through a few common scenarios where the capital gains tax from selling a house becomes a reality. These situations pop up all the time for property owners in Kelowna, Penticton, and right across the valley.

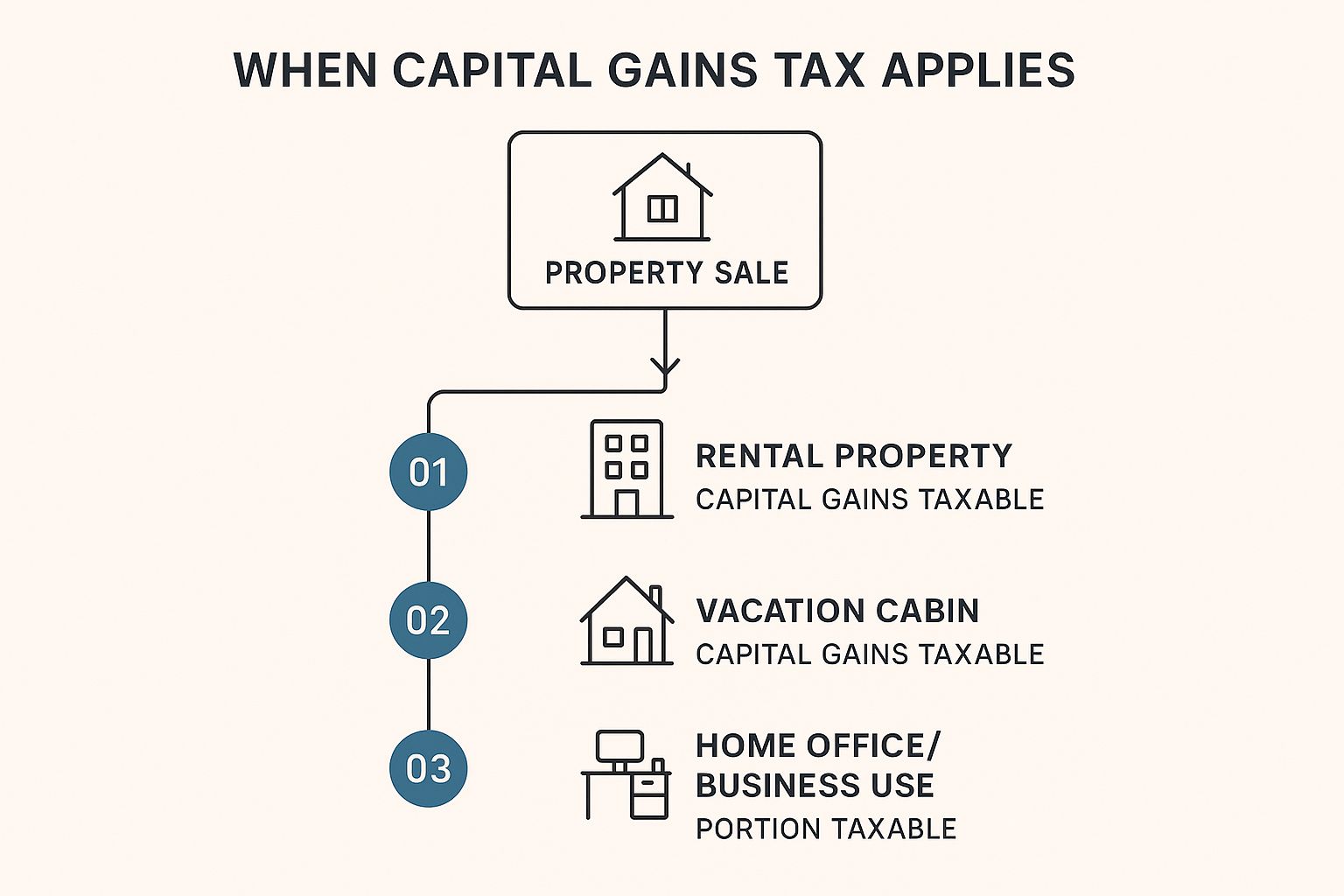

This flowchart gives you a quick visual of the most common situations where capital gains tax can apply to your property sale.

As you can see, once you move beyond selling your primary home and into the world of rental properties, vacation homes, or business use, tax implications come into play.

