2025 First Time Home Buyer Guide | Kelowna, BC

Buying your first home is a massive milestone, especially in the beautiful Okanagan market. It’s an exciting time, but let's be honest - it can also feel completely overwhelming. This guide is your straightforward roadmap, designed to turn that complexity into clarity.

Your Homeownership Journey Starts Here

We get it. The thought of buying your first place in a city like Kelowna or Penticton brings up a lot of questions. It's one of the biggest moves you'll ever make, and you want to get it right. From sorting out your finances to finally holding those keys, there are a lot of moving parts.

This guide breaks the whole process down into simple, manageable pieces. We'll share practical advice and local insights that actually make a difference, so you can walk into your very first home feeling smart and confident.

Why This Guide Is Different

Instead of generic advice you could find anywhere, we're diving into what it really takes to succeed in the unique Okanagan real estate market. We’ve helped hundreds of first-time buyers navigate everything from the hot summer market in West Kelowna to finding hidden gems in Vernon.

At Vantage West Realty, our entire approach is built on partnership. You should feel guided and supported at every single turn, never left wondering what comes next.

Here’s a snapshot of what you'll learn:

Financial Prep: How to build a real-world budget that covers way more than just the mortgage payment.

The Search: Pinpointing what you really need and exploring neighbourhoods that actually fit your lifestyle.

Making an Offer: Crafting a strong, strategic offer that stands out, especially when things get competitive.

Closing the Deal: Understanding the final steps, from the home inspection all the way to possession day.

Think of us as your trusted partner in Kelowna real estate. Let’s get you started on this exciting new chapter.

Building Your Financial Foundation

Before you even start scrolling through the latest Kelowna homes for sale, we need to talk about the most important step: getting your money right.

I know, I know - it’s not the most glamorous part of the home-buying journey, but trust me, it’s the foundation for everything else. Getting this piece right sets you up for a smooth, confident process instead of a stressful, uncertain one.

It’s all about creating a crystal-clear picture of what you can comfortably afford, not just for the monthly mortgage payment, but for the whole picture of homeownership in the Okanagan. Let's break it down so you can move forward with total clarity.

Crafting a Realistic Home Budget

Your home budget needs to cover a lot more than just the mortgage. Homeownership in places like West Kelowna or Vernon comes with other regular costs you absolutely need to plan for. A smart budget prevents you from feeling "house poor" down the road.

Think beyond the mortgage and be sure to include these key expenses:

Property Taxes: These are paid to your local municipality and vary based on your home's assessed value. They cover essential local services like schools and road maintenance.

Home Insurance: This is mandatory for getting a mortgage. It also protects your single biggest asset from damage or loss.

Utilities: This covers everything from electricity and natural gas to water and internet. These costs can definitely fluctuate, especially during our hot Okanagan summers and cold winters.

Maintenance Fund: This is a big one. You need to set aside a small amount each month for unexpected repairs like a leaky roof or a broken water heater. A good rule of thumb is to budget 1% of your home's value per year.

A well-planned budget is your best defence against financial stress. It gives you the confidence to know you’ve prepared for the true cost of owning a home.

To help you get started, here's a simple checklist outlining the key expenses you'll need to account for.

First Time Home Buyer Budget Checklist

Down Payment | The initial portion of the purchase price you pay upfront. | 5% - 20%+ of purchase price |

Mortgage Payments | Principal and interest paid to your lender each month. | Varies based on loan amount/rate |

Property Taxes | Annual tax paid to the local municipality. | 0.5% - 1% of home's value annually |

Home Insurance | Protects your home and belongings from damage. | $80 - $200+ per month |

Utilities | Electricity, gas, water, internet, and waste services. | $200 - $500+ per month |

Closing Costs | Legal fees, land transfer tax, appraisal fees, etc. | 1.5% - 4% of purchase price |

Maintenance & Repairs | A fund for unexpected issues (e.g., appliance failure). | ~1% of home value per year |

Moving Expenses | Hiring movers, renting a truck, packing supplies. | $500 - $3,000+ |

This table gives you a solid framework, but remember to research the specific costs for the areas you're interested in, as they can vary.

