Finding the 7 Best Mortgage Lenders in Canada for 2025

Securing the right mortgage is a huge step toward owning your dream home here in the beautiful Okanagan. It's also one of the most stressful parts of the process. With so many options out there, how do you know you're making the right choice for your purchase in the Kelowna real estate market?

It feels complicated, but it doesn’t have to be. Think of us as your trusted guide, here to simplify the process and give you the straight talk you need. At Vantage West Realty, we’ve helped thousands of clients navigate buying a home in Kelowna, and that includes connecting them with the right financing to make their goals a reality.

This guide cuts through the noise. We're going to walk you through our top picks for the best mortgage lenders Canada has to offer in 2025, focusing on what matters most to buyers in Kelowna, West Kelowna, and across the Okanagan Valley. We'll explore who each lender is, what they offer, and who they're best for, from first-time buyers to seasoned investors.

We'll break down the pros and cons of major banks, credit unions, and online mortgage platforms, giving you a clear picture of your options. Each profile will provide actionable insights to help you compare rates, understand product types, and identify the perfect financial partner for your property journey. Our goal is to equip you with the knowledge to move forward with confidence and secure the financing that fits your unique situation.

1. Ratehub.ca

Ratehub.ca isn't a lender itself, but it’s one of the most powerful starting points for anyone looking for the best mortgage lenders in Canada. Think of it as a one-stop shop where you can compare interest rates from dozens of lenders—including the big banks, credit unions, and alternative "monoline" lenders—all in one place. Its real-time, side-by-side comparisons give you a clear picture of the mortgage landscape, saving you countless hours of research.

What makes Ratehub.ca stand out is its seamless transition from comparison to action. You don't just find a rate; you can proceed with getting the mortgage through their in-house brokerage, CanWise Financial. This hybrid model combines the transparency of a comparison site with the personalized guidance of a licensed mortgage professional.

Key Features and Tools

Ratehub.ca is packed with resources that are especially helpful for first-time home buyers in Kelowna or investors planning their next move.

Live Rate Tables: See up-to-the-minute rates for various terms (e.g., 5-year fixed, 3-year variable). You can filter by province and down payment amount to get a more accurate quote.

Comprehensive Calculators: Their suite of tools helps you understand your financial position. You can use the affordability calculator to see how much you can borrow, the payment calculator to estimate monthly costs, and the penalty calculator to understand the cost of breaking your mortgage.

Education Centre: If you're new to the mortgage world, this section is invaluable. It breaks down complex topics like the mortgage stress test, amortization, and prepayment privileges into easy-to-understand articles. One of the biggest decisions you'll make is choosing between a fixed or variable rate; you can dive deeper into the fixed vs. variable rate mortgage debate here to make an informed choice.

Pros and Cons

| Broad Market View: Compares dozens of lenders, giving you a full picture of available rates. | Sponsored Placements: Some lenders pay for premium spots, so be sure to look at all the results. |

| Beginner-Friendly: Excellent educational resources and easy-to-use tools. | Conditional Rates: The lowest advertised rates often have strict conditions, like being for high-ratio (insured) mortgages only. |

| End-to-End Service: You can go from comparing rates to securing a mortgage all on one platform. | Not a Direct Lender: You are working with their brokerage, which then connects you with the actual lender. |

Who It's Best For

Ratehub.ca is ideal for digitally savvy home buyers who want to research their options thoroughly before committing. It empowers you with data and tools to feel confident in your decisions, whether you're buying your first condo in Downtown Kelowna or investing in a property in the Upper Mission.

Website: https://www.ratehub.ca/

2. LowestRates.ca

Similar to Ratehub.ca, LowestRates.ca is a powerful mortgage comparison engine rather than a direct lender. It excels at simplifying the first step of your mortgage journey: finding out what rates you can actually get. By pulling quotes from over 50 banks and brokers across Canada, it gives you a comprehensive overview of the market after you fill out a single, straightforward form.