Selling a Rental or Investment Property

This one is the most straightforward. If you own a property in West Kelowna or Vernon that you’ve never personally lived in—it’s always been rented out—the Principal Residence Exemption simply doesn't apply.

When you sell that rental, any profit you make is a capital gain, plain and simple. It's a key factor for anyone looking to build a real estate portfolio here in the Okanagan.

Selling a Vacation Home or Cabin

Who doesn't love having a cabin on Okanagan Lake or a condo up at one of the ski resorts? It’s a huge part of the lifestyle here. But you can only designate one property as your principal residence for any given year.

That means your beloved second property will eventually be subject to capital gains tax when you sell it. Any increase in its value from the day you bought it will be considered a capital gain. This is where strategic planning with a tax professional is absolutely essential, especially if you've owned both properties for a long time.

Using Part of Your Home for Business

What happens when your home is also your workplace? It's a common setup for entrepreneurs, consultants, and anyone running a home-based business in Kelowna.

If you’ve claimed Capital Cost Allowance (CCA)—also known as depreciation—on the part of your home used for business, you've signalled to the CRA that this portion is an income-producing asset. As a result, that specific part of your property may not qualify for the Principal Residence Exemption.

For example, if you used 20% of your home's square footage exclusively as an office and claimed CCA on it, then 20% of the gain you realize upon selling could be taxable. This is a critical conversation to have with your accountant well before you decide to sell.

Turning Your Home into a Rental Property

Life changes. Maybe you decide to move but want to hold onto your original home as a rental. This "change in use" is a major event in the eyes of the CRA.

When your principal residence becomes an income-producing property, the CRA considers you to have sold it at its fair market value on that day, and then immediately bought it back at the same price. This is called a 'deemed disposition.' The good news? The PRE can shelter any gain up to that point. The catch? All future appreciation is now a taxable capital gain.

Selling a Home You Lived in for a Short Time

Owning a property for a very short period can sometimes raise a red flag. If your primary goal was to buy, renovate, and sell quickly for a profit—what's commonly known as "flipping"—the CRA might see your profit as business income, not a capital gain.

The difference is huge. Business income is 100% taxable, while only 50% of a capital gain is added to your income. Our guide on the BC home flipping tax digs into this topic in more detail. Understanding this distinction is vital for anyone doing quick-turnaround projects in the hot Okanagan real estate market.

How to Calculate Your Capital Gain and Potential Tax

Alright, so you've figured out you might have a taxable gain on your hands. The big question is, "How much are we actually talking about?" Let's break down the math. It's not nearly as intimidating as it looks, and walking through it step-by-step will give you a clear picture of what you might owe.

The entire calculation for the capital gains tax selling house boils down to figuring out your profit. In the CRA's language, this means subtracting your property's "Adjusted Cost Base" from its "Proceeds of Disposition."

Start With Your Proceeds of Disposition

This is the easy part. Your proceeds of disposition is simply the sale price of your home, but you get to subtract the costs you paid to sell it.

Think of things like:

Real estate commissions

Legal fees for the sale

Any advertising costs you covered

So, if you sold your Kelowna condo for $600,000 and paid $30,000 in commissions and legal fees, your proceeds of disposition would be $570,000. It's the net amount you pocket before dealing with the mortgage.

Figure Out Your Adjusted Cost Base

Next up is the other half of the equation: your Adjusted Cost Base (ACB). This is where keeping good records really pays dividends. Your ACB isn't just the price you paid for the property; it includes a lot more.

It starts with the original purchase price. Then, you add all the eligible expenses from when you bought it, plus the cost of any major capital improvements you've made over the years.

Your ACB represents the total capital you've invested in the property over its lifetime. The higher you can legitimately get this number, the lower your capital gain will be.

When tallying up your ACB, you can include much more than just the sticker price. Costs like legal fees, land transfer taxes, and significant improvements (like a new roof or a full kitchen reno) all count. What doesn't count is routine maintenance, like painting or minor repairs. This is why holding onto receipts for all those capital expenses is crucial—it helps you accurately calculate your gain and can seriously minimize your tax bill. To see exactly what the CRA allows, you can check their official guidelines on calculating your capital gain or loss.

