A 2025 Guide to Property Transfer Tax B.C. Exemptions

In British Columbia, you can avoid paying the Property Transfer Tax (PTT) by qualifying for specific programs known as property transfer tax B.C. exemptions. These programs are a huge help, designed to make buying a home more affordable for folks like first-time buyers, people purchasing new construction, and even families transferring property between relatives.

What Is The Property Transfer Tax In B.C.?

Before we dive into the exemptions, let's get a handle on what the Property Transfer Tax (PTT) actually is. Simply put, it's a one-time tax the B.C. government collects whenever a property's title changes hands. It’s a major closing cost that can easily add thousands of unexpected dollars to your purchase, and it often catches buyers off guard.

The tax is calculated on the home’s fair market value when it sells. It doesn't matter if you’re buying a starter condo in Rutland or a sprawling lakefront estate in West Kelowna—the PTT applies. Once you realize how much money is on the line, finding an exemption becomes a top priority for anyone navigating the Kelowna real estate market.

How The PTT Is Calculated

The PTT works on a tiered system, a bit like how income tax is calculated. The tax rate goes up as the property's value increases.

Here’s a quick breakdown of the rates:

1% on the first $200,000 of the property's value

2% on the portion of the value between $200,000 and $2,000,000

3% on the portion of the value greater than $2,000,000

An additional 2% on the portion over $3,000,000 for residential properties

Let's run through a real-world Kelowna example. Say you're buying a home for $850,000. You'd pay 1% on the first $200,000 ($2,000) and 2% on the remaining $650,000 ($13,000). Your total PTT would come out to $15,000. That’s a serious chunk of change that could otherwise go toward renovations, furniture, or just easing the financial strain of a new mortgage.

This tiered structure means that as home prices in the Okanagan continue to climb, so does the tax bill. It's a critical factor to budget for, which is why qualifying for an exemption can be a complete game-changer for your purchase.

As you can see, the PTT is a major expense. Luckily, the provincial government offers several exemptions to help reduce or even eliminate this cost entirely. For a deeper dive into how real estate taxes work in our province, you might be interested in navigating B.C.'s real estate tax landscape.

The First-Time Home Buyers Program

Getting into the Kelowna real estate market for the first time is a massive milestone. Let's be honest, it can also feel a little overwhelming. The good news is that the B.C. government offers a major helping hand specifically for people like you. It's called the First-Time Home Buyers’ Program, and it’s designed to save you a significant chunk of money right when you need it most.

This program is one of the most powerful property transfer tax exemptions out there. It can completely wipe out the PTT on qualifying homes, putting thousands of dollars right back into your pocket. Just think about what that extra cash could do—cover moving costs, furnish your new place, or just give you a comfortable financial cushion as you settle in.

Updated Rules for 2025 and Beyond

The government recently gave the rules a much-needed update to better reflect today's home prices, especially in places like the Okanagan. As of April 1, 2024, first-time buyers in British Columbia can save big on the Property Transfer Tax (PTT).

Under the new First-Time Home Buyers’ Program, you get a full PTT exemption on the first $500,000 of your home's value, as long as the property is valued at $835,000 or less. The property also has to be on land that's no bigger than 0.5 hectares (about 1.24 acres).

For homes priced between $835,000 and $860,000, a partial exemption kicks in, phasing out gradually so you're not hit with the full tax bill all at once. The maximum you can save is up to $8,000.

This is a game-changer for buyers in Kelowna, West Kelowna, and Vernon. The old threshold was way too low, making it almost impossible to find a qualifying home in our market. Now, a lot more starter homes and condos actually fall within the exemption range.

Do You Qualify for the Exemption?

Qualifying for the First-Time Home Buyers’ Program isn't just about this being your first home purchase in B.C. It has to be your first residential property purchase anywhere in the world, ever.

Here are the key boxes you’ll need to tick:

Canadian Citizen or Permanent Resident: You have to hold one of these statuses to be eligible.

B.C. Residency: You must have lived in British Columbia for at least a year right before you register the property, OR have filed at least two income tax returns as a B.C. resident in the last six years.

True First-Time Buyer: You can't have ever owned an interest in a principal residence anywhere in the world, at any time. This applies to both you and your spouse if you're buying together.