The Importance of Your Credit Score

Your credit score is a simple, three-digit number that tells lenders how reliable you are with debt. It's a huge deal.

A higher score often means you'll qualify for a better mortgage interest rate, which can literally save you tens of thousands of dollars over the life of your loan. Lenders look at it to gauge risk, so a strong score makes you a much more attractive borrower.

If your score isn't where you'd like it to be, don't panic. You can take simple, actionable steps to improve it, like paying all your bills on time, every time, and keeping your credit card balances low.

Saving for That All-Important Down Payment

Saving for a down payment is often the biggest hurdle for first-time home buyers. In British Columbia, the minimum down payment depends on the purchase price, but aiming for a larger down payment is always a good strategy. It can significantly lower your monthly payments and help you avoid extra insurance costs like CMHC fees.

While affordability is a major challenge across North America - with a recent report showing that in early 2025 only 17% of households in California could afford a median-priced home - strategic saving can make a huge difference here in the Okanagan.

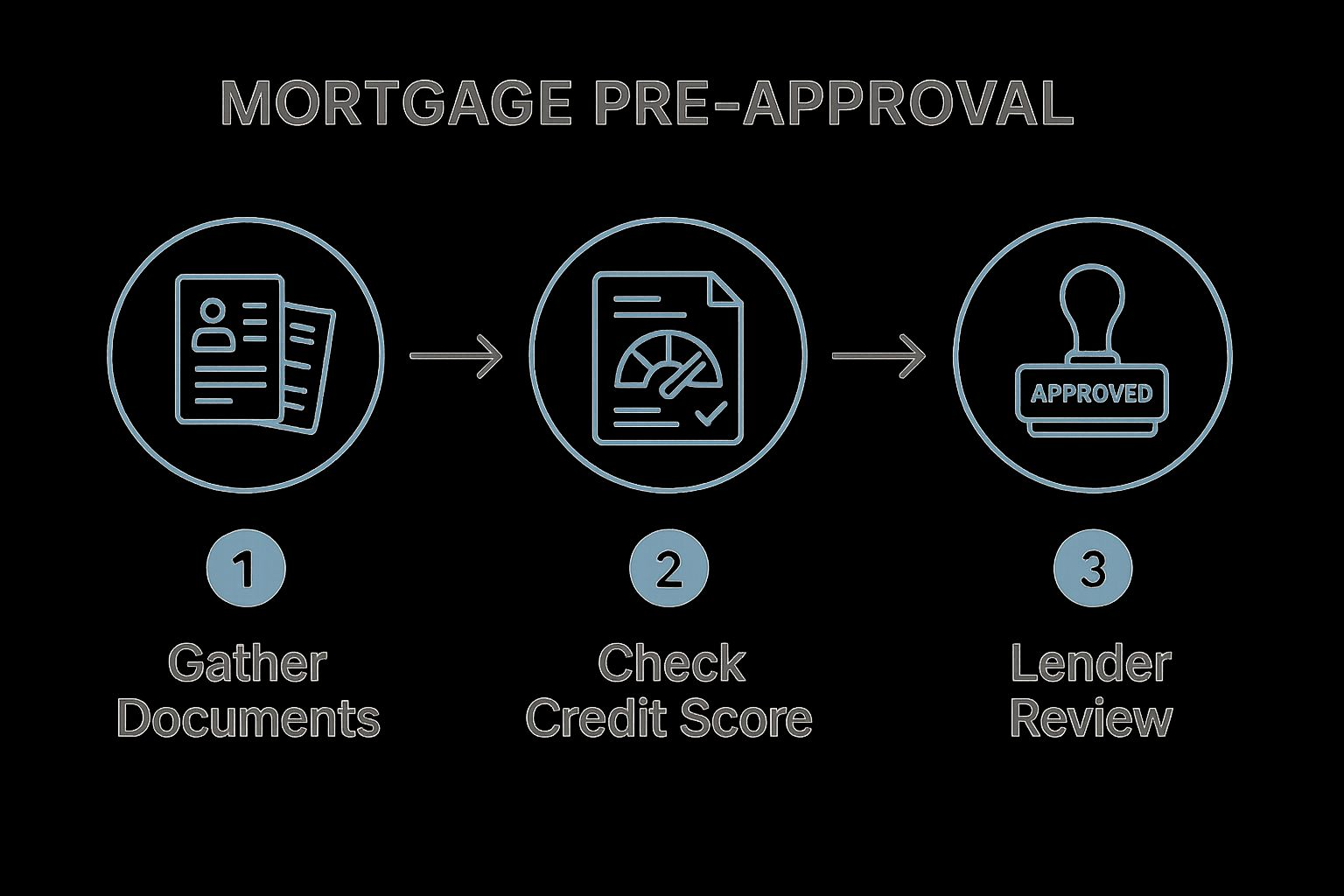

Why Mortgage Pre-Approval Is Non-Negotiable

In the competitive Okanagan real estate market, getting pre-approved for a mortgage is a must. A pre-approval is a formal commitment from a lender stating exactly how much they are willing to lend you.

It immediately shows sellers and their agents that you are a serious, qualified buyer ready to make a move.

This process confirms your financial readiness and gives you a powerful advantage when it’s time to make an offer. It also gives you a firm price ceiling, so you can search for homes with confidence, knowing exactly what you can truly afford.

Your first move? Connect with a trusted mortgage professional to get the ball rolling.

Finding Your Perfect Okanagan Home

Alright, you’ve got your financial ducks in a row. Now for the part everyone looks forward to - the actual house hunt! This is where your dream of owning a home in the Okanagan starts to feel incredibly real.

A successful search requires a clear strategy to find a home that genuinely fits your life, your budget, and your future.