Putting It All Together: A Penticton Example

Let's walk through a quick scenario for a rental property in Penticton to see how it all works in the real world.

First, the cost side:

Original Purchase Price: $300,000

Purchase Costs (Legal Fees, Land Transfer Tax): $8,000

Capital Improvements (New Windows & Deck): $42,000

Total Adjusted Cost Base (ACB): $350,000

Now, for the sale:

Selling Price: $700,000

Selling Costs (Commission, Legal Fees): $35,000

Total Proceeds of Disposition: $665,000

Finally, we calculate the capital gain:

$665,000 (Proceeds) - $350,000 (ACB) = $315,000 (Capital Gain)

The Final Step: The Inclusion Rate

The good news? You don't get taxed on that full $315,000. In Canada, we have what's called a capital gains inclusion rate. Right now, that rate is 50%.

This means only half of your total capital gain is actually considered taxable income.

Total Capital Gain: $315,000

Inclusion Rate: 50%

Taxable Capital Gain: $157,500

This $157,500 is the magic number. It's the amount you'll add to your total income for the year you sold the property. Your final tax bill will depend on your personal marginal tax rate, but now you can see exactly how the numbers come together to get a much clearer estimate of what you might owe.

Reporting Your Home Sale to the CRA

Here’s a step that trips up many Okanagan homeowners: even if the Principal Residence Exemption wipes out your tax bill completely, you still must report the sale of your home on your annual income tax return. This is a non-negotiable step with the Canada Revenue Agency (CRA).

Since 2016, the rules have been crystal clear. Failing to report the sale in the year it happens can lead to some pretty hefty penalties, even if you don't owe a single dollar in tax. Think of it as the final piece of paperwork that officially closes the chapter on your home sale and keeps you in good standing with the CRA.

The process itself is meant to be straightforward, but you have to know which forms to use. Getting this right is the key to a smooth, stress-free tax season after your sale.

The Key Forms You Will Need

When you sit down to do your taxes after selling your home in Kelowna or Penticton, you'll need to pay close attention to two specific parts of your tax return. These forms work together to tell the CRA about your sale and officially claim your exemption.

The two main forms involved are:

Schedule 3, Capital Gains (or Losses): This is the standard form for reporting any capital transactions. You’ll enter the date you bought the home, the proceeds of disposition (your sale price), and your adjusted cost base.

Form T2091(IND), Designation of a Property as a Principal Residence by an Individual: This is where you officially tell the CRA that the property you sold was your principal residence. Even if it was your home for every single year you owned it, you still need to complete this form.

Keeping organized records is your best friend during this process. Having your original purchase documents, receipts for major improvements, and the final sale agreement handy will make filling out these forms quick and painless.

Why Reporting Matters So Much

The CRA's reporting requirement is all about transparency. It lets them verify that a sale actually qualifies for the Principal Residence Exemption. Forgetting this step can be a costly mistake.

Penalties for late filing can be as high as $100 for each complete month the return is late, climbing up to a maximum of $8,000. It's a steep price to pay for a simple oversight.

Think of it as your final compliance checklist. By properly reporting the sale, you create a clear record and prevent any future questions or audits from the CRA. It’s the last step in a successful home sale, and it buys you complete peace of mind.

For a deeper dive into property-related taxes, you can explore our comprehensive guide on navigating BC real estate tax.

Smart Strategies to Minimize Your Tax Burden

A little proactive planning can make a world of difference to your final tax bill. When it comes to the capital gains tax selling house, making smart, informed decisions before you list your property is the key to keeping more of your hard-earned equity in your pocket.

Thinking strategically about the timing of your sale and understanding how major life events can throw a wrench in your plans—or open up new opportunities—can save you thousands. This is especially true here in the Okanagan, where it's common for families to own more than one property.

Timing Your Sale and Designating Your Residence

If you own multiple properties—say, your primary home in Kelowna and a summer cottage up near Vernon—timing and designation are everything.

In Canada, you can only designate one property as your principal residence for any given year. This forces you to make a choice for each year you own both homes. Strategic designation, almost always planned with a tax professional, can seriously minimize the total capital gains tax you'll pay when you eventually sell both properties. This kind of planning is critical for long-term owners in high-value areas like ours.

You can learn more directly from the CRA about how to designate a principal residence.