It Must Be Your Principal Residence: The home you buy has to become your primary place to live. You're required to move in within 92 days of the purchase and continue living there for at least one full year.

Making sense of these rules is a critical part of the process, and our team at Vantage West Realty is here to walk you through every detail. For a deeper dive, check out our complete guide on the B.C. First-Time Home Buyers' Program for 2024.

A Kelowna Example in Action

Let’s put this into a real-world scenario. Imagine a young family is buying their first home—a beautiful townhome in Glenmore for $825,000. They've never owned property before, are Canadian citizens, and have lived in Kelowna their whole lives.

Under the new rules, their home's value is safely under the $835,000 threshold. This means they qualify for a full exemption. The PTT they would have owed—a cool $8,000—is completely waived.

That's $8,000 they can now put toward their family's future. This is exactly how the program is meant to work, making homeownership just a little more achievable for those starting out in the Okanagan.

The Newly Built Home Exemption

If you've been eyeing one of the brand-new condos or townhomes popping up across the Okanagan, you're in for a treat. The B.C. government offers a powerful incentive called the Newly Built Home Exemption, and it’s not just for first-time buyers. This exemption is a game-changer for anyone purchasing new construction, potentially saving you a massive amount on the Property Transfer Tax (PTT).

This program is designed to make buying a brand-new home more affordable, whether you're a family needing more space, a retiree downsizing into a modern condo in Penticton, or even an investor grabbing a new property in Kelowna. It directly supports the demand for new housing in our growing communities, making those freshly built properties even more attractive.

What Is a Newly Built Home?

So, what exactly qualifies as a "newly built home" in the government's eyes? It's pretty straightforward.

The property must be a brand-new unit that has never been lived in. This includes homes in new subdivisions, newly constructed condo buildings, or even a home that has been so thoroughly renovated it’s considered new.

To be eligible, the property must also sit on land that is 0.5 hectares (about 1.24 acres) or smaller. This covers the vast majority of new builds you'll find in urban and suburban areas like West Kelowna and Vernon.

A Major Boost in Affordability

The real excitement around this exemption comes from the recently updated price thresholds. With construction costs on the rise, the government recognized that the old limits were out of sync with the Okanagan real estate market.

As of April 1, 2024, the Newly Built Home Exemption offers a full PTT exemption for qualifying new homes valued up to $1,100,000. If the home is priced between $1,100,000 and $1,150,000, you can still get a partial exemption. This significant increase nearly doubles the previous threshold, potentially saving eligible buyers up to $20,000 in avoided tax.

These new numbers make a huge difference, bringing many more new builds within reach for buyers. You can explore more about how this is calculated and its impact on our local market by reading the full research about the PTT from wowa.ca.

Eligibility Criteria You Need to Know

While this exemption is open to a wider range of buyers, there are still a few key rules you need to follow. Think of it as a checklist to ensure you get the full benefit.

Here are the main requirements:

It Must Be Your Principal Residence: Just like the first-time buyer program, this exemption is for the home you plan to live in.

Move-In Timeline: You must move into your new home within 92 days of the property registration date.

Residency Requirement: You need to continue living in the home as your principal residence for at least the rest of the registration year.

Citizenship: You must be a Canadian citizen or a permanent resident.

It’s worth repeating this key point: you do not need to be a first-time buyer to qualify. This is a huge benefit for families looking to upsize into a larger new home or for retirees selling their long-time family house to downsize into a brand-new, low-maintenance condo.

Putting It All Together: A Kelowna Scenario

Let's picture a couple who currently own a small condo in downtown Kelowna. Their family is growing, and they’ve decided to purchase a newly built single-family home in the Upper Mission for $1,050,000.

Because the home is brand new and its price falls below the $1,100,000 threshold, they qualify for the Newly Built Home Exemption. They plan to move in as soon as it's ready and will use it as their primary home.

So, what are the savings? The PTT on a $1,050,000 home would normally be $19,000. Thanks to this exemption, that entire amount is waived. That’s $19,000 they can now use for landscaping, new furniture, or just adding to their savings. It’s a perfect example of how this program helps make the dream of a new home a reality for families right here in the Okanagan.

