What it Really Costs to Own a Home in Canada (2025)

In 2021-2022, a combination of low mortgage rates and fear of missing out have led to a frenzy in Canadian home buying and a boom housing market.

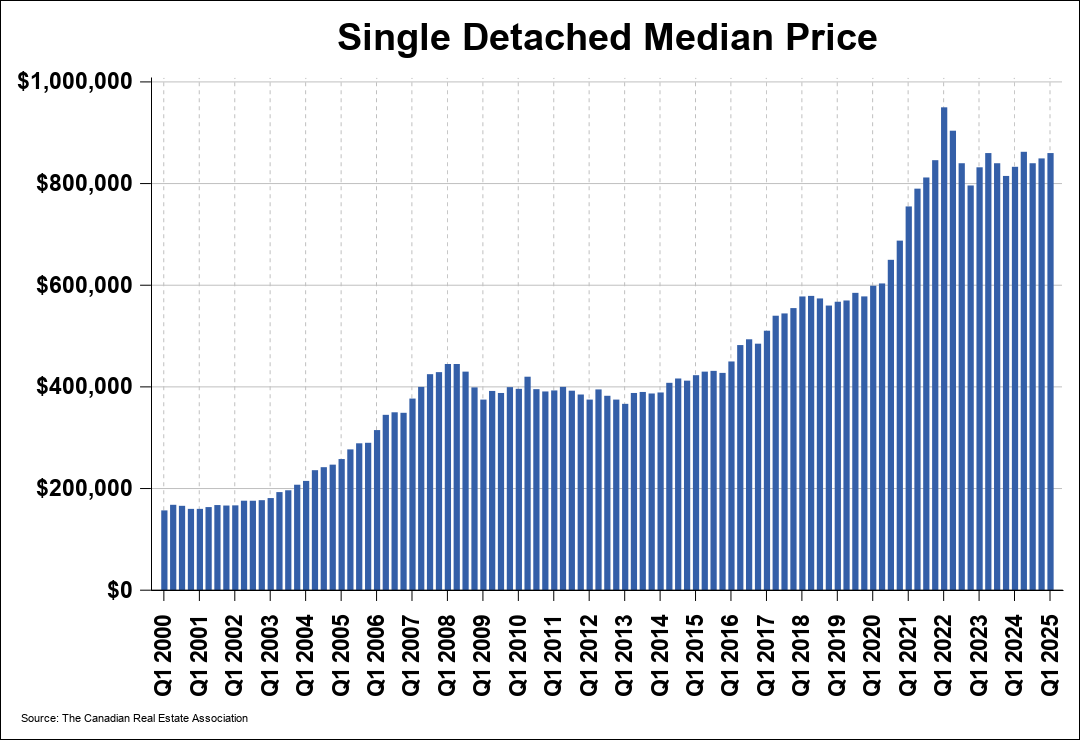

source: CREA MLS® Home Price Index (HPI)

source: CREA MLS® Home Price Index (HPI)

If you’re a first time home owner, or you’ve just purchased a new home, you’ll need to budget some of your income and savings towards the hidden costs of home ownership. This article breaks down the major expenses and shows you the true costs of owning a home in Canada.

Your Mortgage Payment

As of June 2025, the median price of a detached, single-family home in Kelowna is $860,000.

Try out our mortgage calculator to see how much mortgage you can afford.

You’ll need to purchase mortgage default insurance if you plan to buy a home with less than 20% down. This is a one-time premium which costs between 0.6% and 4.5% of the purchase price.

Mortgage life insurance helps borrowers repay their mortgage principal in the event of the borrower’s death, so loved ones aren’t left inheriting a large debt. Mortgage life insurance starts around $600 per year.

Home Insurance

Home insurance protects your home and belongings from theft, loss, or damage to your home or property. In Canada, the average price of home insurance is $924 per year. Unless your home mortgage is fully paid for, you’ll need home insurance to get approved for a mortgage.

Land Transfer Tax

When you buy a home in Canada, you’re required to pay a one-time land transfer tax which costs 1% for the first $200,000, and 2% for amounts up to $2,000,000. For a $830,000 home, the land transfer tax costs $14,600.

Property Tax

In Canada, if you own or lease a property, you’re liable to pay property taxes to City Hall once a year. They go towards local schools, libraries, roads, parks, police & fire protection, emergency rescue, and hospitals. Property tax rates for 2020 in the City of Kelowna cost 0.53% of your home’s assessed value. In 2020, the annual property tax amount for an $800,000 home came out to $4,208.40.

British Columbia Speculation & Vacancy Tax

If you’re buying a home as an investment property, you may be required to pay BC’s punitive Speculation & Vacancy Tax, which costs 0.5 percent of assessed home value for Canadians, and 2 percent for foreign owners. On an $830,000 home, the spec tax will come to $4,150 per year; but there are several ways to avoid paying the spec tax.

Telecommunications

Canadians pay some of the highest prices for internet, cable, and mobile phone plans anywhere in the world.

You should factor in $200 to $300 as a monthly payment for Canadian telecommunications.

- High speed internet: $80 to $120 / mo

- Mobile phone: $50 to $100 / mo

- Home phone: $20 to $30 / mo

- Cable television: $50 to $100 / mo

Local Utilities

According to BC Hydro, the average utility bill costs $103 per month ($1236 annually).

In British Columbia, utilities include both hydroelectricity & natural gas usage, which gets billed every 60 days.

Maintenance and Repairs

As a rule of thumb, you should budget 1% of your home’s purchase price towards annual maintenance and repairs.

Regular home maintenance includes:

Roof repairs

Plumbing

Furnace maintenance

Eavestroughs maintenance

Drain repair

Tree trimming

For a home worth $830,000, 1% of annual repairs comes to $8,300 per year.

Condo / Strata Fees

If you own a high rise condo or a home in a gated community, you’ll be liable to pay monthly strata fees that go towards maintenance of the common areas like parking, lobbies, and amenities.

The average strata fee costs $0.35 to $0.40 per sq ft of condominium space. For a 1,000 sq ft property, expect to pay around $370 per month in strata expenses.

Keep in mind that condo real estate with fancy amenities like pools, gyms, and recreation rooms come with higher strata costs.

The Total Cost of Home Ownership in Canada

Following our $830,000 home example, here’s how much money you’ll need to own a home that costs $830,000 in Canada.

Mortgage payments | $31,296 per year ($2,608 / mo) |

Home insurance | $924 per year |

Land transfer tax | $14,600 (one-time payment) |

Property tax | $4,376 per year |

Utilities | $1,236 per year |

Telecom | $3,000 per year |

Maintenance & repairs / strata fees | $8,300 per year |

Total Costs to Own a Home in Canada | $49,132 per year |

As we’ve shown, the cost of buying and owning a home in Canada adds up fast...

Home Budgeting 101

Make sure to take into account your monthly savings goal and basic living expenses like food, entertainment, & healthcare. Homeowners planning to renovate should budget at least $10,000 to $20,000 to hire licensed contractors and pay for building materials.

Next, read about Kelowna's cost of living (2023 update).