Cash On Cash Return Calculator For Kelowna Real Estate In 2025

If you're trying to figure out how to spot a genuinely good real estate deal in Kelowna, you've landed in the right place. Cash-on-cash return is a straightforward yet incredibly powerful metric that shows you exactly how hard your invested money is working for you, year after year.

Your First Step To Smarter Okanagan Real Estate Investing

Navigating the Okanagan real estate market can feel like a maze, especially when your goal is to build long-term wealth through property. How do you really know if that downtown condo or the duplex in West Kelowna is a smart investment? The secret often lies in looking beyond the sticker price and digging into its actual performance.

Think of it this way: cash-on-cash return gives you a clean, clear snapshot of the annual return on the actual cash you pulled out of your pocket. It cuts through the noise and answers the single most important question for any investor: "For every dollar I put in, how much am I getting back each year?"

What This Guide Will Cover

This guide, put together by the local experts here at Vantage West Realty, will walk you through everything you need to know. We want to demystify real estate investing and arm you with the confidence to analyze deals like a pro. Here's what's in store:

A simple breakdown of the cash-on-cash return formula.

Step-by-step examples using realistic properties right here in the Kelowna area.

Common mistakes to sidestep when you're crunching the numbers.

Why this metric is critical for anyone using a mortgage to invest.

At Vantage West Realty, our mission is to bring clarity to a market that can often feel complicated. Led by AJ Hazzi, our team is built on the belief that a successful investment journey begins with a solid, data-backed understanding of the fundamentals.

By the end of this guide, you’ll be able to use a cash-on-cash return calculator with the skill of a seasoned investor. Our goal is to empower you to build a successful and profitable real estate portfolio in our community by making smart decisions based on numbers, not just emotion. Let’s dive in.

What Exactly Is Cash On Cash Return?

When you’re looking at investment properties, you’ll hear a lot of different terms thrown around. It can get confusing fast. But cash on cash return is one you really need to get a handle on because it cuts right to the chase.

Simply put, it measures the annual cash income you earn relative to the actual cash you invested. It answers the most important question for any investor: "For every dollar I put into this deal, how many cents am I getting back each year?"

Think of it like this: Imagine you plant an apple tree. Your total cash invested is the cost of the tree itself, the shovel, and the good soil you bought for it. Your annual cash flow is the money you make each year selling the apples. Your cash on cash return tells you how fruitful that tree is relative to what you spent to get it in the ground.

A bigger, more expensive tree might produce more apples, but if it cost you a fortune to buy, was the return on your initial cash outlay actually better than the smaller, more affordable tree? This metric helps you figure that out.

The Simple Formula

The calculation itself is refreshingly straightforward. You don't need a complicated spreadsheet to get a quick read on a property's performance.

The Formula: Annual Pre-Tax Cash Flow / Total Cash Invested = Cash on Cash Return

Let's quickly break down what each of those terms means so there's no confusion.

Key Terms You Need To Know

Annual Pre-Tax Cash Flow: This is the money left in your pocket at the end of the year before you've paid income taxes. You figure it out by taking your total rental income and subtracting all your actual cash expenses—mortgage payments (principal and interest), property taxes, insurance, strata fees in places like Kelowna or Penticton, and a budget for maintenance and vacancies. It’s the real cash profit your property generates.

Total Cash Invested: This isn't just your down payment. It’s every single dollar you had to bring to the table to close the deal. This includes your down payment, all closing costs (like legal fees and property transfer tax), and any immediate repair or renovation costs needed to get the property rent-ready.

Getting these two components right is the foundation for accurately using a cash on cash return calculator. It ensures you're comparing the true cash profit against the true cash cost, giving you an honest look at how hard your money is working for you in the Okanagan real estate market.

Calculating Cash On Cash Return Step-By-Step

Alright, theory is great, but let's get our hands dirty. The best way to really understand a metric is to put it to work with a real-world example. We're going to walk through the numbers for a potential investment property right here in the Kelowna real estate market.

Let’s say you’re looking at a condo for sale in the desirable Lower Mission neighbourhood. To figure out if it's a winner, you need to gather a few key pieces of information. It might seem like a lot at first, but we’ll break it down into simple, manageable steps.

Step 1: Find Your Annual Pre-Tax Cash Flow

First things first, we need to figure out how much actual cash the property will put in your pocket each year. This isn't just about the rent you collect; it's what's left after all the bills are paid.

Calculate Annual Gross Rental Income: Start by researching what similar condos are renting for in the Lower Mission. Let's say the market rent is $2,500 per month. Multiply that by 12, and you get an annual gross income of $30,000.