Exemptions For Family And Special Transfers

Property transfer tax doesn't just come up when you're buying a home from a stranger. Here in the Okanagan, a lot of property changes hands between family members, and these situations often carry a lot of emotional weight. Thankfully, the government has put specific exemptions in place to make these transitions a little smoother and more affordable.

These rules are a lifesaver for Kelowna families looking to pass down a legacy property, shuffle ownership, or navigate a separation. Getting a handle on them can save you tens of thousands of dollars and ensure a tax-free transition during what can be a sensitive time.

Passing Property To a Loved One

One of the most common situations we see is when a property is transferred between close family members. This might be a parent helping their child get a foot in the door of Kelowna's competitive real estate market by signing over a title, or spouses adjusting ownership after getting married.

The good news is that these kinds of transfers are often completely exempt from PTT. The critical detail is that the transfer must be between related individuals, which includes:

A spouse, child, grandchild, or great-grandchild

A parent, grandparent, or great-grandparent

The spouse of your child, grandchild, or great-grandchild

The parent, grandparent, or great-grandparent of your spouse

This exemption is a really powerful tool for estate planning and helping out family, as it removes a massive tax bill that could otherwise make the transfer unfeasible. For example, gifting a condo in downtown Kelowna to your child can be done without triggering a nasty PTT invoice.

Transfers Due To a Separation

Going through a separation or divorce is incredibly tough, and financial stress just piles on the pressure. The government gets this, which is why they offer a full PTT exemption for property transfers that happen because of a written separation agreement or a court order.

This means if you and your former spouse or common-law partner need to transfer the title of your family home in West Kelowna as part of your separation, you won't have to pay PTT. It's a small but significant relief that helps make the division of assets as fair and financially manageable as possible.

Other Important Exemptions

Beyond the usual family transfers, a few other unique situations also get a pass on the property transfer tax. These are less common, but they're just as important for those who qualify.

Family Farm Transfers: To support our agricultural community here in the Okanagan, special rules allow for the transfer of family farms to certain relatives without hitting them with PTT.

Transfers to a Registered Charity: If a property is gifted to a registered charity, it is typically exempt from the tax.

There are a handful of other exemptions out there, covering things like transfers of First Nations land or those involving marriage breakdowns. As of May 21, 2024, First Nations even gained exemptions for transfers of property they already beneficially own under the Indian Act, creating a tax-free way to manage wealth and assets. You can get more details on these specialized transfers by checking out this 2025 PTT update from tingsapp.com.

