Home Equity Loan vs. Line of Credit: A 2025 Kelowna Guide

If you're a homeowner in Kelowna, Penticton, or anywhere across the Okanagan, you've probably seen your property's value grow. That equity is a powerful tool, but figuring out how to use it can be tricky. When you're looking at a home equity loan vs. a line of credit, it really comes down to one question: do you need predictability or flexibility?

Think of it like this. A home equity loan gives you one lump-sum payment at a fixed interest rate. It's perfect for a big project with a clear budget. A home equity line of credit (HELOC) is more like a financial tool you can use as needed, letting you borrow what you need, when you need it, usually with a variable interest rate.

Unlock Your Okanagan Home's Hidden Value

Watching your property's value climb in the Okanagan real estate market is always a great feeling. But that growth is more than just a number on paper—it's equity, a powerful financial tool you can put to work. The real challenge is figuring out how to access it.

Let's break it down. Your two main paths for tapping into your home's value are a home equity loan or a home equity line of credit (HELOC). Each serves a different purpose, and knowing which one aligns with your goals is the first step toward making a smart financial move.

Understanding the Core Concepts

Imagine you're planning a major kitchen renovation for your West Kelowna home. You've got a firm quote from a contractor, so you know exactly how much it'll cost. This is a classic scenario where a home equity loan shines.

- Home Equity Loan: You get a one-time lump sum of cash. It comes with a fixed interest rate and a set repayment schedule, which means your monthly payments never change. That stability makes budgeting simple and predictable.

Now, what if your plans are less concrete? Maybe you have several smaller projects to tackle over the next few years, or you just want a financial safety net for unexpected expenses. A HELOC offers the kind of flexibility you need.

- Home Equity Line of Credit (HELOC): This is a revolving line of credit. You get approved for a certain limit and can draw from it as needed. Crucially, you only pay interest on the amount you've actually used. The interest rate is typically variable, meaning it can change with market conditions.

"Your home’s equity is one of your greatest assets as an Okanagan homeowner. Choosing between a loan and a line of credit is about matching the right tool to your specific financial job—whether it’s a big one-time project or a series of ongoing needs."

To make it even clearer, here’s a quick overview of how the two options stack up.

Home Equity Loan vs. HELOC At a Glance

The table below breaks down the fundamental differences to help you see which option might be a better fit for your situation.

Feature Home Equity Loan Home Equity Line of Credit (HELOC)

How You Get Funds | A single, one-time lump sum payout. | A revolving credit line you can draw from as needed. |

Interest Rate Type | Typically a fixed rate, so payments are predictable. | Typically a variable rate that can fluctuate over time. |

Repayment Structure | Fixed monthly principal and interest payments. | Often interest-only payments during a "draw period." |

Best For | Large, planned expenses with a known cost (e.g., major renovations). | Ongoing projects, uncertain costs, or a financial safety net. |

Ultimately, the best choice depends entirely on how you plan to use the money and how comfortable you are with different payment structures.

How a Home Equity Loan Works in BC

Let's dig into the details of a home equity loan, which you might also hear called a second mortgage. When you take one out in British Columbia, you're borrowing a specific, fixed amount against the equity you've built in your property. The best part? You get all the money in one go.

This lump-sum structure is perfect for homeowners with a clear, one-time project in mind. Imagine you’re planning a full kitchen remodel for your Kelowna home and have a firm quote for $80,000. A home equity loan provides that exact amount upfront.

That means you can pay your contractor and get the project rolling without any financial guesswork.

Predictability is the Key Benefit

The biggest advantage of a home equity loan is its predictability. You get a fixed interest rate for the entire loan term, so your monthly payments never change. This consistency makes budgeting a breeze, which is a huge plus for anyone who values financial stability.

You'll know exactly what you owe and for how long, right from day one. In a fluctuating market, that peace of mind is priceless.

This structure helps Okanagan homeowners plan their finances with confidence, whether they're upgrading their forever home in Vernon or renovating a property in Penticton to sell.

What Lenders Look For in an Application

When you apply for a home equity loan in BC, lenders will assess a few key things to determine your eligibility and the amount you can borrow. They aren't just looking at your property; they're looking at your complete financial picture.

Here’s what they’ll review:

Your Home's Appraised Value: A professional appraiser will determine the current market value of your home. This is the starting point for calculating your available equity.

Your Existing Mortgage Balance: The lender subtracts what you still owe on your first mortgage from your home’s appraised value to find your total equity.

Your Credit Score and History: A strong credit score shows lenders you have a reliable track record of managing debt, which is crucial for approval.