Subtract Annual Operating Expenses: This is where many new investors trip up. You have to account for everything—property taxes, condo insurance, strata fees, a buffer for maintenance (think leaky faucets or a broken appliance), and property management fees if you aren't doing it yourself.

Subtract Annual Mortgage Payments: The final piece is your total yearly mortgage payment, which includes both principal and interest. This is a direct cash expense coming out of your bank account.

Once you subtract all those operating expenses and your total mortgage payments from your gross rental income, you're left with your Annual Pre-Tax Cash Flow.

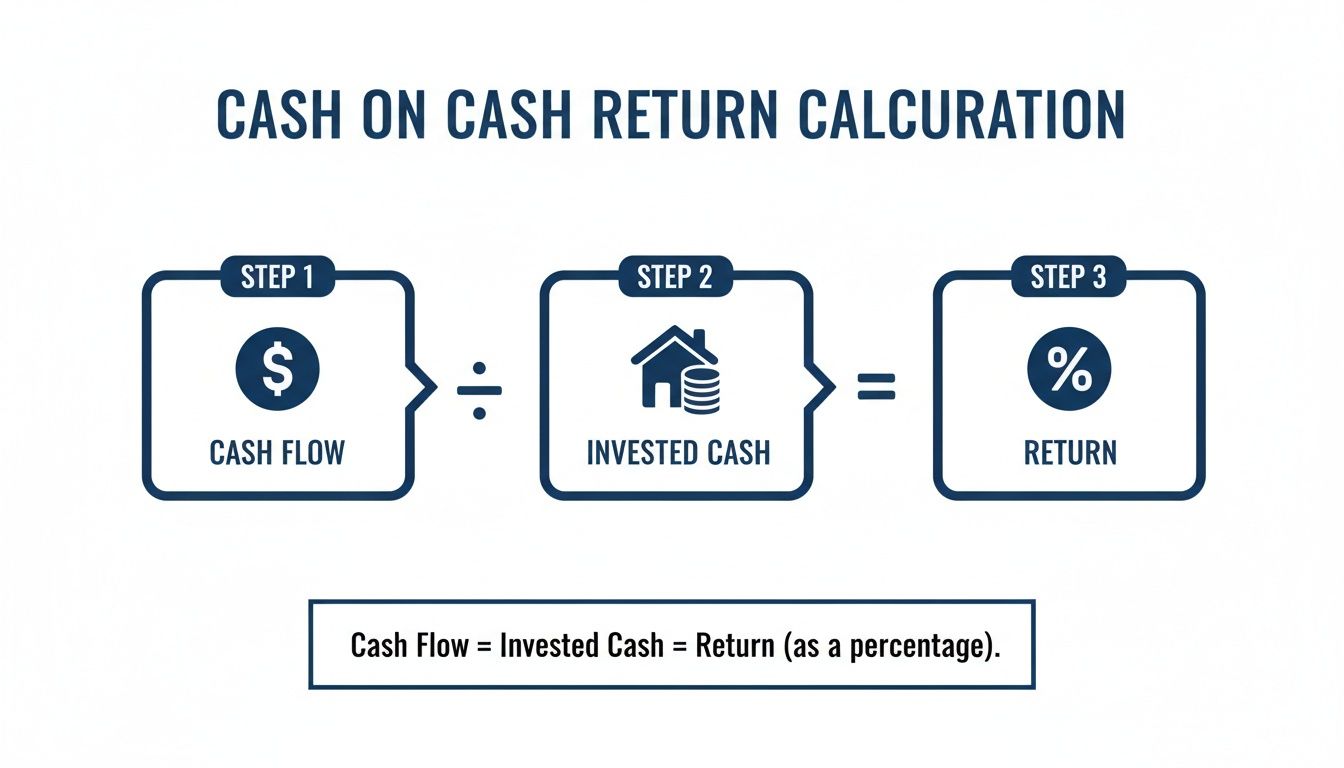

This is the "cash" part of the equation. As this simple diagram shows, it’s all about what you earn versus what you spent to get started.

It really boils down to dividing the cash you earn by the cash you spent to get the investment off the ground.

Step 2: Calculate Your Total Cash Invested

Next up is the "on cash" part of the formula: the total amount of your own money you actually put into the deal. It's more than just the down payment.

Your Down Payment: This is usually the biggest piece of your initial investment.

Closing Costs: Don't forget these! They include legal fees, property transfer tax, and any inspection or appraisal fees.

Initial Repairs: Factor in any money you need to spend right away to get the condo rent-ready, like a fresh coat of paint or new carpets.

