How to Refinance Your Mortgage in Kelowna: A 2025 Guide

Refinancing your mortgage is like trading in your current home loan for a new one that’s a better fit for your life right now. The goal is usually to snag a lower interest rate, shrink your monthly payment, or tap into your home's equity. For homeowners across the Okanagan, from Kelowna to Penticton, it can be a savvy move to improve cash flow or finally fund those big life goals.

Why Refinance Your Mortgage in Kelowna

Let's get into the big question many Okanagan homeowners are asking: is now the right time to refinance? The Kelowna real estate market is always in motion, and the mortgage that made sense a few years ago might not be the smartest option today. Refinancing helps make your biggest asset work harder and smarter for you.

Life happens. Maybe you got a promotion, your family is growing, or you're finally ready to tackle that kitchen renovation in your West Kelowna home. Your mortgage should be flexible enough to keep up. It's all about aligning your home loan with where you are now and where you want to go.

Finding Your Reason to Refinance

Every homeowner's story is different, but the reasons for refinancing tend to fall into a few common buckets. Figuring out which one resonates with you is the first step in deciding if this is the right move.

Here are the most common motivations we see from homeowners in the Okanagan:

Secure a Lower Interest Rate: This is the classic driver. If market rates have dropped below what you're currently paying, refinancing can seriously cut down your monthly payment and the total interest you’ll pay over the long haul.

Tap Into Home Equity: Property values in places like Kelowna and Penticton have climbed, meaning you've likely built up a nice chunk of equity. A cash-out refinance lets you access that value to fund renovations, pay for your kids' education, or invest somewhere else.

Consolidate High-Interest Debt: Juggling credit card bills or personal loans? Rolling them into a single mortgage payment at a much lower rate can simplify your finances and save you a ton of money on interest.

Change Your Loan Term: You might want to switch from a 30-year mortgage to a 15-year term to pay off your home faster and build equity like a pro. On the flip side, you could extend your term to lower your monthly payments and free up cash flow.

To give you a clearer picture, here’s a quick breakdown of the main reasons homeowners choose to refinance and what each one means for your bottom line.

Quick Guide: Reasons to Refinance Your Mortgage

Reasons What It Means For You Best For Homeowners Who...

Get a Lower Rate | Reduces your monthly payment and the total interest you pay over the loan's life. | Have seen market rates drop since they got their mortgage and have a good credit score. |

Access Home Equity | You receive a lump sum of cash by borrowing against your home's value. | Need funds for a major expense like a renovation, tuition, or investment. |

Debt Consolidation | Combines high-interest debts (like credit cards) into a single, lower-rate mortgage payment. | Are looking to simplify their finances and reduce their overall interest costs. |

Switch Loan Term | Pay off your mortgage faster (shorter term) or lower your monthly payments (longer term). | Want to align their mortgage timeline with their retirement goals or current cash flow needs. |

Each path offers unique benefits, so it's all about matching the strategy to your personal financial goals.

The Impact of Current Interest Rates

The interest rate climate is a massive factor in any refinancing decision. The market has been on a bit of a rollercoaster lately. Even a small dip in rates can translate into significant monthly savings, especially with the mortgage sizes we see here in the Okanagan.

For most homeowners, the end game is to make their mortgage more manageable and aligned with their financial reality. A lower payment can free up hundreds of dollars each month, which makes a huge difference for families in our community.

Of course, understanding your options means taking a hard look at the numbers. Passing the mortgage stress test is a non-negotiable part of the process, and you need to know how it works. We’ve put together a guide that explains exactly how the new stress test impacts your mortgage approval.

Deciding whether to refinance is a personal call. It’s about weighing your goals against the costs to see if the long-term benefits are worth the upfront effort. With the right advice from a team that knows the Kelowna real estate market, you can make a choice that puts you in a much stronger financial position.

Preparing Your Finances for a Successful Application

Before you even think about shopping for new mortgage rates, it’s time to get your financial house in order. Think of it like prepping your home for sale—you want to present it in the best possible light. Lenders will be digging into the details, and having everything organized and looking sharp is your best first move.

