How to Prepare for a Home Appraisal in Kelowna [2025 Guide]

Getting ready for your home appraisal can feel like studying for a big test, but it doesn’t have to be. Think of it this way: a home appraisal is simply an independent, professional opinion of your property's value. Lenders rely on this number to approve loans, and we've seen firsthand how a little prep work can make a huge difference for our clients.

A higher appraisal can mean more money from a sale or better terms for a refinance. It’s one of those rare moments where your effort directly translates into dollars.

Why Your Home Appraisal Matters in the Okanagan

Whether you’re selling a beautiful home in Kelowna or refinancing your property in West Kelowna, the appraisal is a critical milestone. It’s the number that banks use to decide how much they’re willing to lend on a property.

For sellers, a strong appraisal backs up your asking price, giving you serious leverage in negotiations. If you're a homeowner looking to refinance, it can unlock more equity for those dream renovations or other investments.

In the Okanagan real estate market, an appraisal gives everyone an objective valuation amidst shifting prices. It confirms your home's actual worth in today's market. This value is shaped by a few key things:

Location: An appraiser will absolutely factor in proximity to amenities in sought-after areas like Pandosy Village or the Lower Mission.

Condition: This is all about the overall maintenance and state of repair of your home. Those little fixes matter.

Upgrades: Recent renovations, especially in kitchens and bathrooms, can have a huge impact.

Comparable Sales: Appraisers heavily weigh the recent sale prices of similar homes in your immediate neighbourhood.

To give you a better idea of what to expect, we put together a simple table that breaks down the key areas to focus on.

Home Appraisal Quick-Start Checklist

Here’s a quick-start checklist to help you prioritize your efforts before the appraiser walks through your door.

Focus Area Key Actions Impact on Value

Repairs & Maintenance | Fix leaky faucets, patch drywall, ensure all lights and appliances work. | High: Demonstrates a well-maintained property, preventing value deductions. |

Curb Appeal | Mow the lawn, trim bushes, add fresh mulch, paint the front door. | Medium: Creates a strong, positive first impression. |

Interior Staging | Declutter all rooms, clean thoroughly, organize closets, and ensure good lighting. | Medium: Helps the appraiser see the space clearly and highlights its best features. |

Documentation | Compile a list of all upgrades, renovations, and major repairs with dates and costs. | High: Provides concrete evidence of investments that add value. |

This checklist is a fantastic start to putting your best foot forward.

