Your 2025 Guide to the Credit Score for a Home Loan in Kelowna

Let's be real. If you're dreaming of buying a home in Kelowna or Penticton, that three-digit number—your credit score—is probably on your mind.

Think of it as your financial handshake with Okanagan lenders. It makes a powerful first impression and can set the tone for your entire home loan application.

In Canada, you'll generally need a credit score of at least 640 to get in the door for a mortgage. But to get the best rates from major lenders, you'll want to aim for 680 or higher. If your score is dipping below 640, don't panic—options still exist, but they often come with higher interest rates or require an insured mortgage.

What Credit Score Is Needed for a Kelowna Home Loan?

A strong credit score is one of the most critical factors lenders look at. It’s a snapshot of your history with debt, telling them how reliable you are as a borrower. A good score gives them confidence that you can handle the responsibility of a mortgage.

In a competitive market like the Okanagan, a higher score helps you get approved and gives you a serious advantage.

Understanding the Score Tiers

Lenders in British Columbia tend to categorize credit scores into different tiers. Knowing where you stand is the first, most important step to getting yourself mortgage-ready.

Here’s a quick overview of how Okanagan lenders typically view different credit score tiers for home loan applications in BC.

Credit Score Ranges for a Kelowna Mortgage Approval

Credit Score Range Lender Perception Potential Impact on Your Mortgage

740+ (Excellent) | You're a top-tier applicant and seen as very low-risk. | Lenders will offer you their best interest rates and most favourable loan terms. |

670-739 (Good) | This is a solid range. You're considered a reliable borrower. | You should have no trouble getting approved and will be offered competitive rates. |

580-669 (Fair) | You can still qualify, but lenders see you as a higher risk. | Your options may be limited, likely leading to higher interest rates or requiring mortgage insurance. |

Below 580 (Needs Improvement) | Securing a loan from a traditional lender will be very challenging. | This is a clear signal to focus on credit improvement before reapplying. |

Ultimately, a higher credit score means lower borrowing costs. Simple as that.

At Vantage West, our lead, AJ Hazzi, always reminds clients: "A better score unlocks lower interest rates, which can save you tens of thousands of dollars over the life of your mortgage. It's about paying less for your home."