When you apply to refinance, lenders are essentially deciding whether to invest in you all over again. They'll be looking closely at your credit score, your income stability, and how you manage your existing debt. Putting your best foot forward here is the key to unlocking the best possible terms.

Your Credit Score Is King

Your credit score is one of the most powerful numbers in your financial life, and it plays a huge role in refinancing. For lenders, it’s a quick snapshot of your reliability as a borrower. A higher score tells them you’re a lower risk, which almost always translates into a lower interest rate for you.

So, where do you stand? Start by checking your credit report. You can get free copies every year from Canada's two main credit bureaus, Equifax and TransUnion. Go through it line by line, looking for any errors—like incorrect late payments or accounts you don't recognize—and dispute them right away.

If your score isn't quite where you want it to be, don't sweat it. You can take some simple, practical steps to improve it:

Pay Every Bill on Time: This is the big one. Your payment history is the single largest factor in your score, and even one late payment can have a noticeable impact.

Keep Credit Card Balances Low: Lenders like to see that you're not maxing out your credit. Aim to use less than 30% of your available credit limit on each card.

Don't Open New Accounts: Hold off on applying for new credit cards or loans in the months leading up to your refinance application. Each application can trigger a "hard inquiry," which can temporarily ding your score.

Improving your credit takes a bit of patience, but even a small bump can save you thousands over the life of your new loan. It’s an effort that really pays off.

Understanding Your Debt-to-Income Ratio

Another crucial metric lenders look at is your debt-to-income (DTI) ratio. It’s a straightforward calculation that compares your total monthly debt payments to your gross monthly income, and it helps lenders gauge your ability to comfortably manage a new mortgage payment.

To figure out your DTI, just add up all your monthly debt payments:

Mortgage or rent

Car loans

Credit card minimum payments

Student loans

Any other personal loans

Then, divide that total by your gross monthly income (your income before taxes). Lenders generally prefer a DTI ratio below 43%, but honestly, the lower, the better. A low DTI shows you have plenty of breathing room in your budget.

A strong application shows lenders you can responsibly manage the money you have. A healthy DTI and a solid credit score are your best tools for demonstrating financial stability.

The reality is that lenders in high-value markets like the Okanagan look for well-qualified borrowers. Recent data shows that nearly 79% of new mortgages went to borrowers with credit scores above 720, confirming that those with strong financial profiles get the best deals.

Ultimately, preparing your finances is about building a compelling case for yourself. The more you can do to strengthen your credit and manage your debt, the smoother your application process will be. If you're looking for more ways to understand your financial picture, check out our guide on what it really costs to own a home in Canada. Taking these steps now sets you up for success and gets you closer to achieving your refinancing goals with confidence.

So, you’ve done your homework, run the numbers, and you're ready to make a move. What happens now? Let's pull back the curtain and walk through it, step by step.

It’s a pretty straightforward process once you know what to expect.

Assembling Your Financial Story

First things first, you'll need to gather all your financial documents. Lenders need a crystal-clear snapshot of your income, assets, and liabilities to make their decision. Getting everything organized upfront is the single best thing you can do to make the whole process smoother and faster.

Think of it as preparing your case—you want to present the strongest, most complete picture from the get-go.

Here's a checklist of the usual suspects you'll need to round up:

Proof of Income: Typically your most recent pay stubs covering a 30-day period, plus your T4 slips from the last two years.

Tax Documents: Your Notices of Assessment from the Canada Revenue Agency (CRA) for the past two years are essential.

Bank Statements: You'll need to show recent statements for all chequing and savings accounts, usually from the last 2-3 months.

Existing Mortgage Details: A copy of your most recent mortgage statement is needed to show your current balance, interest rate, and payment info.

Property Tax Bill: Your latest municipal property tax statement is also a standard requirement.