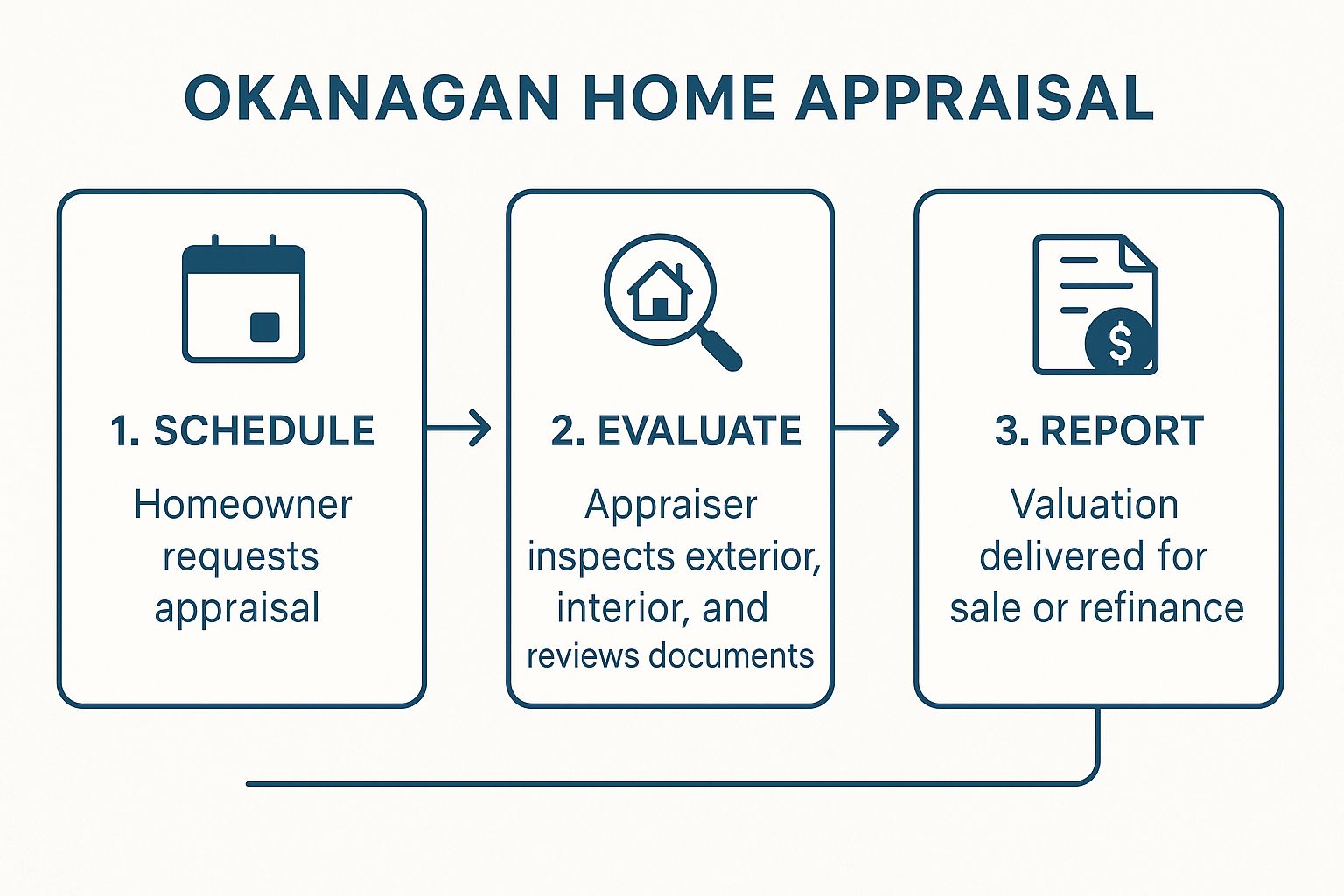

The appraisal process itself is pretty straightforward. This flow chart breaks down the three main stages, from scheduling the appointment to getting the final report.

As you can see, the process moves from your initial request to a detailed on-site evaluation and, finally, to the finished valuation report. While you might have played around with automated tools online, they often miss the small details and neighbourhood nuances an experienced appraiser catches. For a deeper dive into their accuracy, check out our guide on online home value estimates.

Understanding what appraisers look for is the first step toward a successful outcome. It gives you the power to highlight your home’s best features and make sure your investment is valued properly.

Boosting Curb Appeal for a Strong First Impression

First impressions are everything. For a home appraiser, that impression starts the second they pull up to your curb. Before they even step through the front door, they're already forming an opinion based on your home's exterior. Nailing this is an easy win that signals your property is well cared for.

This goes way beyond just mowing the lawn. We’re talking about simple, high-impact changes that frame your home in its best possible light. Whether your property is in Penticton or Vernon, these small efforts can make a huge difference in the appraiser’s initial assessment.

A Quick Exterior Checklist

Think of your home’s exterior as the cover of a book—it has to be inviting. Tidy landscaping, a clean driveway, and a welcoming front entrance all contribute to a positive start.

Here are a few things our team always tells clients to tackle before appraisal day:

Landscaping and Yard Care: Get out there and pull those weeds, trim any overgrown bushes, and maybe lay down some fresh mulch in the garden beds. A neat yard immediately shows pride of ownership. It just looks crisp.

Exterior Touch-Ups: Walk the perimeter and look for peeling paint on trim, siding, or fences. A quick touch-up is a super low-cost fix that makes a massive difference. Also, give your house numbers a good clean so they're easy to read.

A Welcoming Entrance: Your front door is a major focal point. If it’s looking a bit tired, a fresh coat of paint can work wonders. Clean the hardware, and make sure the doorbell works! A nice seasonal wreath or a couple of potted plants can add a perfect, welcoming touch.

Roof and Gutters: This is a big one. Clear out any leaves and debris from the gutters. An appraiser will absolutely notice overflowing gutters, which can hint at potential water damage issues down the road.

These tasks don't require a huge budget. Most are simple weekend projects that really pay off. For more ideas, you can explore some of our other recommendations for easy home updates potential buyers will love.

A Key Takeaway: The goal here is to present a property that looks solid, maintained, and problem-free from the outside in. An appraiser who sees a well-kept exterior is more likely to enter the home with a positive mindset, setting the stage for a better overall valuation. It's the small details that, when combined, really boost your home’s perceived condition.

What Appraisers Actually Look for Inside Your Home

Once an appraiser steps across your threshold, their focus snaps from the curb to the core of your home—its condition, functionality, and features. They aren't there to critique your decor; they're assessing the bones of the property. A well-maintained interior sends a clear signal that the home is a solid investment.

Their walkthrough is surprisingly methodical. They'll be checking that appliances are in good working order, taps don't leak, and toilets flush properly. They will flip light switches to test the electrical system and give your flooring, walls, and ceilings a once-over. Think of it as a health checkup for your house.