What sets LowestRates.ca apart is its clarity around different mortgage types. It clearly distinguishes between rates for insured mortgages (less than 20% down), uninsured mortgages, and various loan-to-value (LTV) ratios. This transparency helps you avoid the disappointment of seeing a super-low rate, only to find out you don't qualify. It connects you with a licensed broker who can secure the rate you’ve found, blending digital convenience with professional guidance.

Key Features and Tools

LowestRates.ca provides practical tools that give buyers in the Okanagan a clear advantage when planning their finances.

Side-by-Side Rate Grids: The platform clearly displays different rate tiers, including insured, 80% LTV, 65% LTV, and uninsured. This is incredibly helpful for understanding how your down payment impacts the interest rate you'll be offered.

Single Form for Multiple Quotes: Instead of applying to multiple lenders, you complete one form and let brokers and lenders compete for your business. This saves a massive amount of time and effort.

No-Obligation Broker Connection: Once you find a rate you like, you can be connected with a mortgage professional to lock it in. There's no pressure to proceed, so you can explore your options freely.

Live Updates and Commentary: The site provides context on current mortgage trends, helping you understand why rates are moving and what to expect next in the Canadian market.

Pros and Cons

| Clear Rate Breakdowns: Excellent at showing how LTV and insurance status affect your rate. | Broker-Centric Model: You’ll typically finalize the mortgage through a partner broker, not directly with the lender. |

| Broad Lender Access: Gathers quotes from over 50 lenders, including banks and brokers. | Eligibility-Dependent Rates: The lowest "as low as" rates are often for ideal candidates with high credit scores and insured mortgages. |

| Free and Fast Process: The quote process is quick, easy, and completely free to use. | Connection is the Goal: The platform's main purpose is to connect you with a broker, so expect follow-up communication. |

Who It's Best For

LowestRates.ca is perfect for home buyers who want a quick, clear, and competitive snapshot of the rates they qualify for. Whether you're a first-time buyer in West Kelowna needing an insured mortgage or an investor in Penticton looking for the best conventional rate, this platform cuts through the noise and connects you with professionals who can get the deal done.

Website: https://www.lowestrates.ca/mortgage

3. Rates.ca (RATESDOTCA)

Rates.ca, also known as RATESDOTCA, is another powerful financial marketplace instead of a direct lender. It excels at bringing together mortgage options from a wide array of Canadian lenders, giving you a comprehensive overview of the market. Its platform is designed to help you look beyond just the lowest advertised rate and understand the bigger picture of borrowing costs over time.

What sets Rates.ca apart is its focus on deep-dive comparisons and decision-making tools. The platform makes it easy to explore different mortgage terms in detail and provides unique features that help you calculate the long-term value of a specific rate or product. This makes it an excellent resource for anyone wanting to run different scenarios, from a first-time buyer in West Kelowna to a seasoned investor eyeing a property in the Okanagan.

Key Features and Tools

Rates.ca offers several standout tools that empower you to make a more informed financial decision.

Detailed Term Pages: You can easily browse and compare rates for specific terms (1, 2, 3, 4, 5, 7-year, etc.) and even view bank-specific pages to see how a particular institution stacks up against the competition.

Rate Navigator Tool: This unique feature helps you rank different mortgage terms by their projected five-year cost. It goes beyond the simple interest rate to estimate which term might offer the best value, factoring in potential market changes.

Clear Lender Information: Each listing often notes key details, such as if a rate hold is available. This helps you quickly identify lenders who can lock in a rate for you while you finalize your home purchase in a competitive market like Kelowna's. Understanding all the variables is a key part of figuring out which mortgage is right for you.