Let’s dive into how you can focus your search, make sense of the local market, and find that perfect spot in Kelowna, West Kelowna, or Vernon.

Defining Your Must-Haves vs. Nice-to-Haves

Before you even think about stepping into an open house, grab a pen and paper. You’re going to make two lists: one for your "must-haves" and one for your "nice-to-haves." This simple exercise is a game-changer for keeping your search focused.

Your must-haves are the absolute non-negotiables. These are the things you simply cannot live without.

Number of Bedrooms: Do you need a dedicated home office, or are you planning for a growing family?

Location: What’s the maximum commute you can tolerate? Are you tied to a specific school district?

A Fenced Yard: Is having a secure space for a pet or for the kids to play a top priority?

Then you have your nice-to-haves—the features that would be the cherry on top. Think of things like a two-car garage, a modern kitchen with granite countertops, or a home tucked away on a quiet cul-de-sac. You'd love them, but you could live without them for the right house.

Having this clarity from the get-go saves you so much time and emotional energy. It helps you quickly filter through listings and focus only on the properties that are a true potential fit.

Finding the Right Okanagan Community

The Okanagan is brimming with incredible communities, each with its own distinct character and lifestyle. The best neighbourhood for you depends on what you value most.

Kelowna: This is your spot for a vibrant mix of urban energy and outdoor living. Areas like the Lower Mission are fantastic for families, with great schools and easy beach access. Downtown Kelowna is perfect if you love being a stone's throw from restaurants, boutiques, and cultural events.

West Kelowna: Known for its jaw-dropping lake views, world-class wineries, and a slightly more relaxed pace. It’s a great choice if you want a bit more space while still being just a short bridge-crossing from the city centre.

Vernon: If you're after a more community-focused, small-town feel, Vernon is it. You get amazing access to the outdoors, including the stunning Kalamalka and Okanagan Lakes. It's often seen as a more affordable entry point into the Okanagan real estate market.

The best way to know? Explore these areas in person. Spend a weekend driving around, grabbing coffee at a local cafe, and walking through parks to get a true feel for the vibe.