Key Areas of Focus Inside

Appraisers zero in on the high-value rooms: kitchens and bathrooms. An updated kitchen with modern appliances or a freshly renovated bathroom can add a serious boost to your valuation. But even if you haven't done a major overhaul, just making sure these spaces are spotless and fully functional is non-negotiable.

Don't let the little things become a big problem. A sticky door, a cracked tile, or a leaky faucet might seem minor to you, but an appraiser will note these as 'deferred maintenance.' A running list of small issues like these can add up, chipping away at your home's final value. It’s absolutely worth spending a weekend tackling those simple fixes.

It's also crucial to place your home within the bigger picture. Part of preparing for an appraisal is understanding the local market's supply and demand. In the Okanagan, for instance, the supply of homes has been creeping up, giving buyers more options. This shift means sellers need to work harder to make their property stand out. Highlighting your home's unique features can help maximize its value in a competitive market.

Room-by-Room Interior Checklist

To help you get ready, here’s a quick guide to what an appraiser will likely be checking in each area of your Kelowna home.

Kitchen: Are all appliances (stove, dishwasher, oven) functional? How's the plumbing under the sink looking? They'll also check the condition of your countertops and cabinets.

Bathrooms: Do the toilets flush correctly and without issue? Are there any leaks from the faucets or showerheads? They’ll also be on the lookout for signs of mould or water damage.

Bedrooms & Living Areas: Appraisers measure every room to confirm the home’s total square footage. They'll also assess the condition of floors, walls, and windows.

Basement & Attic: Make sure they have clear access. They need to get into these spaces to check for structural integrity, insulation, and any tell-tale signs of moisture.

Our Pro Tip: An appraiser is required to test safety features. Make sure all your smoke detectors and carbon monoxide alarms have fresh batteries and are working properly. It’s a small detail that shows your home is compliant and cared for.

By taking the time to address these interior details, you're actively demonstrating your home's real value and solid condition.

Tell Your Home's Story with the Right Paperwork

An appraiser sees your home's current condition, but they can't see the years of effort and thousands of dollars you've invested behind the walls. That’s where you come in. Providing a detailed backstory with the right paperwork is one of the most powerful ways to influence your home's final valuation.

Think of it as creating a 'brag book' for your property. This is your chance to hand the appraiser a neat, organized folder that tells the full story of your home's value. You need to spell out the value you’ve added.

Building Your Brag Book

A well-documented list of upgrades gives the appraiser concrete, undeniable evidence to justify a higher value. We’ve seen this play out time and again with clients in the Kelowna real estate market; a simple binder of receipts and permits can directly translate to thousands of dollars on an appraisal report.

Here’s what you should pull together:

A List of Major Upgrades: Create a clean, chronological list of all significant improvements. Make sure to include the date of the upgrade, what it cost, and the contractor's name if you have it.

Key Renovation Details: Did you install a new roof (2023), replace the hot water tank (2022), or completely remodel the kitchen (2021)? Get specific.

Supporting Documents: Back it all up. Include copies of receipts, warranties for major appliances, and any permits you pulled for the work.

Utility Bills: If you’ve made energy-efficient upgrades (like new windows or insulation), prove the payoff by showing a few recent utility bills. Lower running costs add real value.

Property Survey: Always have your property survey handy. This document confirms your property lines and the exact size of your lot, leaving no room for guesswork.

This kind of prep also means looking at the bigger picture. Preparing for a home appraisal in the Okanagan requires an awareness of current market conditions. Right now, the local housing market is showing signs of stabilization, with sales rising slightly and prices inching upward year-over-year. This modest growth means your well-maintained and documented property is perfectly positioned to stand out.

Vantage West Success Story: We recently worked with a homeowner in West Kelowna who had meticulously renovated their home over five years. By compiling a detailed list with receipts for their new kitchen, updated bathrooms, and professional landscaping, they provided undeniable proof of their investment. The appraiser specifically noted this documentation in the report, and the home appraised for significantly more than comparable properties that lacked that evidence.

It's a small amount of effort that ensures your hard work doesn't go unnoticed. Ultimately, it’s about making the appraiser’s job easier and ensuring every single dollar you’ve invested gets counted.

Navigating the Appraisal Day and What Comes Next

The big day is here. After all that work getting your home ready, it’s completely normal to feel a bit on edge. The key now is to be a calm, professional, and helpful host. Your main job is to make the appraiser’s visit as smooth as possible.

It's a smart move to be there for the appointment, but be sure to give them their space. Greet the appraiser, hand over your neatly organized "brag book" of all the upgrades and improvements you've made, and simply let them know you're around if they have any questions. Then, take a step back and let them do their thing. Shadowing them from room to room can feel intense and might throw off their systematic process.

Understanding the Appraisal Report

Once the appraiser has left your Kelowna home, the waiting game starts. You can usually expect to see the final report within a week to ten days. This isn't just a single number; it's a comprehensive document, often running 20 pages or more.