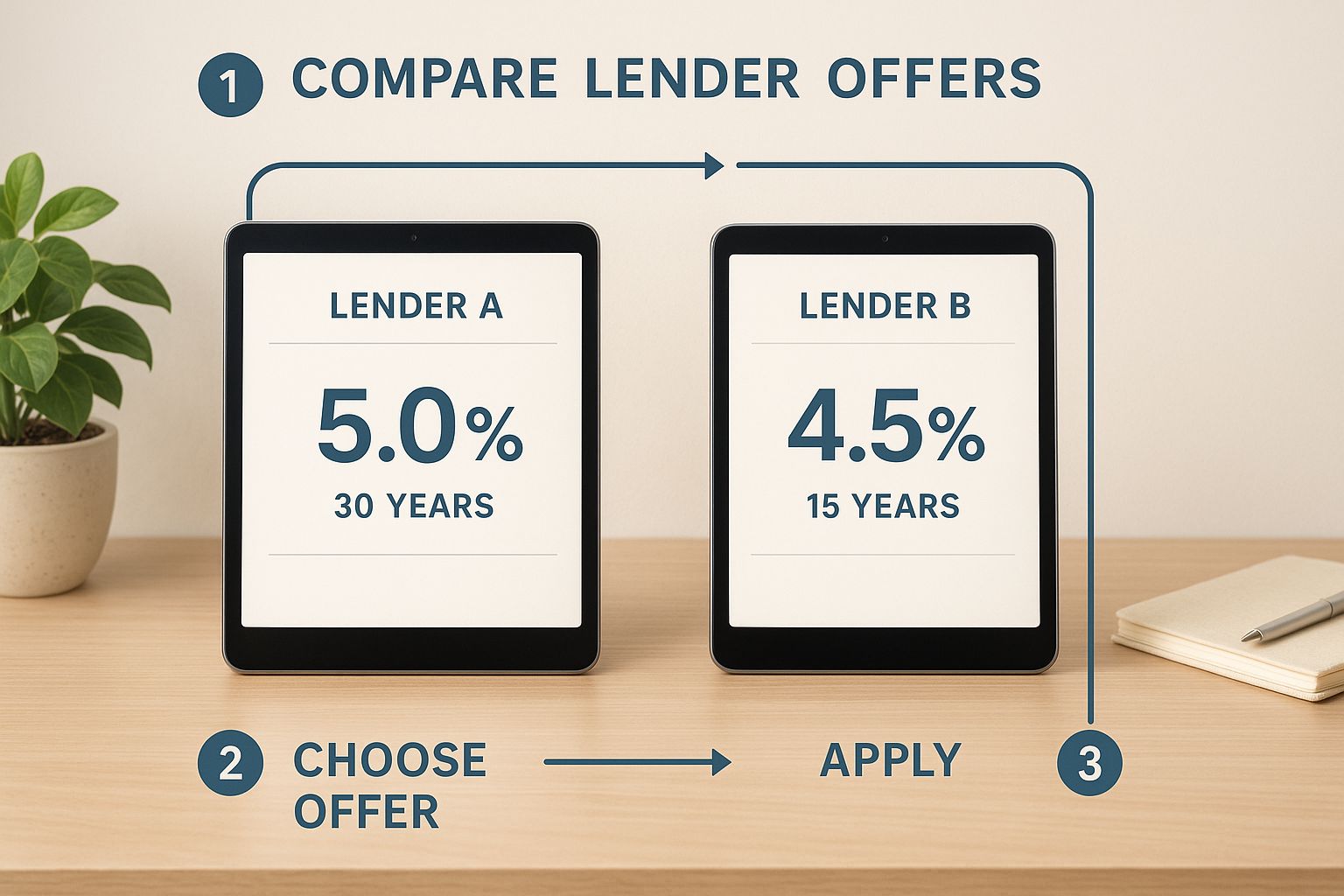

It’s one thing to get offers from different lenders, but it’s another to see them all laid out side-by-side.

When you can visually compare terms like this, it’s much easier to spot the offer that truly fits your goals. It cuts through the noise and makes a complex decision feel a lot simpler.

The Home Appraisal: Where the Rubber Meets the Road

Once your application is in, the home appraisal becomes the next critical milestone. A professional appraiser will visit your property to determine its current market value. This is a big deal, especially for homeowners in places like Kelowna and West Kelowna, where the real estate market is always on the move.