Your Income and Debt-to-Income Ratio: They need to see that you have a stable income and can comfortably handle the new monthly loan payment on top of your existing bills.

At Vantage West Realty, we always remind our clients that a strong application is built on solid financial footing. Getting your documents in order and understanding your credit profile beforehand can make the entire process smoother.

The average Canadian homeowner's access to home equity has grown significantly. In early 2025, the nation’s average home equity loan offer was $144,330. Homeowners in high-value markets like Kelowna often have access to much larger amounts, reflecting the region's strong property values. This makes the choice between a fixed-rate loan and a variable-rate HELOC especially relevant. For example, a five-year, $30,000 home equity loan averages 8.15%, while interest rates on a HELOC of the same amount have recently dropped. Find out more about current home equity interest rates and trends.

Securing the Loan Against Your Property

It's important to remember that a home equity loan is a secured loan. This means your home acts as collateral, which is why lenders can offer more favourable interest rates compared to unsecured options like personal loans or credit cards.

The loan is registered on your property’s title, right behind your primary mortgage. This gives the lender a legal claim to the property if you are unable to make your payments.

While this secures a better rate for you, it also means you must be completely confident in your ability to manage the repayment schedule before signing on the dotted line. This is a powerful tool for achieving your goals, and like any tool, it needs to be used responsibly.

The Flexibility of a Home Equity Line of Credit

Now, let’s explore the other side of the coin: the home equity line of credit, or HELOC. This option offers a completely different approach to accessing your equity. Instead of a one-time lump sum, a HELOC provides a revolving line of credit you can draw from as you need it.

Think of it like a credit card that’s secured by your home. This structure is what makes a HELOC incredibly flexible and a powerful tool for Okanagan homeowners.

Imagine you have a $100,000 HELOC approved for your West Kelowna property. You could use $20,000 for landscaping this spring, pay some of it back over the summer, and then draw another $30,000 for a new roof next year—all without having to reapply for a new loan.

The Draw Period and Repayment Structure

A HELOC is typically split into two distinct phases. Understanding these is key to using this tool effectively and planning your finances.

The first phase is the draw period, which often lasts for 10 years. During this time, you can borrow money from your line of credit up to your approved limit. A major benefit here is that your monthly payments are often interest-only, which keeps them lower and gives you more financial breathing room.

This is ideal for projects where the final costs are uncertain or for homeowners who want a ready source of funds without immediately taking on a large debt. You only pay interest on the amount you’ve actually used, not the entire credit limit.

After the draw period ends, you enter the repayment period. At this point, you can no longer borrow from the line of credit. Your monthly payments will now include both principal and interest, calculated to pay off the remaining balance over the rest of the term, which might be another 10 to 20 years.

Understanding the Variable Interest Rate

The most important detail about a HELOC is its variable interest rate. This rate is tied to the lender's prime rate, which fluctuates with changes in the Bank of Canada's key interest rate.

This means your monthly payments can change. If the prime rate goes up, your interest payments will increase. If it goes down, you’ll pay less.

"A HELOC’s flexibility is its greatest strength, but it requires a bit more financial management. It's a fantastic tool for homeowners in Kelowna who are comfortable with potential rate changes and want on-demand access to their equity."

This variability is the main trade-off for the incredible flexibility a HELOC offers. It’s perfect for someone with a good handle on their budget who can absorb potential payment increases.

For example, an investor in the Okanagan real estate market might use a HELOC to quickly fund a down payment on a new rental property in Penticton, knowing they can pay it down quickly once the property is tenanted. The initial lower rate and quick access to cash are worth the risk of future rate changes.

So, while a home equity loan provides stability, a HELOC delivers adaptability. It’s built for ongoing needs, unexpected opportunities, and homeowners who want a financial safety net they can tap into whenever necessary.

Comparing Your Home Equity Options

Alright, let's put these two options side-by-side. When you’re weighing a home equity loan vs. a line of credit, seeing how they stack up directly is the best way to get some clarity. For an Okanagan homeowner, this is about finding the financial tool that actually fits your life and your goals.

We'll break down the core differences, focusing on how you get the money, what you'll pay in interest, and how you pay it all back.

How You Access the Funds

The biggest difference right out of the gate is how the money lands in your bank account. A home equity loan gives you a single, lump-sum payout. This is perfect when you know the exact cost of a project, like that $75,000 basement suite renovation you've planned for your Penticton home. You get all the cash at once, and you're good to go.

A HELOC, on the other hand, is all about on-demand access. You're approved for a certain credit limit and can draw what you need, whenever you need it. That kind of flexibility is a game-changer for ongoing projects or for Kelowna homeowners who want a financial safety net without taking on a massive chunk of debt immediately.