Pros and Cons

| Deep Term-by-Term Analysis: Excellent tools for comparing specific mortgage terms beyond just the base rate. | Eligibility Verification Needed: Many listings require a follow-up conversation to confirm you meet the specific criteria for the advertised rate. |

| Focus on Long-Term Value: The Rate Navigator tool helps you think about the total cost of borrowing. | Rates May Not Be Instant: The site shows when rates were last updated, so you always need to verify the latest numbers directly before committing. |

| Free and Actionable: You can use the platform for free and it connects you with a broker or the lender to move forward. | Acts as an Intermediary: It's a comparison site, not a direct lender, meaning you'll be passed on to another professional to finalize the mortgage. |

Who It's Best For

Rates.ca is perfect for the analytical home buyer who loves to dig into the numbers. If you want to compare not just rates but the long-term implications of different mortgage terms, this platform provides the tools you need. It’s particularly useful for buyers and investors in the Okanagan who are planning their finances carefully and want to model various outcomes before signing on the dotted line.

Website: https://rates.ca/

4. RateSpy.com

RateSpy.com is a data-heavy, independent Canadian mortgage rate publisher, making it a powerful tool for those who want to dig deep into the numbers. It’s not a lender or a brokerage but an information hub that tracks both the "posted" rates you see advertised and the estimated "discretionary" rates that banks might actually offer. This transparency gives you a more realistic view of what you could be paying for your mortgage.

What makes RateSpy truly stand out is its editorial guidance. It doesn't just list rates; it provides commentary on lender policies, hidden fees, and potential pitfalls that can affect the true cost of your loan. This approach helps you look beyond the sticker price and understand the long-term implications of a mortgage offer, making it an excellent resource for anyone from a first-time buyer in West Kelowna to a seasoned investor in Penticton.

Key Features and Tools

RateSpy is built for the detail-oriented researcher who wants to understand the 'why' behind the rates.

Posted vs. Special Rate Tracking: It uniquely displays both official posted rates and estimated special or discretionary rates on single pages. This gives you a better sense of potential negotiating room with major lenders.

Extensive Lender Listings: The site tracks rates from over 300 providers, including banks, credit unions, monoline lenders, and brokers, offering one of the most comprehensive views available.

In-depth Editorial Guidance: Beyond numbers, RateSpy provides expert commentary on crucial policy details like prepayment penalties, refinance restrictions, and other clauses that can make a low-rate mortgage more expensive than it appears.

Pros and Cons

| Deep Transparency: Exposes the fine print and policies that impact the real cost of a mortgage. | Not a Lender: You can't apply through the site; it directs you to the lender or broker to complete the application. |

| Unbiased Listings: Aims to list the lowest rates regardless of advertising relationships, ensuring a more objective view. | Data-Dense Interface: The sheer amount of information can be overwhelming for beginners who prefer a simpler user experience. |

| Comprehensive Market Coverage: Includes a massive number of lenders, increasing your chances of finding niche or specialized offers. | Rates are Estimates: Discretionary rates are estimates and not guaranteed, requiring verification with the lender. |

Who It's Best For

RateSpy.com is perfect for the analytical home buyer or investor who wants to conduct exhaustive due diligence. If you're someone who likes to read the terms and conditions and understand every detail before making a decision, RateSpy’s data-rich environment will provide you with the insights you need to confidently find one of the best mortgage lenders in Canada.

Website: https://www.ratespy.com/

5. NerdWallet Canada (Mortgages)

NerdWallet Canada isn’t a direct lender or a rate marketplace; it’s a powerful educational resource designed to arm you with knowledge before you even start applying for a mortgage. Think of it as your trusted financial literacy hub, offering expert guides, unbiased lender reviews, and up-to-date rate tables from Canada’s major banks. Its focus is on helping you understand the landscape so you can confidently choose the right path, whether that’s going directly to a bank or working with a broker.

What sets NerdWallet apart is its vendor-neutral approach. The platform is committed to providing clear, straightforward information to help you decipher complex mortgage concepts. It equips you with the insights needed to compare different types of lenders and products, making it an essential first stop for anyone feeling overwhelmed by the home-buying process.