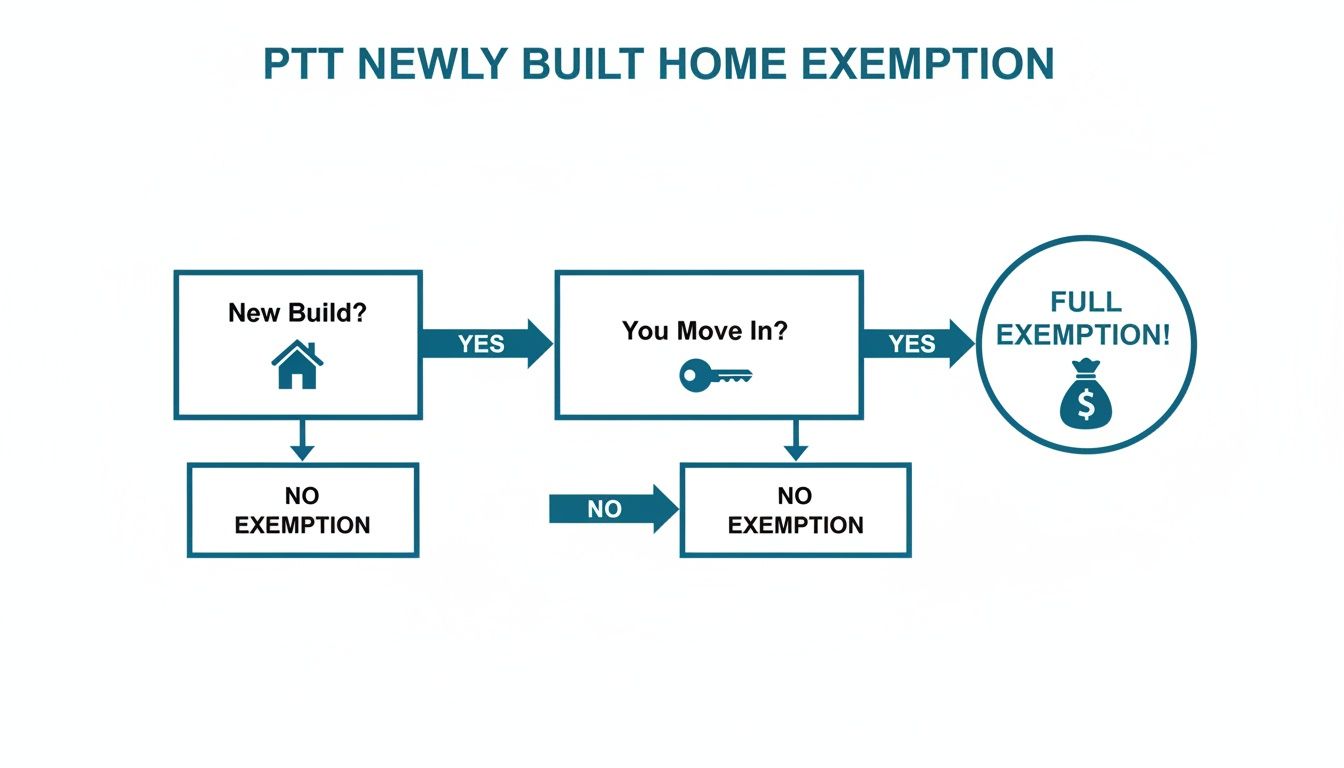

This decision tree shows a simple path to qualifying for the newly built home exemption.

As the flowchart shows, buying a new build and moving in to use it as your principal residence are the two key steps to unlocking a full PTT exemption.

How To Claim Your PTT Exemption

Knowing you qualify for a property transfer tax exemption in B.C. is a huge relief, but the next step is making sure you actually claim it properly. It might sound a little intimidating, but it’s a pretty straightforward process once you know what to expect.

Think of this as your simple checklist for success—a clear path to securing every dollar of savings you're entitled to.

The key player in this whole process is your legal representative—that’s your lawyer or notary public. When you buy a home in Kelowna, they’re the ones who handle all the final paperwork, including filing the Property Transfer Tax (PTT) Return.

Your Vantage West Realty agent will work hand-in-hand with them, making sure they have all the correct details about your purchase.

The Step-By-Step Process

Claiming your exemption happens at the exact same time you officially take ownership of your new home. Your lawyer or notary will walk you through the PTT Return form, but it’s always a good idea to understand the steps yourself.

Gather Your Information: Before you head to your signing appointment, get all your necessary documents ready. This includes your government-issued ID, Social Insurance Number (SIN), and any specific proof related to your exemption, like a Permanent Resident card if applicable.

Complete the PTT Return Form: Your legal pro will fill out this form with you. You'll need to provide your personal details and confirm that you meet all the eligibility rules for the specific exemption you’re claiming.

Sign and Submit: You’ll sign the form, declaring that everything you’ve provided is true and accurate. Your lawyer or notary then submits it electronically to the Land Title and Survey Authority of BC at the same moment they register the property transfer into your name.

At Vantage West Realty, we make this part of the process totally seamless for our clients. We coordinate directly with your legal team to ensure they have the purchase details they need, so you can focus on the excitement of your new home.

Avoiding Common Pitfalls

While the process is designed to be clear, a few common mistakes can cause headaches, delays, or even disqualification. Knowing what to watch for ahead of time is your best defence.

Here are a few things to keep on your radar:

Missing Deadlines: The exemption must be claimed on the PTT Return at the time of registration. You can't go back and apply for it later, so it's critical to have everything locked in before your completion date.

Incorrect Information: Double-check every single detail on the form. A simple typo in a name or SIN can create a real mess. Make sure the information perfectly matches your official documents.

Failing to Meet Residency Rules: For exemptions like the First-Time Home Buyers’ Program, you have to move in within 92 days and live there for at least one full year. If you don't meet these post-purchase requirements, the government can come back asking for the full tax amount, plus interest.

Navigating the paperwork for B.C.'s property transfer tax exemptions doesn't have to be a source of stress. With a knowledgeable team guiding you—from your real estate agent to your notary—you can feel confident and in control. We help our clients through this every day, making sure no detail gets missed.