Add these all together, and you have your Total Cash Invested. For a deeper dive into the specifics of cash flow, check out our guide on using a rental property cash flow calculator.

A Real-Life Kelowna Condo Scenario

Now, let's bring it all together with a timely example. Imagine you're eyeing a median-priced Kelowna condo at $515,000. You put down 20% ($103,000) and get a mortgage for the rest.

Here's a sample breakdown of how the numbers might look.

Sample Cash On Cash Return For A Kelowna Condo

Metric Calculation/Amount Notes

Purchase Price | $515,000 | A typical condo price in Kelowna. |

Down Payment (20%) | $103,000 | This is the largest part of your invested cash. |

Closing Costs (est. 2%) | $10,300 | Includes legal fees, PTT, etc. |

Initial Repairs | $2,500 | A small budget for paint and minor fixes. |

Total Cash Invested | $115,800 | ($103,000 + $10,300 + $2,500) |

Gross Annual Rent | $33,600 | Based on a strong market rent of $2,800/month. |

Annual Expenses | ($18,480) | Includes mortgage, strata, taxes, insurance & maintenance. |

Annual Pre-Tax Cash Flow | $15,120 | ($33,600 - $18,480) |

Cash on Cash Return | 13.05% | ($15,120 / $115,800) |

In this scenario, plugging the numbers into the formula ($15,120 / $115,800) gives you a very healthy 13.05% cash on cash return. This is exactly why Kelowna condos can be such a powerful tool for investors looking to grow their portfolios in the Okanagan.

The real power of this metric is its honesty. It forces you to look at the cold, hard numbers—the real cash in versus the real cash out—which is the most dependable way to assess an investment's performance.

With your Annual Pre-Tax Cash Flow and your Total Cash Invested, you have everything you need. Divide the first number by the second, and you get your cash on cash return as a percentage. This simple figure gives you an incredible amount of clarity when comparing different investment opportunities across Kelowna, West Kelowna, or even Penticton.

Why This Metric Is Crucial For Financed Investments

When you first start digging into real estate investing, you’ll hear a lot about metrics like Cap Rate and ROI. And while they’re useful, they don’t always tell the full story for an investor who’s using a mortgage. This is exactly where cash on cash return steps into the spotlight.

For most investors in the Okanagan who are financing their purchases, this is the single most important number to get your head around. Why? Because it focuses purely on the performance of the actual cash you’ve taken out of your pocket and put into the deal. It measures the return on your money, not the property’s total value.

This is the key to understanding the power of leverage—using borrowed capital to ramp up the potential return of your investment.

Cap Rate vs. Cash On Cash Return

It’s easy to get these two confused, but they serve very different purposes.

Capitalization Rate (Cap Rate) is how you compare the potential profitability of different properties as if they were all bought with cash. It completely ignores financing.

Cash on Cash Return is your personal scorecard. It directly factors in your mortgage payments, showing you how the financing structure impacts your real-world profit.

Cap Rate is fantastic for a quick, high-level comparison between two buildings in Vernon or Penticton. It answers the question, "How profitable is this property in a vacuum?" But your personal investment journey isn't in a vacuum—it involves a down payment and a monthly mortgage. And that's where your focus should be.

The moment you get a mortgage, your personal return story splits from the property’s Cap Rate. Your true performance is measured by what your invested cash is doing for you.

Let's look at a quick table to see how these two stack up.

Cash On Cash Return vs. Cap Rate At A Glance

Here’s a quick comparison to help you figure out when to use each metric for analyzing properties in the Okanagan market.

Metric What It Measures Best Use Case

Cash on Cash Return | The annual return on your actual cash investment after debt service. | Analyzing a specific deal for your portfolio, especially when using a mortgage. |

Cap Rate | The unleveraged annual return of a property based on its total cost. | Quickly comparing the raw profitability of multiple properties, regardless of financing. |

This table makes it clear: Cap Rate is for comparing opportunities, but Cash on Cash Return is for deciding if an opportunity is right for you. To see just how much of a difference this makes, let's explore a scenario with two investors.

The Power Of Leverage: A Kelowna Example

Imagine two friends, Sarah and Ben, are both buying identical, brand-new townhomes in West Kelowna. Both properties cost $700,000, generate the same rental income, and have the same operating expenses. Their Net Operating Income (NOI) is a solid $35,000 per year.

Sarah decides to buy her property with all cash. She pays the full $700,000 upfront.

Ben uses financing. He puts down 20% ($140,000) and gets a mortgage for the remaining $560,000. His annual mortgage payments are $28,000.

Now, let's look at their returns.