Key Features and Tools

NerdWallet’s strength lies in its curated content, which is especially useful for understanding the different players in the Canadian mortgage space.

“Today’s Rates” Tables: Get a quick overview of the current mortgage rates being offered by the Big 6 banks. This provides a solid baseline for what the market looks like before you dive deeper.

Guides on Lender Types: The platform excels at explaining the differences between A-lenders (major banks), B-lenders, and private lenders. This is crucial for borrowers in unique situations, like those who are self-employed in the Okanagan and need flexible income verification.

Curated Lender Lists: NerdWallet offers specialized coverage for different borrower profiles. You can find curated lists of the best lenders for newcomers, individuals with bad credit, or those looking for specific mortgage features.

Broker vs. Lender Explainers: One of the most helpful resources is their detailed breakdown of when to use a mortgage broker versus going directly to your bank. This guidance helps you make a strategic choice based on your financial situation and needs.

Pros and Cons

| Clear, Vendor-Neutral Education: Empowers you to choose the right lender type before picking a specific lender. | Not a Pure Rate Marketplace: You can’t apply directly; it links out to the banks or brokers to continue the process. |

| Excellent Foundational Knowledge: Perfect for first-time buyers who need to learn the basics from a trusted source. | Rate Tables Focus on Major Banks: You may not see rates from all the broker-only or monoline lenders. |

| Useful Guidance on Broker vs. Direct: Helps you decide which application route is best for your circumstances. | Less Interactive than Competitors: The experience is more article-based rather than tool-based. |

Who It's Best For

NerdWallet Canada is the ideal starting point for anyone who wants to become an educated borrower. It’s perfect for first-time home buyers in Kelowna who need to understand the fundamentals of mortgages, or for investors who want to research different lender types for their next property in Penticton or Vernon. If you value knowledge and want to understand the "why" behind your mortgage choices, NerdWallet is an indispensable resource.