Navigating the Current Market Dynamics

The Okanagan real estate market is always in flux. Understanding whether it’s a buyer's market (more homes for sale than buyers) or a seller's market (more buyers than homes) will directly impact your entire strategy.

In a seller's market - which is common in desirable areas - you have to be ready to act fast and come in with a strong offer. Homes can sell in a flash, sometimes with multiple offers on the table. A buyer's market, on the other hand, gives you more time and more negotiating power.

This is exactly where an experienced local agent becomes invaluable. An agent from Vantage West Realty lives and breathes the Kelowna real estate market. We know which neighbourhoods are heating up, what a home is really worth, and how to position you for success no matter what the market is doing.

Tight inventory can be a real challenge for first-time buyers. As an example, some high-demand markets in North America see homes sell incredibly quickly.

Making the Most of Property Viewings

Once you start touring homes, it's easy to get wowed by fresh paint and stylish decor. Your job is to look deeper and spot the potential red flags hiding in plain sight.

Here’s what to pay close attention to during a viewing:

Look for signs of water damage: Check for stains on ceilings, in corners, and under sinks. A musty smell is also a major giveaway.

Test everything: Don't be shy. Flip light switches, turn on taps to check the water pressure, and open and close all the windows and doors.

Assess the big-ticket items: Get a sense of the age and condition of the roof, furnace, hot water tank, and windows. These are expensive to replace.

Scope out the neighbourhood: Drive by at different times of the day and on different days of the week. What are the traffic and noise levels like? What's the general atmosphere?

Sometimes, you just get a feeling when you walk into a house. For a little more guidance, check out our article on the 6 signs a home might be the one. Bringing a checklist and a critical eye will help you make a smart, informed decision.

Making a Winning Offer

You’ve found it. After looking at countless Kelowna homes for sale, one has finally captured your heart. The excitement is real, but let’s be honest, so are the nerves. Now comes the moment of truth in your first-time home buyer journey: making an offer.

This part can feel like the final boss battle, but it doesn't have to be. With the right strategy and a seasoned pro in your corner, you can walk into this step with total confidence. It’s all about understanding the key pieces of the puzzle and putting together a proposal that tells the seller you’re serious and ready to go.

Understanding the Contract of Purchase and Sale

The official document you'll be working with is called the Contract of Purchase and Sale. It's the legally binding rulebook for the entire transaction. Every single detail, from the price to the move-in date, is laid out here, leaving absolutely no room for confusion later on.

Here’s a quick rundown of what a standard offer includes:

The Price: This is the big one—the amount you’re offering to pay for the property.

The Deposit: Think of this as your "good faith" money. It's a sum held in trust that shows the seller you're committed, and it gets applied to your down payment at closing.

Important Dates: This trio of dates is crucial. It includes the completion date (when ownership legally transfers), the possession date (when you get the keys!), and the adjustment date (when you officially take over costs like property taxes).

Crafting a compelling offer is both an art and a science. It's about presenting a clean, confident proposal that minimizes uncertainty for the seller.

Having a Vantage West Realty expert walk you through this document is absolutely vital. We’ll make sure you understand every single clause and that your best interests are protected from start to finish.

Your Safety Net: Subjects and Conditions

One of the most powerful parts of your offer is what we call "subjects" or "conditions." These are your safety nets. They are specific clauses that must be satisfied before the deal becomes firm, giving you a set amount of time to do your due diligence. If something isn't right, these subjects allow you to back out without losing your deposit.

For a first-time buyer, the most common (and non-negotiable) subjects are:

Subject to Financing: This gives you time to get the official, final approval from your lender for this specific property.

Subject to a Home Inspection: You get to hire a professional inspector to go over the home with a fine-tooth comb. If they uncover major issues, this gives you the power to renegotiate or walk away.

Subject to Property Disclosure Statement Review: You'll receive a document from the seller disclosing any known issues with the home. This gives you time to review it carefully.