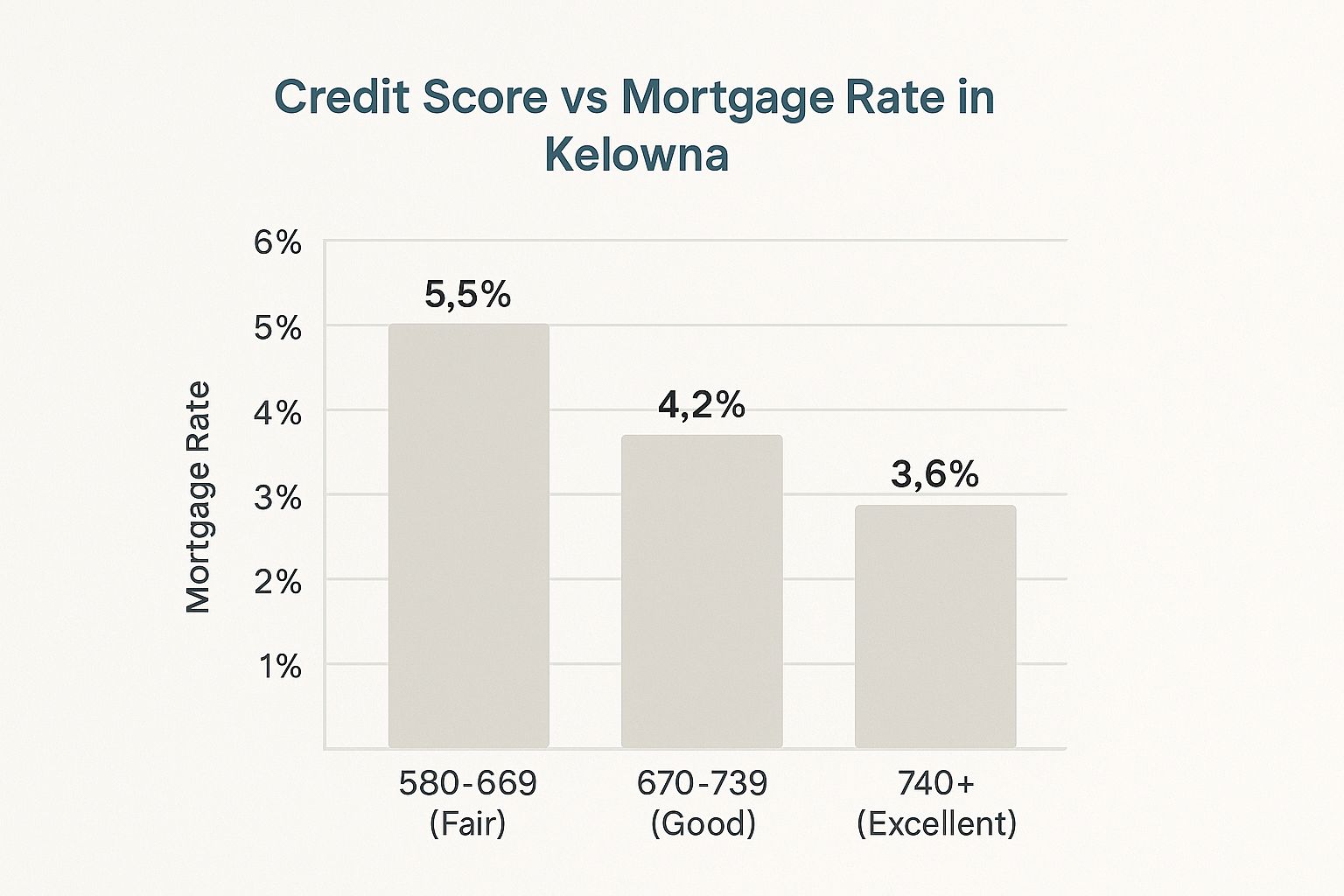

This chart shows just how much your credit score can influence the mortgage rate you're offered here in Kelowna.

As you can see, jumping from a "Fair" to an "Excellent" score can lead to massive savings. It’s also important to remember that your credit score is just one piece of the puzzle. Factors like the mortgage stress test also play a huge role in your final approval, especially when interest rates are changing. Understanding how all these pieces fit together is crucial when you're planning your Okanagan home purchase.

How Lenders Analyze Your Credit Report

When a Kelowna lender pulls your credit report, they aren’t just looking at that single three-digit number. They're digging into your entire financial story to predict how you’ll handle a mortgage. It’s their way of assessing risk before handing over a huge sum of money for that dream Okanagan property.

A great way to understand it is to compare your credit report to a driver's abstract. A long history of on-time payments is like a clean driving record—it shows you’re reliable. Missed payments, on the other hand, are like little fender-benders that raise red flags. Seeing your credit habits through their eyes is the first step to getting prepared.

The Five Key Ingredients of Your Score

Your credit score is a recipe made up of five main factors, and each one carries a different weight. Lenders in West Kelowna and Vernon look at all of them, not just the final number.

Payment History (35%): This is the big one—the single biggest piece of the puzzle. It shows if you’ve paid your credit accounts on time, every time. There's no better way to build a strong score than with consistent, timely payments.

Credit Utilization (30%): This is all about how much of your available credit you're using. If your credit cards are constantly maxed out, it signals to lenders that you might be financially overextended. The golden rule? Keep your balances below 30% of your total credit limit.

Length of Credit History (15%): A longer credit history generally works in your favour. Lenders feel more comfortable when they can see a proven, multi-year track record of you managing credit responsibly.

Types of Credit Used (10%): It helps to show you can juggle different kinds of credit. A healthy mix, like a car loan, a line of credit, and a credit card, demonstrates financial versatility.

New Credit Inquiries (10%): If you apply for a bunch of new credit cards or loans in a short time, your score can take a temporary hit. It can make lenders nervous, suggesting you might be in some financial trouble.

Knowing these components helps you pinpoint exactly where to focus. For most people buying a home in Kelowna, nailing your payment history and credit utilization will make the biggest impact.

A lender just wants to feel confident that you can repay your home loan. Every piece of your credit report helps build that confidence. A clean, responsible history makes their decision to approve you an easy one.

On a positive note, the average credit score in British Columbia has been on the rise, recently hitting 722 for FICO scores as of late 2024. That’s even higher than the national average of 717. This trend shows that consumers across the province are getting better at managing their credit, setting a strong benchmark for aspiring homeowners in the Okanagan.

How Your Score Impacts Your Mortgage Rate

This is where the rubber really meets the road. Your credit score directly influences how much your home will cost you every single month.

A difference of even 50 or 100 points can have a massive impact on the interest rate you're offered. This translates into thousands, sometimes tens of thousands, of dollars in interest paid over the life of your mortgage. Think about it: a lower rate means a lower monthly payment, giving you more financial breathing room.