Website: https://www.nerdwallet.com/ca/mortgages

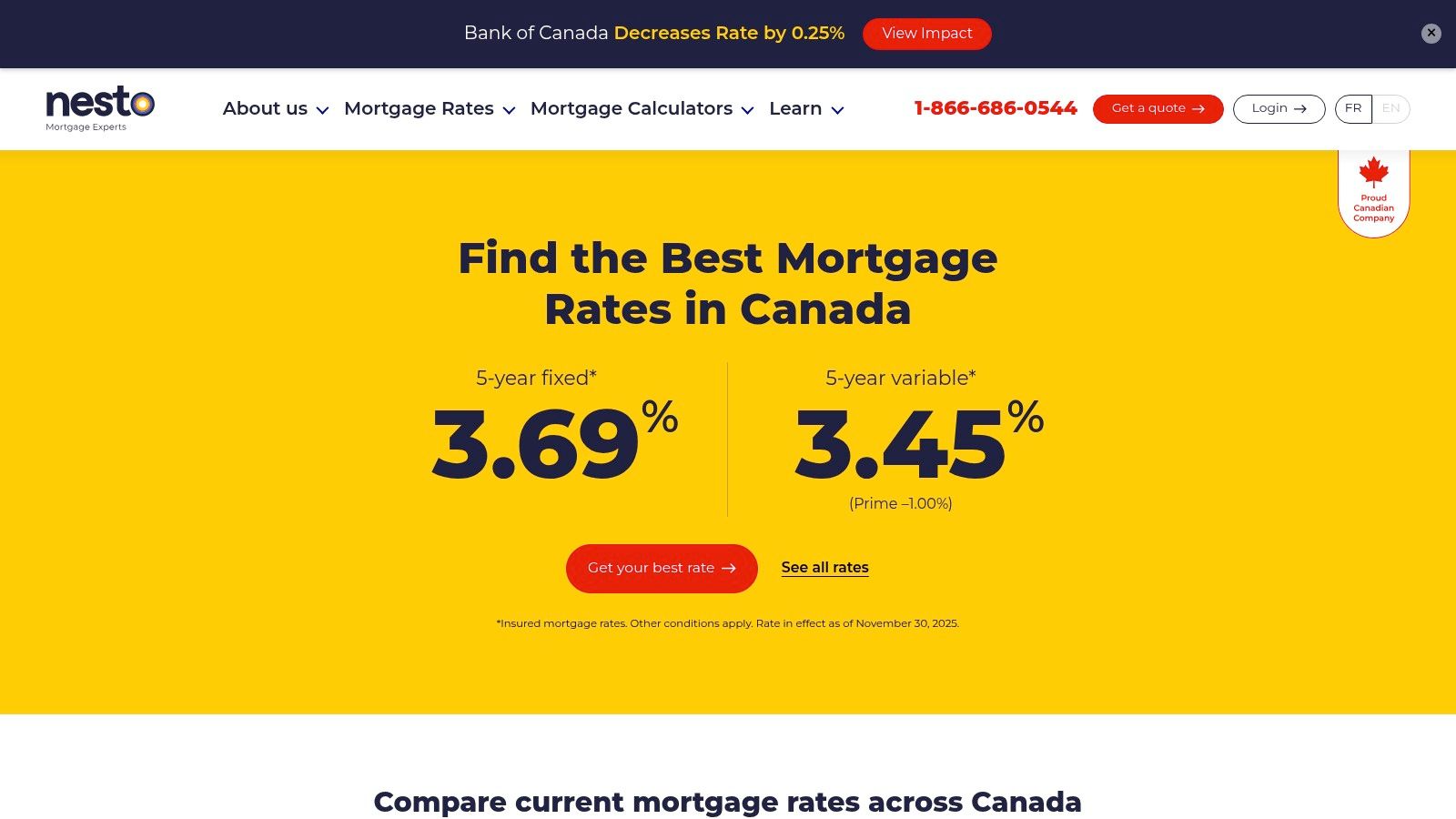

6. nesto

nesto is a direct-to-consumer digital mortgage lender that has streamlined the process of securing a home loan, making it a compelling choice for some of the best mortgage lenders in Canada. Instead of acting as a marketplace, nesto is the lender itself, offering a fully online experience from pre-qualification to the final signature. This digital-first approach allows them to offer highly competitive rates by reducing the overhead associated with traditional brick-and-mortar operations.

What makes nesto particularly appealing is its transparency and speed. Their website clearly displays live rates for both insured and uninsured mortgages, allowing you to see exactly what you might qualify for. The entire application, including document uploads and underwriting, is handled digitally, which is a massive advantage for tech-savvy buyers in the Kelowna real estate market who value efficiency.

Key Features and Tools

nesto's platform is designed for clarity and action, providing users with the tools they need to secure a mortgage with confidence.

Live Rate Transparency: The site features an up-to-date table of their best rates for various terms, distinguishing between insured (less than 20% down) and uninsured mortgages. It also clearly shows the discount off the prime rate for variable options.

Fully Digital Application: You can complete your entire mortgage application online, from getting pre-qualified to uploading necessary documents like pay stubs and proof of down payment. This can significantly speed up the approval timeline.

Generous Rate Holds: nesto is known for offering some of the longest rate holds in the industry (historically up to 150 days). This is a huge benefit for anyone buying a new construction home in areas like West Kelowna or Vernon, as it protects you from rate increases during the lengthy building process.

Pros and Cons

| Highly Competitive Rates: Their digital model often translates into some of the lowest headline rates available. | Limited Lender Choice: As a direct lender, you're only seeing their products, unlike a broker who can shop your file around. |

| Fast and Efficient Process: The all-digital experience is perfect for straightforward renewals, switches, and new applications. | No In-Person Support: If you prefer face-to-face guidance, the lack of physical branches might be a drawback. |

| Excellent Rate Hold Policy: The long rate hold period provides security and peace of mind for buyers. | Standard Qualification: While the process is digital, underwriting standards are still firm, and complex files may not fit. |

Who It's Best For

nesto is an excellent option for confident, digitally-inclined home buyers who have a straightforward financial profile. If you're comfortable managing your application online and are looking for a competitive rate for your new home in the Okanagan, nesto’s streamlined process could be a perfect match. It's also ideal for those needing a quick renewal or refinance without the hassle of multiple in-person appointments.