Your Next Move, Made With Confidence

Figuring out property taxes, especially the nuances of property transfer tax B.C. exemptions, can feel like a heavy lift. But you don’t have to do it alone. Knowing how these exemptions work isn't just trivia—it's a powerful tool that makes owning a home right here in the Okanagan that much more achievable.

Whether you're a first-time buyer ready to put down roots in Kelowna, a family building from the ground up in West Kelowna, or simply passing a property between relatives, these savings are significant. The difference often comes down to working with a team that has deep local knowledge and a genuine track record of helping people succeed.

Your Partner in Okanagan Real Estate

At Vantage West Realty, we’ve built our name on giving clear, straight-up advice that works. Our job is to be your partner, cutting through the complexity of the market to make sure you have the support and guidance you need to make smart, confident moves. We simplify the process so you can focus on what matters.

With over 1,000 five-star reviews, our clients say it best. They feel guided, supported, and understood every step of the way. We believe in straight talk backed by experience—no sales fluff, ever.

Our team, led by AJ Hazzi, has an unmatched feel for the Kelowna real estate market. We live and breathe this stuff, from pricing trends in Penticton to new builds popping up in Vernon. We make it our business to ensure you know about every opportunity to save money and get the most out of your investment.

Choosing the right real estate brokerage means picking a partner who is accountable, authentic, and truly invested in your success. We’ll handle the complexities so you can focus on the excitement of your next chapter.

If you're ready to see what's possible for buying or selling in the Okanagan, our team at Vantage West Realty is here to help you make your move with total confidence. Let's get started.

A Few Common Questions About PTT Exemptions

When you’re navigating the world of property transfer tax exemptions, a lot of specific questions pop up. It’s completely normal to have those "what if" moments. We've put together some of the most common questions we hear from buyers right here in the Okanagan to give you clear, straightforward answers.

What Happens If I Have To Move Before The One Year Mark?

This is a big one. Let's say you’ve claimed an exemption like the First-Time Home Buyers’ Program, which hinges on you living in your new home for at least one full year. But then life throws you a curveball—a fantastic job offer in another city that you just can't refuse.

If you move out before that one-year anniversary hits, you'll likely have to repay a portion of the PTT you were exempted from. The government calculates this on a prorated basis, which means you’ll owe an amount based on how many days you fell short of the full year.

There are some rare exceptions for situations like an employer-required work relocation, but the rules are incredibly specific. Your best bet is always to chat with your lawyer or notary to understand the full financial picture before you even think about packing a single box.

Can I Get An Exemption If I Am Not a Canadian Citizen?

In most cases, the main exemptions—the First-Time Home Buyers’ Program and the Newly Built Home Exemption—are reserved for Canadian citizens or permanent residents. The government is quite strict on this requirement.

If you’re new to Canada and hoping to buy a home here in Kelowna, it’s absolutely critical to confirm your eligibility with a legal expert before assuming you'll qualify for these savings. The last thing anyone wants is an unexpected and hefty tax bill on closing day. We can easily connect you with trusted professionals in the Okanagan who specialize in these exact scenarios.

The rules around residency and property ownership can get pretty complicated. For example, being a "taxable trustee" for a foreign national can trigger additional taxes, even if you're a Canadian citizen yourself. Getting expert advice isn't just a good idea—it's non-negotiable.

Do These Exemptions Apply To Investment Properties?

The short answer here is a firm no. Both the First-Time Home Buyers’ Program and the Newly Built Home Exemption are specifically designed to help people buy a principal residence—the home you actually live in, day in and day out.

These powerful property tax exemptions simply don't apply to properties you're buying just for rental income or as a quick flip. The government's goal is to make homeownership more accessible for residents, not to subsidize real estate investments.

That said, if you are looking to grow your portfolio, our team at Vantage West Realty has extensive experience guiding investors toward smart acquisitions in the hot Okanagan market.

Understanding these nuances is the key to making a confident and stress-free purchase. If more questions come up, our team is always here to help. You can also find a lot more answers by checking out our comprehensive FAQ page for Kelowna home buyers.

If you’re thinking about buying or selling in Kelowna, Vantage West Realty can help you make your next move with confidence. Reach out today.