Putting the Numbers into Perspective

Let's make this real with a quick example right here in the Okanagan. Imagine two different buyers are looking to purchase a condo in Kelowna for $550,000. They both make a 20% down payment, leaving them with a mortgage of $440,000.

Now, let's see how their credit scores change everything.

Buyer A has an excellent credit score of 780. Lenders see them as a very safe bet and roll out the red carpet with a competitive interest rate.

Buyer B has a fair credit score of 680. They still qualify, but the lender sees them as a slightly higher risk and offers a higher interest rate to compensate.

Even a seemingly small difference in the rate can add up significantly. Recent 2025 data shows just how closely rates are tied to credit scores in British Columbia. For instance, borrowers with top-tier scores (760+) were offered average APRs around 7.242%, while those with good scores (700-759) saw slightly higher rates around 7.449%.

The Long-Term Cost of a Lower Score

Let's plug some hypothetical numbers into our Kelowna condo example. We'll use a 25-year amortization period, which is common for Canadian mortgages.

Credit Score Sample Interest Rate Monthly Payment Total Interest Paid (25 Yrs)

780 (Excellent) | 4.5% | $2,442 | $292,600 |

680 (Good) | 5.5% | $2,693 | $367,900 |

As you can see, Buyer B pays $251 more every single month. That might not seem like a fortune on its own, but over the full 25 years, it adds up to an extra $75,300 in interest payments. That’s enough for a major home renovation, a new vehicle, or a huge boost to your retirement savings.

Seeing these numbers in black and white provides some powerful motivation. Taking the time to improve your credit score before you start looking at Kelowna homes for sale is one of the smartest financial moves you can make. It’s a direct investment in your long-term wealth.

Understanding Different Mortgage Types in Canada

Not all mortgages are created equal, and neither are their credit score requirements. Getting a handle on the different types of home loans available in Canada is the first step to setting realistic expectations for your property search here in the Okanagan.

Think of it this way: a lender’s rules can change based on the loan type and the property itself. They’ll likely have much stricter criteria for a luxury waterfront property on Okanagan Lake than they would for a starter condo in Rutland. Knowing these differences helps you have smarter, more productive conversations with your mortgage professional.

Conventional Mortgages: The A-Lender Route

Conventional mortgages are the loans you get from traditional lenders, like the major banks. In the industry, we call them "A-lenders," and they usually have the most demanding requirements.

To qualify for a conventional loan, you typically need to bring a down payment of at least 20% of the home's purchase price to the table. Because you're putting more of your own skin in the game, the lender sees you as a lower risk. The big perk? You get to avoid paying for mortgage default insurance. But in return, they’ll expect a strong credit profile.

Insured Mortgages: More Flexibility for Buyers

If your down payment is less than 20%, you’ll be looking at an insured mortgage. This is where providers like the Canada Mortgage and Housing Corporation (CMHC) come into play.

They essentially insure the loan for the bank, protecting the lender in case you can't make your payments. This insurance opens the door to homeownership for thousands of buyers who haven't saved up a full 20% down payment. While the credit score requirements for these loans can be more flexible, you will have to pay for the insurance premium, which is usually just rolled into your mortgage principal.

Choosing between a fixed vs. variable rate mortgage is another critical decision you'll make, as it directly impacts your monthly payments and how much you pay over the long haul.

No matter which path you take, your credit score for a home loan plays a massive role. It’s the lender’s snapshot of how you manage debt and signals how reliable you are as a borrower. A stronger score always leads to better options.

Here in British Columbia, the type of loan you’re going for directly influences the credit score you'll need. As of 2025, conventional loans from A-lenders generally require a minimum credit score of 620. However, to get the absolute best mortgage rates, you’ll want to be in the 740-and-up club.

Insured loans offer more leeway, sometimes accepting scores as low as 500 if you have a larger down payment to compensate. Understanding these benchmarks is the first step toward building a winning home-buying strategy in Kelowna.

Actionable Steps to Boost Your Credit Score

Feeling like your credit score could use a little attention before you start looking at Kelowna homes for sale? The good news is, you're in the driver's seat. Improving your score is about taking small, consistent steps that really add up over time.

We're going to give you the same clear, manageable plan we share with our clients at Vantage West Realty. It's all designed to get you into the strongest possible position before you make an offer on that dream Okanagan home.

Focus on the Fundamentals First

Before diving into complex strategies, mastering the basics gives you the biggest bang for your buck. These two actions have the most significant impact on your credit score, hands down.