Website: https://www.nesto.ca/mortgage-rates/

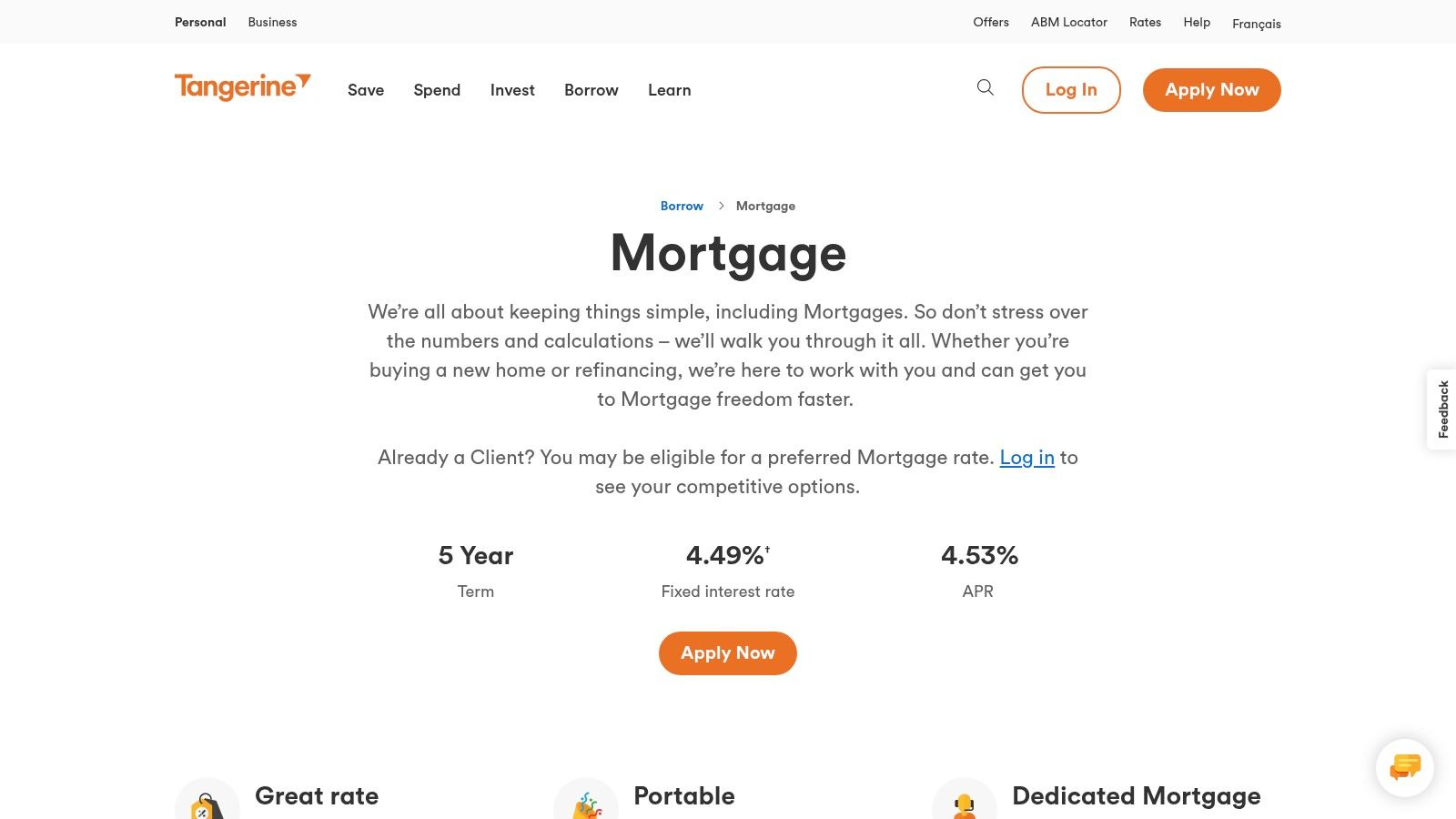

7. Tangerine Bank

Tangerine Bank, Scotiabank’s digital-first offshoot, offers a streamlined and straightforward mortgage experience for Canadians who are comfortable managing their finances online. It combines the credibility of a major bank with the simplicity and competitive rates often found with online-only lenders. Their approach is ideal for buyers who want a self-serve process but still value having a dedicated specialist to call upon when needed.

What makes Tangerine stand out is its blend of digital efficiency and human support. You can start your application online, lock in a competitive rate for 120 days, and then work with an assigned mortgage specialist to finalize the details. This model removes much of the friction of traditional banking while providing a safety net for questions and guidance.

Key Features and Tools

Tangerine’s platform is built for clarity and action, making it one of the best mortgage lenders in Canada for those who prioritize a no-fuss digital experience.

Transparent Rate Display: Their website clearly posts current fixed and variable mortgage rates for popular terms, including the Annual Percentage Rate (APR), so there are no surprises.

120-Day Rate Hold: You can secure a rate hold online before even completing your full application, protecting you from rate increases while you search for the perfect home in Kelowna.

Generous Prepayment Privileges: Tangerine allows you to make annual lump-sum prepayments of up to 25% of your original mortgage amount and increase your regular payments by up to 25% once per year. This flexibility can help you become mortgage-free much faster.

Assigned Mortgage Specialist: Once you begin an application, you're connected with a dedicated specialist who can guide you through the process, answering questions and ensuring everything is in order.

Pros and Cons