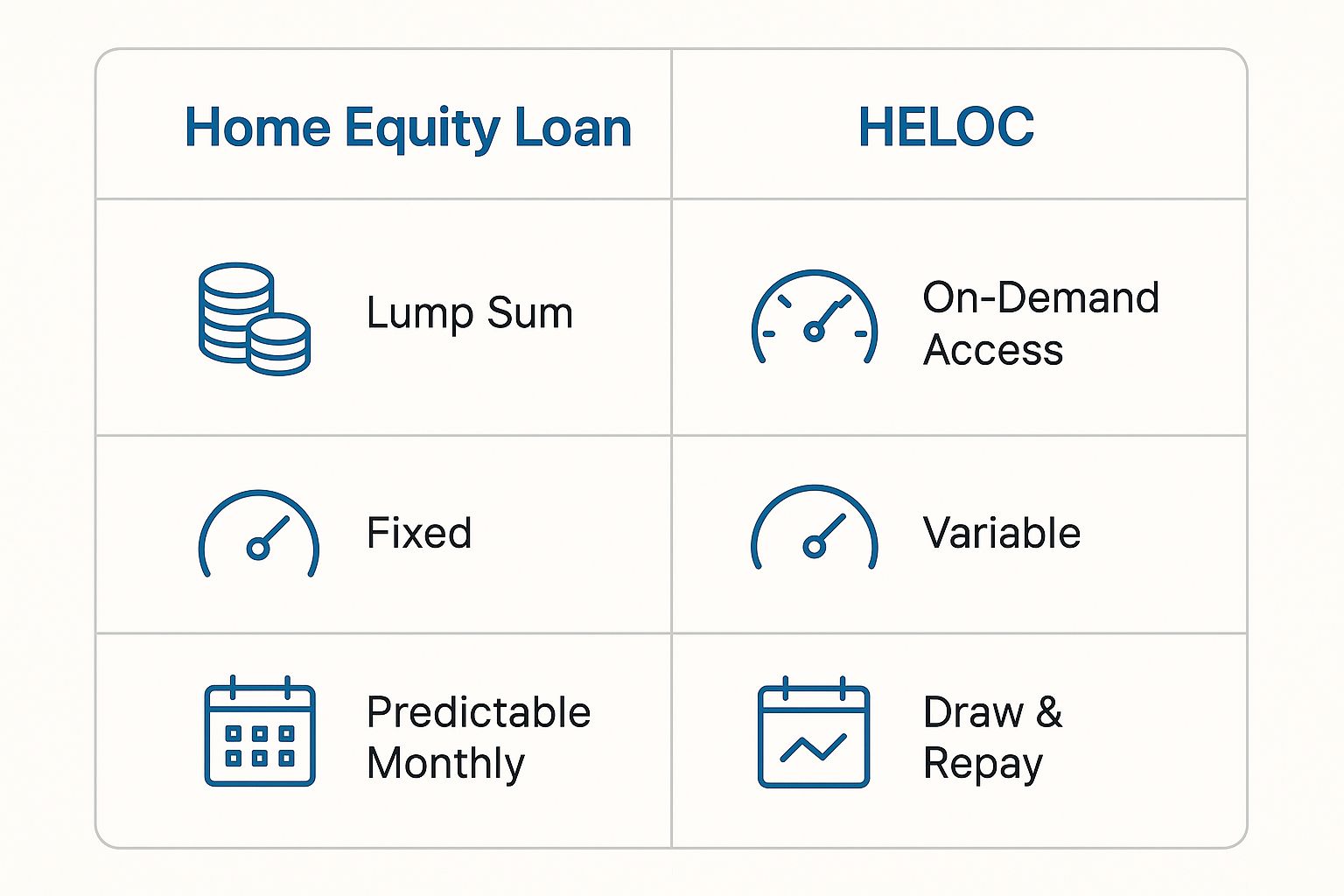

This infographic simplifies the key distinctions between a home equity loan and a HELOC.

As you can see, the choice really boils down to whether you need one predictable transaction or ongoing, flexible access to your equity.

Interest Rates and Market Stability

Your comfort level with financial risk plays a huge role here. A home equity loan nearly always comes with a fixed interest rate. For anyone who values predictability, this is a massive plus. Your monthly payment is locked in for the entire loan term, shielding you completely from market swings or interest rate hikes from the Bank of Canada.

That stability makes long-term budgeting a breeze. You’ll never have to stress about your payment suddenly jumping up.