Subject to Title Search: Your lawyer or notary will perform a title search to ensure there are no hidden legal claims, liens, or other issues attached to the property.

These conditions are your best friend in this process. They protect your deposit and your financial future, making sure you don't get locked into buying a home with serious, hidden problems.

Standing Out in a Competitive Market

The Okanagan real estate market can heat up quickly, and you might find yourself in a multiple-offer situation. This is exactly what it sounds like: a seller receives offers from more than one buyer at the same time. It’s a high-stakes scenario, but it’s completely manageable with the right game plan.

A winning offer is often about more than the highest price. Sellers also put a huge value on certainty and convenience. Things like a larger deposit, a flexible possession date that lines up with their own moving plans, or even a personal letter explaining why you fell in love with their home can make a real difference. And of course, having that mortgage pre-approval locked and loaded is non-negotiable - it’s proof you’re a ready and capable buyer.

Negotiation is a delicate dance, and this is where having an experienced agent from Vantage West truly pays off. We live and breathe the local market, and we know exactly how to position your offer to give you the best possible shot at getting those keys. To dig deeper into the specifics, check out these 6 tips to help you avoid a critical blunder when making an offer on a house.

From Accepted Offer to Closing Day

You got the call - your offer was accepted! Pop the bubbly, do a happy dance, and take a minute to celebrate. This is a huge milestone on your home-buying journey.

While the most nerve-wracking part might be behind you, we're not quite at the finish line. Now, we dive into what’s known as the "due diligence" or "subject removal" period.

This is the phase where you and your team work behind the scenes to make sure the property is exactly what you think it is before the deal is legally binding. It can feel like a whirlwind with lots of moving parts, but don't worry. We’ll lay out exactly what to expect as you move smoothly toward getting those keys in hand.

The Essential Home Inspection

One of the first and most important things you'll do is hire a professional home inspector. Honestly, this is non-negotiable for first-time buyers.

Think of an inspector as your expert set of eyes. They’re trained to spot the potential issues you might miss, from a furnace on its last legs to the subtle signs of past water damage in the basement.

Their job is to give you a complete, unbiased picture of the home's condition. You’ll get a detailed report, packed with photos and recommendations, that empowers you to make a fully informed decision. This report either gives you peace of mind or becomes critical leverage for negotiating repairs if significant problems pop up.

Assembling Your Professional Team

During this period, you'll be working closely with a few key professionals who will guide you through the final steps. Each one plays a distinct and vital role.

Your Vantage West Agent: We’re your primary coordinator. We make sure all deadlines are met, handle communication with the seller’s agent, and help you navigate the findings from the inspection report.

Your Mortgage Broker: You’ll be in close contact with them to finalize your financing. They’ll submit all the necessary paperwork to the lender to secure your formal mortgage approval—the official green light.

Your Lawyer or Notary Public: This legal pro handles the actual transfer of ownership. They review all documents, conduct a title search to ensure there are no legal claims against the property, and manage the flow of funds on closing day.

This is where the value of a strong, coordinated team really shines. Everyone works in sync to protect your interests and ensure a seamless path to homeownership.

Understanding Your Closing Costs

Closing costs are the one-time fees you pay on the completion day to finalize the purchase. It's so important to have these funds set aside to avoid any last-minute surprises.

These costs are completely separate from your down payment and typically range from 1.5% to 4% of the home’s purchase price.

Here’s a quick breakdown of what they usually cover:

Property Transfer Tax (PTT): In B.C., this is a provincial tax you pay when a property changes hands.

Legal Fees: This covers the services of your lawyer or notary for preparing documents, transferring the title, and registration.

Home Inspection Fee: The cost for that crucial professional inspection.

Property Tax Adjustments: You’ll likely need to reimburse the seller for any property taxes they've already paid for the part of the year you'll own the home.

Title Insurance: This is a policy that protects you and your lender from potential future issues with the property’s title.