| Simple Digital Process: The online application is intuitive, and you're paired with a specialist for support. | Less Room for Negotiation: Posted rates are competitive but generally less negotiable than those from a mortgage broker. |

| Competitive Posted Rates: Often features some of the best headline rates for both fixed and variable terms. | Limited Special Programs: May have fewer options for newcomers or buyers with unique income situations. |

| Strong Prepayment Options: Excellent flexibility for paying down your mortgage faster without penalties. | Digital-First Model: Less suitable for those who prefer face-to-face meetings at a physical branch. |

Who It's Best For

Tangerine is a great fit for digitally confident borrowers—from first-time home buyers to seasoned investors in the Okanagan—who want a simple, transparent mortgage process backed by a reputable bank. If you're comfortable managing finances online and appreciate having clear, competitive rates from the start, Tangerine is a top contender. Understanding your potential payments is a critical first step, and you can learn more about how to calculate mortgage payments here to prepare.

Website: https://www.tangerine.ca/en/personal/borrow/mortgage

Top 7 Canadian Mortgage Lenders Comparison

| Ratehub.ca | Low (web tools; optional brokerage process) | Basic user info; documents if applying via brokerage | Side‑by‑side rates, calculators, end‑to‑end brokerage support | Beginners who want comparison plus advisor help and an easy apply path | Broad market coverage, calculators, in‑house licensed advisors |

| LowestRates.ca | Low (single‑form quote flow) | One consolidated application form; broker follow‑up | Multiple broker/lender quotes to review and lock via broker | Shoppers who want many quotes quickly and LTV clarity | Wide lender access, clear insured/uninsured breakdowns |

| Rates.ca (RATESDOTCA) | Low–Medium (term pages and decision tools) | Time to use tools like Rate Navigator; basic info to connect | Term‑ranked comparisons and broker/lender connections | Users deciding between terms or seeking best‑value term | Deep term analysis, Rate Navigator, detailed term pages |