The goal is to use the Principal Residence Exemption on the property that has seen the highest average gain per year. By applying the exemption to the property with the faster-growing value, you shelter the biggest profit from tax.

Navigating Life Changes

Life is rarely static, and major events have a direct impact on your real estate and tax planning.

Marriage or Common-Law Partnership: Once you become a couple, the CRA treats you as a single family unit. This means you can only designate one principal residence between the two of you for each year going forward.

Separation or Divorce: The transfer of a property between spouses due to a separation can often be done on a tax-deferred basis, meaning no capital gains are triggered right away. However, specific rules apply, and getting professional advice is non-negotiable.

Inheritance: If you inherit a property, its cost base for tax purposes is "stepped up" to its fair market value at the time of the original owner's passing. This is a huge advantage. It means you're only taxed on the growth in value from the date you inherited it, not from when your loved one first bought it.

Special Considerations for Okanagan Investors

For those investing in the Okanagan real estate market, tax planning gets even more layered. If you own a rental property in Penticton or West Kelowna, you're probably familiar with claiming expenses.

One key concept is the Capital Cost Allowance (CCA), which is basically the depreciation you can claim on your rental building. While CCA is great for reducing your taxable rental income each year, it comes with a catch. When you sell the property, any CCA you've claimed in the past may be "recaptured" and added back into your income for the year of the sale. This can lead to a surprisingly large tax bill if you aren't prepared for it.

Understanding the interplay between capital gains and CCA is essential for any real estate investor. For a more detailed breakdown, check out our guide on rental property tax deductions.

This is exactly where having a professional team becomes invaluable. At Vantage West Realty, we work alongside your accountant, providing the real estate insights needed to help you see the full picture and make moves that support your long-term financial goals.

Got Questions About Capital Gains? We’ve Got Answers.

We get it—taxes can feel like a maze, especially when you’re navigating a huge life event like selling your home. It's a topic that comes up all the time with our clients here in Kelowna and across the Okanagan. Let's clear up some of the most common questions about capital gains tax on a house sale.

Can I Avoid Capital Gains Tax When I Sell My House?

For most homeowners in BC, the answer is a big, resounding yes. The government’s Principal Residence Exemption is your best friend here. It’s designed to shelter the entire profit from the sale of your main home from taxes, as long as it's been your primary home for every year you've owned it.

But it’s not a blanket rule. If you’re selling a rental property, a vacation home, or if you’ve used a part of your home for business and claimed depreciation (like a home office), then you'll likely owe some tax on the gain.

What’s the Difference Between Short-Term and Long-Term Gains?

This is a really important distinction in Canada, but maybe not in the way you think. Unlike other countries, we don't have different tax rates for short-term versus long-term gains. Instead, how long you've owned the property changes how the CRA sees your profit.

Long-Term Ownership: If you’ve held onto the property for a while, any profit is almost always treated as a standard capital gain.

Short-Term Ownership: This is where you need to be careful. If you buy and sell a home very quickly (say, in under a year) and it looks like your main goal was just to flip it for profit, the CRA might view it differently. They could classify your earnings as business income, which is 100% taxable, instead of a capital gain where only 50% of the profit is taxed. That's a huge difference.

What if I Inherit a House in Kelowna?

Inheriting a property actually comes with a major tax advantage. When you inherit a home, its cost base is "stepped up" to whatever its fair market value was on the date the original owner passed away.

What does this mean for you? If you decide to sell the inherited property right away, your capital gain will probably be close to zero. You're only taxed on the increase in value from the day you inherited it, not from the day your loved one bought it, potentially decades ago.

Do I Have to Pay the Taxes Right After the Sale?

No, you don’t write a cheque to the CRA at the closing table. The taxable part of your capital gain is simply added to your total income for the year you sold the property.

You’ll report it all on your annual income tax return and settle up with the CRA then. If the gain is massive, you might have to make tax instalment payments, but that’s a conversation best had with your accountant.

Navigating the financial side of selling your home is just as important as the sale itself. At Vantage West Realty, we partner with our clients, bringing clarity and support to every single step. We want you to make your next move with total confidence.

If you’re thinking about buying or selling in Kelowna, Vantage West Realty can help you make your next move with confidence. reach out to our team today.