Pay Every Single Bill on Time: This is the big one. Your payment history makes up about 35% of your entire score. Set up automatic payments or calendar reminders for everything—credit cards, car loans, and even your phone bill. Just one late payment can set you back, so consistency is truly your best friend here.

Keep Credit Card Balances Low: Lenders pay close attention to your credit utilization ratio, which is just a fancy way of saying how much credit you're using compared to your total limit. A great rule of thumb is to keep your balances below 30% of your limit. So, if you have a $10,000 limit, you'll want to keep what you owe under $3,000.

Smart Strategies for a Stronger Score

Once you’ve got the basics locked down, you can add these other powerful tactics to your routine. Think of these as the fine-tuning that shows lenders you’re a responsible, low-risk borrower.

Don't Close Old Accounts: It can be tempting to close an old credit card you never use, but that can actually hurt your score. An older account adds to the length of your credit history, which is a big positive. Just keep it open, maybe use it for a small purchase once in a while, and pay it off immediately.

Avoid New Credit Applications: When you're gearing up to apply for a mortgage, it's smart to hit pause on applying for any new credit. Every application triggers a "hard inquiry" on your report, which can temporarily dip your score by a few points. Too many of those in a short period can make lenders in Kelowna a little nervous.

Check Your Report for Errors: Believe it or not, mistakes happen. You have the right to get a free copy of your credit report from both Equifax and TransUnion each year. Go through it carefully. If you find errors, like accounts that aren't yours or incorrect payment info, dispute them. A simple correction could give your score a nice, quick boost.

Building a great credit score for a home loan is a marathon, not a sprint. The small, smart choices you make today will directly impact the mortgage rate you secure for your home in Penticton or West Kelowna tomorrow.

Navigating Your Home Purchase with Confidence

You’ve put in the work, your credit looks solid—so, what comes next? The single most powerful step you can take is getting a mortgage pre-approval long before you start seriously looking at Kelowna homes for sale.

A pre-approval is your golden ticket. It hands you a clear, realistic budget, which means you’re only touring homes you know you can comfortably afford. No more guesswork or disappointment.

Even more important, it signals to sellers that you are a serious, qualified buyer ready to make a move. In a competitive market like the Okanagan, this gives you a massive advantage when it’s time to put in an offer.

Your Trusted Partner in Real Estate

Here at Vantage West Realty, we’re more than just agents; we’re your guides through every twist and turn of the home-buying journey. Our goal is to make sure you feel supported and confident from our first chat to the day you get your keys.

What does that look like in practice?

We’ll connect you with top-tier local mortgage professionals who can get your pre-approval sorted out quickly.

We’ll help you make sense of all the details, from your purchasing power to the final closing costs.

Once you find the perfect home, we’ll step in to negotiate the best possible deal on your behalf.

Your credit score is a crucial piece of the puzzle, and our team is here to help you put it all together. For a deeper dive, our 2025 First-Time Home Buyer Guide for Kelowna is packed with even more valuable insights.

We’re ready to help you unlock the door to your new Okanagan home.

Your Top Questions Answered

We get a lot of questions from home buyers in the Okanagan about credit scores and mortgages. Here are the answers to the ones that come up most often.

How Quickly Can I Actually Improve My Credit Score?

This really depends on where you're starting from and what you do next. Many people see a positive shift within three to six months just by focusing on the basics: paying every single bill on time and bringing down their credit card balances. It's amazing what a few months of good habits can do.

Bigger issues, like a past bankruptcy, will naturally take longer to fade into the background—often several years. The absolute key is consistency. Building credit is a marathon, and every on-time payment helps.

Will Checking My Own Credit Score Hurt It?

Nope, not at all. When you check your own score through a service like Borrowell or Credit Karma, it’s known as a "soft inquiry." You can do this as often as you like, and it will have zero impact on your score. It's a great way to stay on top of your financial health.

A "hard inquiry" is another story. That's when a lender pulls your credit report because you've applied for something new, like a mortgage or a car loan. This can cause your score to dip by a few points temporarily.

Can I Get a Home Loan in Kelowna with a Co-Signer?

Yes, you certainly can. If your credit score isn't quite where it needs to be, bringing on a co-signer with a strong credit history can be a game-changer. Lenders will look at your co-signer's income and credit profile right alongside yours, which can make your application much more appealing.

Just remember, this is a massive commitment for your co-signer. It's a decision that needs a serious, sit-down conversation with them—and probably a trusted financial advisor—before anyone signs on the dotted line.

If you’re thinking about buying or selling in Kelowna, Vantage West Realty can help you make your next move with confidence. Reach out today.