| RateSpy.com | Medium (data‑dense research platform) | Time and finance literacy to interpret listings and policies | Transparent true‑cost comparison and editorial lender guidance | Advanced users, brokers, or researchers who need policy detail | Comprehensive coverage, policy transparency, non‑pay‑to‑play listings |

| NerdWallet Canada (Mortgages) | Low (editorial hub linking out) | Time to read guides; basic info to follow external links | Vendor‑neutral education and curated lender suggestions | Beginners seeking neutral guidance on lender types and profiles | Clear educational content, borrower‑profile guidance |

| nesto | Low–Medium (direct digital lender) | Full digital application and document upload for underwriting | Fast online pre‑qualification, rate lock and digital underwriting | Digitally‑savvy applicants seeking competitive online rates | Competitive headline rates, fast digital process, long rate holds |

| Tangerine Bank | Low (digital bank flow with specialist) | Standard bank application documents; online specialist support | Bank‑issued mortgage with clear terms and prepayment options | Customers who prefer a recognized bank brand and simple digital process | Bank trust, assigned specialist, transparent prepayment and 120‑day hold |

Your Next Move: Partnering for Success in the Okanagan Market

You’ve explored the digital tools, from Ratehub.ca to nesto, and weighed the pros and cons of major banks versus mortgage brokers. Now you understand that finding the best mortgage lenders in Canada involves identifying the right financial partner for your unique situation. Whether you're a first-time buyer excited about a condo in downtown Kelowna, an investor eyeing a duplex in Penticton, or a family looking to upsize in West Kelowna, the journey starts with financial clarity.

The tools and lenders we've covered are your starting point for getting pre-approved and locking in a competitive rate. They empower you with information, helping you grasp what you can afford and what to expect from the lending process. This initial step is foundational; it gives you the confidence to start your property search with a clear budget and solid financial backing.

A pre-approval is just one half of the equation. The other, equally critical half is navigating the dynamic Okanagan real estate market itself. This is where a strategic partnership moves you from being prepared to being successful.

From Pre-Approval to Property Ownership

Securing your financing is the green light, but expert guidance helps you win the race. The Kelowna real estate market has its own unique rhythm, with nuances that online rate calculators simply can't capture. Having a team that understands local inventory, neighbourhood values, and negotiation strategies is what transforms a good offer into a winning one.

Here are the key takeaways to guide your next steps:

Action Your Pre-Approval: Use your pre-approval number to start a focused, realistic search for Kelowna homes for sale. This document is your most powerful tool when you’re ready to make an offer, showing sellers you’re a serious and qualified buyer.

Align Your Lender with Your Goals: As we discussed, your choice of lender matters. If you're self-employed, a lender that works with brokers might be a better fit. If you value a streamlined digital experience, nesto could be your answer. Revisit the lender profiles and align your choice with your specific financial profile and property ambitions, whether it's a luxury lakefront home or a starter townhouse.

Think Beyond the Interest Rate: Remember that the lowest rate isn't always the best deal. Pay close attention to prepayment privileges, porting options, and potential penalties. A slightly higher rate with flexible terms could save you thousands in the long run, especially if your life plans change. This is a crucial consideration for anyone buying or selling a home in Kelowna, where life and career moves are common.

Ultimately, the search for the best mortgage lenders in Canada is the first chapter in your home-buying story. The next chapter involves translating that financial readiness into a successful purchase. This requires on-the-ground expertise, a deep understanding of the Okanagan, and a partner committed to your success. With over 1,000 five-star reviews and a foundation of trust within the community, our team provides the authentic advice and accountable service needed to navigate this journey. We're here to ensure you feel supported and confident, every step of the way.

Choosing the right lender is your first strategic move, and partnering with the right real estate team is your next. At Vantage West Realty, we bridge the gap between your financial pre-approval and handing you the keys to your new Okanagan home. If you’re thinking about buying or selling in Kelowna, Vantage West Realty can help you make your next move with confidence. reach out to our team today.