Here’s what it will break down:

Property Details: The nitty-gritty like square footage, room counts, and a professional assessment of your home’s overall condition.

Comparable Sales: This is the heart of the valuation. It includes a detailed look at a minimum of three similar properties in your area that have sold recently.

Market Analysis: The appraiser’s take on the current state of the Okanagan real estate market and specific trends in your neighbourhood.

Final Value: Their professional opinion on what your property is worth in the current market.

This is also where a solid grasp of the local economic picture comes into play. In British Columbia, the costs associated with homeownership are notably higher than the national average, a factor that definitely influences the appraisal process. The typical monthly payments for buying a home in the Okanagan reflect this, shaped by both property prices and mortgage rates. Keeping these factors in mind helps you see your property through the same lens as appraisers and potential buyers.

What to Do If the Appraisal Comes in Low

Getting an appraisal that’s lower than you hoped for can feel like a punch to the gut, but it’s not the end of the story. Don't panic. Your first move should be to comb through the report for any factual errors. Did they get the square footage wrong? Did they use "comparable" sales that are outdated or not really comparable at all?

If you spot a legitimate mistake, you can file a formal appeal. This is where all your prep work really pays off. Your detailed list of upgrades and any comparable sales your agent pulled can serve as powerful evidence to build your case. In many cases, there's also an opportunity to renegotiate with the buyer or rethink your refinancing options. For a deeper dive into your obligations, our guide explains if you have to make repairs after an appraisal.

At Vantage West Realty, we guide our clients through this process with a steady hand. We'll help you dissect the report, identify any grounds for an appeal, and strategize the best path forward. It's about providing clear, accountable advice when you need it most.

Your Home Appraisal Questions Answered

We get a lot of questions about the home appraisal process from our clients across the Okanagan. It’s a step that can feel a bit mysterious and high-stakes, so we’ve pulled together answers to some of the most common ones we hear. Our team's experience in the Kelowna real estate market has given us the insights to provide the straight answers you're looking for.

Should I Stage My Home for an Appraisal?

The short answer is yes, but you don't need to go all out. While an appraiser is trained to see past personal photos and a bit of clutter, a clean, tidy, and well-organized home always makes a better subconscious impression.

Think of it this way: a spotless home sends a powerful signal that the property is well-maintained. You don't need to hire a professional stager. Simply deep cleaning, decluttering every room, and making sure every space is easily accessible goes a long way. It helps the appraiser move through your home efficiently and reinforces the idea that you take excellent care of your property, which can positively influence their overall assessment.

What Happens if the Appraisal Is Lower Than the Sale Price?

This situation is known as an "appraisal gap," and it’s more common than you might think, especially in a shifting market. If this happens, don't panic. You have a few solid options on the table.

The Buyer Covers the Difference: In a competitive market, the buyer might have the funds to pay the difference between the appraisal value and the agreed-upon sale price in cash.

The Seller Adjusts the Price: You, as the seller, could agree to lower the sale price to match the new appraisal value to keep the deal from falling apart.

Meet in the Middle: Often, the best solution is for both parties to negotiate a new price somewhere between the original offer and the appraised value. It’s a compromise that keeps everyone moving forward.

Challenge the Appraisal: You can formally dispute the appraisal, but you need to come with strong evidence. You’ll need to point out things like missed comparable sales or factual errors in the report to make a compelling case.

At Vantage West, we help our clients navigate this crucial conversation with confidence and a clear strategy. Having an experienced guide in your corner makes all the difference when unexpected hurdles pop up.

How Long Does an Appraisal Take?

The on-site inspection is usually the quickest part of the process. For a typical Kelowna property, an appraiser might be in your home for anywhere from 30 minutes to a couple of hours, depending on its size and complexity.

But their real work begins after they leave. The appraiser then has to do their research, analyze comparable properties (or "comps"), and write a detailed report. All said and done, you can generally expect your lender to receive the final appraisal report within a week to ten days after the inspection.

Do Small Cosmetic Upgrades Really Affect the Value?

This is a fantastic question, and the answer is a little nuanced. A fresh coat of paint isn't going to directly add a specific dollar amount to your appraisal report. But its indirect impact is huge.

Fresh, neutral paint makes a home feel clean, bright, and well-cared-for. It instantly erases the signs of daily life and helps the appraiser—and future buyers—see the home's full potential. This contributes directly to their overall "condition" rating of the property. A home that feels move-in ready and meticulously maintained will almost always get a better assessment than one with scuffed walls and dated colours, which absolutely translates to a higher final value.

If you’re thinking about buying or selling in Kelowna, Vantage West Realty can help you make your next move with confidence. Reach out to us today to get started.