Since Sarah paid cash, her cash on cash return is exactly the same as the property's Cap Rate:

$35,000 (NOI) / $700,000 (Invested Cash) = 5% Cash on Cash Return

Ben’s situation is different. First, we need his pre-tax cash flow:

$35,000 (NOI) - $28,000 (Mortgage Payments) = $7,000 Annual Cash Flow

Next, we calculate his cash on cash return based on his much smaller initial investment:

$7,000 (Cash Flow) / $140,000 (Invested Cash) = 5% Cash on Cash Return

Wait, they’re the same! What gives? While the percentage is identical in this specific case, look closer. Ben now has an extra $560,000 in capital that Sarah has tied up in one property. He can use that to buy four more identical properties, multiplying his income streams and wealth-building potential.

This is the magic of leverage.

Even better, if Ben can find a property with a slightly higher NOI or secure better financing terms, his cash on cash return could soar past Sarah’s. Understanding how different mortgage scenarios affect this outcome is vital, which is why it helps to learn more about calculating mortgage payments accurately.

This simple comparison highlights why using a cash on cash return calculator is essential. It provides a clear, personalized picture of how your investment is performing, allowing you to make smarter decisions and build wealth more effectively through Okanagan real estate.

Common Pitfalls When Calculating Your Return

A cash on cash return calculator is a fantastic tool, but it has one big weakness—it’s only as accurate as the numbers you feed it. It’s surprisingly easy to make a few small mistakes that paint a dangerously rosy picture of a property’s potential.

Getting your numbers right from the very beginning is the key to making a sound investment in the Okanagan real estate market. An overly optimistic calculation can lead to some very unwelcome surprises down the road.

At Vantage West Realty, we’ve seen investors make the same common errors time and again. Let's walk through the biggest pitfalls so you can avoid them and analyze your next deal with total confidence.

Underestimating Your Operating Expenses

This is, by far, the most common mistake we see. Investors get excited about the potential rental income and forget to account for all the little costs that relentlessly add up.

A great-looking cash on cash return can disappear in a flash when reality hits. Here are the expenses that are most often forgotten or underestimated:

Vacancy: Even in a tight rental market like Kelowna’s, you have to budget for the property sitting empty between tenants. A conservative estimate of 5% of your gross annual rent is a safe place to start.

Maintenance and Repairs: Things break. You’ll have to deal with a leaky faucet, a broken dishwasher, or a furnace that needs servicing. Smart investors typically set aside 5-10% of their gross rent for these inevitable costs.

Capital Expenditures (CapEx): These are the big-ticket items that don't happen every year but are guaranteed to happen eventually. Think about replacing the roof in 10 years or the hot water tank in seven. You need to be saving for these future expenses every single month.

Forgetting to budget for vacancy, repairs, and future big-ticket items is like planning a road trip without accounting for gas or oil changes. You might start off strong, but you won't get very far before running into trouble.

Overlooking Your Total Cash Investment

The second major pitfall is getting the denominator in the equation wrong—your Total Cash Invested. Many people mistakenly think it's just their down payment, but it’s so much more than that.

Your initial cash outlay is every single dollar you had to bring to the closing table. Forgetting any of these will artificially inflate your return percentage and give you a false sense of security.

Your Complete Investment Checklist

To make sure your calculations are grounded in reality, here’s a practical checklist of items to include when using a cash on cash return calculator.

Down Payment: This is the largest and most obvious part of your investment.

Closing Costs: These can be significant and typically include:

Legal fees

Property Transfer Tax (PTT)

Inspection fees

Appraisal fees

Initial Renovations or Repairs: Don't forget the cost of that fresh coat of paint, new flooring, or any other work needed to make the property rent-ready.

Utility Setup and Deposits: Sometimes there are one-time costs to get utilities connected in your name before a tenant moves in.

By carefully and honestly accounting for every single one of these expenses, you'll have a true picture of your investment. This diligence ensures your analysis is realistic and sets you up for long-term success. Properly tracking these expenses is also crucial for your finances, as many are deductible. To learn more, check out our guide on common rental property tax deductions.

Sizing Up Your Next Kelowna Investment Property

You’ve put in the work, and now you have the right tools to confidently analyze any investment property in the Okanagan. Whether it's a slick downtown Kelowna condo or a quiet duplex in Penticton, the core principles don't change. Grasping these key takeaways is the first real step toward building a solid portfolio backed by a clear, data-driven strategy.

Let's quickly go over what really counts when you're lining up your next move.