The rising cost of homeownership is a real concern, and these final expenses can add up. For instance, in some North American markets, monthly housing costs have surged dramatically. A recent study showed that in California, monthly payments for even entry-level homes shot up by 87% between 2020 and mid-2025, driven by both price increases and higher mortgage rates.

You can explore the full breakdown of these housing cost trends to see why budgeting for every expense, especially closing costs, is so critical in today's market.

Your Burning Questions Answered

Jumping into the Okanagan real estate market for the first time is exciting, but it also brings up a million questions. That's completely normal. We've been there, and we've helped countless first-time buyers navigate these same waters.

To give you a head start and a bit of peace of mind, we've laid out clear, no-nonsense answers to the questions we hear most often.

How Much Do I Really Need for a Down Payment in BC?

This is usually the first question on everyone's mind. In Canada, the minimum down payment is based on the home's purchase price. Think of it as a tiered system.

For any home under $500,000, you need a minimum of 5% for your down payment. Simple enough. If a property is priced between $500,000 and $999,999, you'll need 5% on the first $500,000, plus 10% on the remaining amount. And for any home that tips over the $1 million mark, the requirement is a straight 20% down.

One crucial detail: if your down payment is less than 20%, you'll have to get mortgage loan insurance. It's designed to protect your lender, and the premium usually gets rolled right into your mortgage loan.

Feeling a bit lost in the numbers? Don't worry. If you've got your eye on a specific place in Kelowna, we can sit down and calculate exactly what you’d need.

What Are Closing Costs and How Much Should I Budget?

This is the big one that often catches new buyers off guard. Closing costs are a collection of fees you pay to finalize the deal, and they are completely separate from your down payment. You need to budget for both.

As a rule of thumb, expect your closing costs to be between 1.5% and 4% of the home's final price. So, for a $700,000 home in West Kelowna, you should have anywhere from $10,500 to $28,000 set aside just for these expenses.

So, what exactly are you paying for? The main players are:

Property Transfer Tax (PTT): This is a provincial tax you pay whenever a property title changes hands.

Legal Fees: You'll need a lawyer or notary to handle all the legal paperwork and the title transfer.

Home Inspection Fee: The cost for a professional to give the home a thorough check-up before you commit.

Our advice is always the same: have this money saved up and ready to go well before your closing date. It's the key to a stress-free final step.

How Long Does the Home Buying Process Take?

Every home buying journey is unique, but most of our clients in the Okanagan find their new home within two to six months.

The first few weeks are usually spent getting your financial ducks in a row and securing a mortgage pre-approval. Then comes the fun part: the actual house hunt. This can take anywhere from one to three months, depending on what's available and how specific your wish list is.

Once you have an accepted offer, you're on the home stretch. The closing period, where all the final legal and financial steps happen, is typically between 30 and 60 days. Our job is to guide you through this timeline at a pace that feels right for you—no rushing, no pressure.

Making Your Move in the Okanagan

Buying your first home is a huge milestone, but it’s a journey you don’t have to take by yourself. It really boils down to careful planning, making smart decisions, and taking one confident step after another.

From getting your finances in order to finally getting the keys to your new place, every single stage is manageable when you have the right people in your corner. Start with a solid plan, get a real feel for the local Kelowna market, and build a team you can truly count on.

Your Partner in Kelowna Real Estate

Buying your first home is one of the biggest moves you'll ever make. Having an expert guide who can answer your questions and go to bat for you makes all the difference. Our team at Vantage West Realty is here to provide exactly that clarity and support.

Every first-time home buyer deserves to feel empowered and excited, not overwhelmed. Our job is to simplify the process, give you straight-talking advice, and make sure you feel supported from our first chat right through to closing day.

With over 1,000+ positive reviews, our reputation is built on being accountable and getting real results for our clients. We’re here to help you navigate the market and find a place in the Okanagan that you’ll be proud to call home.

If you’re thinking about buying a home in Kelowna, Vantage West Realty can help you make your next move with confidence. Reach out today and let's get started.