A HELOC operates on a variable interest rate that’s tied to the prime rate. While this rate might start lower, it can—and does—rise and fall over time, which adds a bit of uncertainty to the mix. Still, many Okanagan homeowners are perfectly comfortable with this trade-off for the flexibility a HELOC offers. If you're leaning this way, it’s smart to budget for potential rate increases to make sure the payments always feel manageable.

At Vantage West Realty, we often see clients choose the option that best matches their personality. If you prefer to 'set it and forget it,' the loan is your friend. If you’re an active manager of your finances, the HELOC is an incredibly powerful tool.

Repayment Structures

Finally, let's talk about how you pay the money back. With a home equity loan, the repayment structure is simple and consistent. From day one, every payment you make goes toward both principal and interest. It’s a straightforward amortization schedule, much like a regular mortgage, so it's easy to see your progress.

A HELOC’s repayment is usually split into two phases. The first is the draw period, which often lasts 10 years. During this time, you might only be required to make interest-only payments. This keeps your monthly costs low, but you aren't making a dent in the principal balance unless you intentionally make extra payments. Once the draw period is over, you enter the repayment phase, and your payments will increase to cover both principal and interest.

For many homeowners exploring different ways to tap into their property's value, it's also worth understanding how to refinance your mortgage, as it offers another powerful route to accessing equity.

Here is a simple table that summarizes the key differences at a glance, helping you see which option might be the right fit for your situation in the Okanagan.

Detailed Comparison Home Equity Loan vs. HELOC

Feature Home Equity Loan Home Equity Line of Credit (HELOC)

Fund Payout | One-time, lump-sum payment. | Revolving credit you can draw from as needed. |

Interest Rate | Typically fixed, so payments are predictable. | Typically variable, tied to the prime rate. |

Best For | Large, one-time expenses with known costs. | Ongoing projects, unexpected expenses, or a safety net. |

Repayment | Principal and interest payments from the start. | Interest-only payments during the draw period are common. |

Flexibility | Less flexible. You get the funds once. | Highly flexible. Borrow, repay, and borrow again. |

Budgeting | Simple and stable; your payment never changes. | Requires more active management due to rate changes. |

Ultimately, the choice comes down to your cash flow needs and financial strategy. If you want lower payments now and can handle larger ones later, a HELOC is a great fit. But if you'd rather start chipping away at the debt immediately with a consistent, predictable payment, a home equity loan is the way to go.

Real Scenarios for Okanagan Homeowners

Theory is one thing, but let's ground these ideas in the real world with some examples from right here in the Okanagan. Seeing how your neighbours might put these financial tools to work can make it much clearer which one fits your own goals in the Kelowna real estate market.

We see these situations play out every single day.

Scenario 1: The Major Renovation

Imagine a family in Vernon planning to add a second storey to their house. They’ve already met with a contractor, the plans are finalized, and they have a firm quote for $150,000. They know exactly how much they need and precisely when the builder needs to be paid.

This is a perfect case for a home equity loan. They receive the full $150,000 upfront in a single lump sum, allowing them to pay the contractor on schedule without any fuss. The fixed interest rate means their monthly payments are completely predictable and won't change, which keeps their household budget simple and stress-free.

Scenario 2: The Strategic Investor

Over in Kelowna, an investor has built up a lot of equity in their primary residence. They want to be ready to pounce on the next great rental property that comes up. They know the Okanagan market moves fast, and having cash ready to go is a massive advantage.

For them, a HELOC is the ideal tool. It gives them the flexibility to make a quick, competitive offer, letting them draw the down payment funds the moment they need them without jumping through the hoops of a new loan application. That kind of readiness can be the deciding factor when a prime property hits the market in a competitive area like the Lower Mission. We dig into similar smart financial moves in our guide on The Equity Optimization Manoeuvre.

"The right financial tool can be as important as the right property. For an investor, a HELOC provides the agility needed to act decisively in a fast-paced market like Kelowna."

Scenario 3: The Ongoing Upgrades

Now, think about a couple in Penticton who plan to tackle several projects over the next few years. They want to build a new deck this summer, redo the landscaping next spring, and then replace the furnace before the following winter. Their costs are spread out, and the exact timing isn't set in stone.

This is where a HELOC truly shines. It allows them to finance each project as it comes up, borrowing only what they need, when they need it. They avoid taking out a huge loan upfront and only pay interest on the money they’ve actually used, keeping their borrowing costs perfectly aligned with their project timeline.

British Columbia is an epicentre for home equity. Homeowners here collectively hold a huge piece of the country's $2 trillion in tappable equity as of June 2025. In a market like Kelowna, the typical mortgage holder has a substantial amount of equity they can access. This dynamic of high property values and built-up wealth has Okanagan homeowners looking more and more at these products to get cash in hand. You can learn more about the trends in homeowner equity and how it's shaping borrowing decisions.