Your Go-To Metric For Comparing Opportunities

In the world of real estate investing, cash-on-cash return is your most trusted ally. It slices right through the fluff to show you exactly how hard your invested cash is working for you. This is the metric that lets you compare wildly different properties on an apples-to-apples basis—something absolutely essential in a market as diverse as the Okanagan.

Let's say you're weighing two options:

Property A: A condo in West Kelowna. The purchase price is lower, but the strata fees are higher.

Property B: A small single-family home in Vernon. It needs some upfront love but has zero strata fees.

At first glance, it's a tough call. Which one is actually the better investment? By running the numbers through a cash-on-cash return calculator, you get a clear, unbiased answer. It forces you to look past the curb appeal and focus squarely on the financial performance, making sure you pick the property that truly lines up with your goals.

Your success as an investor isn't just about finding a good property; it's about finding the right property for your financial situation. Cash-on-cash return is the lens that brings that picture into sharp focus.

The Power Of Local Expertise

While the numbers are non-negotiable, they only paint part of the picture. The real magic happens when you pair a solid, data-first approach with genuine, on-the-ground local knowledge. An experienced real estate team brings insights to the table that a calculator simply can't provide.

We live and breathe the nuances of Kelowna’s neighbourhoods. We know the seasonal rental trends in communities like Penticton and have our finger on the pulse of upcoming developments that could shake up property values. That kind of insight is your competitive edge.

Building Your Portfolio With Confidence

You now get it: a successful real estate investment is built on a foundation of sharp analysis and realistic expectations. The goal is to move forward with total clarity, knowing you've made a decision based on sound financial principles, not just a gut feeling.

This knowledge, combined with the guidance of a trusted local real estate team, is the key to building a profitable portfolio. You have the framework to evaluate deals, sidestep the common pitfalls, and make your capital work smarter for you.

If you’re thinking about buying or selling in Kelowna, Vantage West Realty can help you make your next move with confidence. Reach out today.

Cash On Cash Return: Your Questions Answered

We get a lot of questions from investors trying to make smart moves here in the Okanagan. It’s a dynamic market, and having absolute clarity on your numbers is everything. Here are the answers to some of the most common questions we hear about cash on cash return.

What Is a Good Cash On Cash Return In The Okanagan?

This is the million-dollar question, and the honest answer is: it really depends on your goals.

As a general rule of thumb, many real estate investors aim for a cash on cash return between 8% and 12%. This range is often considered a solid performance, especially when you stack it up against other types of investments.

However, in a competitive market like Kelowna’s, what’s “good” can shift based on the property type. For instance, a brand-new condo in a high-demand area might have a lower cash on cash return at first but offer much better potential for appreciation down the road. On the flip side, an older duplex in Penticton might deliver higher immediate cash flow.

It’s all about balancing that immediate cash flow with your long-term strategy for building wealth.

Does Cash On Cash Return Account For Appreciation?

No, and this is a critical point to remember. The cash on cash return formula is designed to measure one thing and one thing only: how hard your invested cash is working for you based on the property's cash flow.

It completely ignores potential appreciation, which is the increase in the property's value over time. It also doesn’t factor in the equity you build as you pay down your mortgage. Think of it as your "right now" metric—a pure, simple measure of how efficiently your investment is producing income today.

Is A Higher Cash On Cash Return Always Better?

While a higher number usually looks more attractive on paper, it’s not the only thing that matters. Sometimes, a very high cash on cash return can be a red flag for higher risk.

For example, a property might offer a 20% return, but it could be in a less desirable area with higher tenant turnover or require significant, ongoing maintenance that eats into your time and profits.

A strong investment strategy balances a healthy cash on cash return with other crucial factors like property condition, location quality, and long-term growth potential in the Okanagan real estate market.

A slightly lower but more stable return from a premium property in a neighbourhood like the Lower Mission might be a much safer—and ultimately more profitable—long-term hold. Context is everything.

How Does Financing Affect My Return?

Your financing structure has a massive impact on this number. Using more leverage—meaning a smaller down payment—can dramatically increase your cash on cash return, simply because you have less of your own money tied up in the deal. A lower interest rate on your mortgage will also give your return a nice boost by reducing your annual debt service, leaving more cash in your pocket.

This is exactly why working with a great mortgage broker is so important for investors buying a home in Kelowna. Securing the best possible terms can turn a good deal into a great one. The cash on cash return calculator is the perfect tool for modelling how different down payment amounts or interest rates will play out in your final numbers.

At Vantage West Realty, we believe that making confident investment decisions starts with having crystal-clear numbers and trusted local insight. If you're ready to analyze your next property or explore opportunities in the Okanagan, our team is here to provide the data-driven guidance you need.