These practical examples show that the best choice is all about your specific goals. It's about matching the structure of the financing to the shape of your project.

So, Which One Is Right for You?

After breaking it all down, the choice between a home equity loan and a HELOC is about which one is better for you. Your financial habits and your reason for borrowing are the two biggest factors.

Whether you're in Kelowna, West Kelowna, or anywhere in the beautiful Okanagan, it comes down to asking the right questions to figure out what fits your life. Let's walk through what you need to consider.

What’s the Money For?

First things first: get really clear on why you need the cash. Your goal is the best signpost you'll have.

A big, one-time project: If you have a specific goal with a clear price tag—like a $60,000 kitchen overhaul or paying off a large chunk of debt—a home equity loan is usually the smarter play. You get all the money upfront, and the fixed repayment schedule makes budgeting a breeze. No surprises.

Ongoing projects or a safety net: If you're looking at a series of smaller projects over the next few years, or you just want an emergency fund on standby, a HELOC's flexibility is hard to beat. You can draw what you need, when you need it, which is perfect for expenses that pop up unexpectedly.

This first question is the most important one you can ask. It’ll immediately help you lean one way or the other.

What’s Your Risk Tolerance?

Next, think about your comfort level with financial surprises. How would you feel if your monthly payment suddenly changed?

If you sleep better at night knowing exactly what your bills are, the fixed interest rate on a home equity loan is your best friend. Your payment is locked in for the life of the loan, so you're completely shielded from rate hikes. It’s ideal for anyone on a set income or who just prefers predictability.

On the other hand, if you're okay with some fluctuation and want to take a shot at what are often lower initial rates, a HELOC is a powerful tool. It just means you have to keep an eye on the market, but the trade-off is total flexibility.

"Your choice reflects your financial personality. At Vantage West Realty, AJ Hazzi and the team believe in empowering you with authentic, clear advice so you can make a decision that feels right for you, not just for the numbers on a page."

How Disciplined Are You With a Credit Line?

This one requires some real honesty. How do you handle access to credit?

A home equity loan is simple and structured. You get the lump sum, and you start paying it back on a fixed schedule. There’s no temptation to dip back in for more because it’s a one-and-done deal.

A HELOC works more like a credit card, which demands a bit more self-control. It’s incredibly easy to borrow, pay it back, and then borrow again. For some, that’s a massive advantage. For others, it can be a trap if it’s not managed with care. You need the discipline to only borrow what’s necessary and to make payments that actually chip away at the principal, not just the interest.

Thinking through these key points will almost always lead you straight to the right answer for your situation. At Vantage West Realty, we’re here to give homeowners across the Okanagan the honest guidance they need for every step of their real estate journey.

Common Home Equity Questions

We get a lot of questions from homeowners across the Okanagan who are curious about tapping into their home equity. Here are a few of the most common ones we hear, especially when it comes to the differences between a home equity loan and a line of credit.

How Much Equity Can I Borrow in BC?

In Canada, the rule of thumb is that you can borrow up to 80% of your home's appraised value, minus whatever you still owe on your mortgage.

Let's break that down. Say your Kelowna home is valued at $1,000,000 and you have a $400,000 mortgage balance. Lenders will calculate 80% of your home's value, which is $800,000. From there, they subtract your mortgage, leaving you with up to $400,000 in accessible equity ($800,000 - $400,000).

Of course, the final amount you’re approved for will also hinge on your overall financial picture. To get a better feel for what lenders are looking for, take a look at our guide on the ideal credit score for a home loan.

What Are the Main Risks?

The biggest thing to remember is that both of these products are secured by your home. If for some reason you can't make the payments, you could risk foreclosure. That’s why it’s so important to borrow responsibly and have a clear plan.

The specific risks vary a bit. With a HELOC, the danger is rising interest rates, which can unexpectedly increase your monthly payments. For a home equity loan, you’re locked into a fixed rate, which can feel frustratingly high if market rates drop later on.

Which Option Is Faster to Get?

The approval process itself is pretty similar for both, usually taking a few weeks. You'll go through the standard steps: application, income verification, and a professional home appraisal to confirm its value.

The real difference is in how you get the money. A home equity loan pays out everything in one lump sum after closing. A HELOC, on the other hand, gives you access to a credit line you can draw from as needed, right after you're approved. So, once you’re set up, a HELOC offers much quicker access to funds.

If you're thinking about buying or selling in Kelowna, Vantage West Realty can help you make your next move with confidence. Reach out to our team today.