The appraisal value is crucial because it establishes your loan-to-value (LTV) ratio. Lenders live and breathe by this number; it’s their main gauge for risk. For instance, if your home is appraised at $800,000 and your outstanding mortgage is $600,000, your LTV is 75%.

A strong appraisal is validation. It gives the lender solid proof that your property is a sound asset, which can make or break your application.

Most lenders draw the line at an LTV of 80% for a standard refinance. If the appraisal comes in lower than you hoped, it could limit how much you can borrow or even affect the rate you're offered. This is where having a team that knows the Okanagan market inside and out really pays off—we can help set realistic expectations based on current local values.

The Final Stretch: Underwriting to Approval

With the appraisal complete and your documents submitted, your file heads to the underwriter. The underwriter meticulously reviews every single detail—your income, credit history, assets, and the appraisal—to make sure you tick all the lender's boxes.

It's completely normal for an underwriter to come back with a few last-minute questions or a request for one more document. The key is to respond quickly. A fast reply keeps the momentum going and avoids unnecessary delays.

Once the underwriter signs off, you'll get the official loan approval and a commitment letter detailing the terms of your new mortgage. From there, it's off to the lawyer or notary to sign the final papers, pay off your old loan, and officially begin the term on your new, better mortgage. You're at the finish line.

Understanding the Costs of Refinancing a Mortgage

Refinancing your mortgage isn't free, but the right move can be a smart investment if the long-term savings are there. Before you get too excited about that lower monthly payment, it's crucial to get a clear picture of the upfront expenses involved. Knowing the numbers helps you make a confident, clear-eyed decision.

In British Columbia, these expenses are often bundled together as closing costs, and they’re pretty standard across the board. They’re the fees you pay to your lender, lawyer, and other parties to finalize your new loan. Think of them as the administrative costs of setting up a better financial future.

Breaking Down the Common Costs

While every situation is a little different, there are a few common fees you can expect to see when you refinance your home in the Okanagan. Getting familiar with them now means you won't face any surprises down the road.

Here’s a look at what’s typically included:

Appraisal Fee: Your lender needs to know what your home is worth today, so they'll hire a professional appraiser. This usually runs a few hundred dollars and confirms for the lender that the property value supports the new loan.

Legal Fees: You'll need a lawyer or notary to handle all the legal paperwork. They’ll register the new mortgage, discharge the old one, and make sure everything is legally sound. These fees can vary, so it’s always a good idea to get a quote beforehand.

Title Insurance: This is a one-time policy that protects both you and the lender from any potential disputes over the ownership of your property. It’s a small price for long-term peace of mind.

Discharge Fee: Your old lender will likely charge a fee to remove their mortgage from your property's title. It’s a standard part of closing out your previous loan.

And don't forget the big one: a potential mortgage prepayment penalty from your current lender. If you’re breaking your mortgage term early, this can be a significant cost. Make sure you ask your lender for the exact amount before you do anything else.

To get a clearer picture of how these costs add up and what they mean for your decision, let's break it down in a simple table. This example shows you how to calculate your break-even point—the moment your savings start to outweigh the costs.

Common Refinancing Costs and Break-Even Point Example

Appraisal Fee | $300 - $500 | $400 |

Legal Fees & Disbursements | $1,000 - $2,000 | $1,500 |

Title Insurance | $200 - $400 | $300 |

Discharge Fee | $250 - $400 | $300 |

Total Estimated Costs: | $2,500 | |

Monthly Savings: | $200 | |

Break-Even Point: | 12.5 months ($2,500 ÷ $200) |

This table is just an illustration, but it shows how quickly you can start seeing real savings. Once you're past that 12.5-month mark, every dollar you save each month is pure profit in your pocket.

Calculating Your Break-Even Point

This is where the magic happens. The break-even point is the single most important calculation you'll do. It tells you exactly how long it will take for your monthly savings to cover the total cost of refinancing.

It’s surprisingly simple to figure out.

Total Refinancing Costs ÷ Monthly Savings = Months to Break Even

Let’s use a real-world Kelowna example. Say your total closing costs come to $4,000. By refinancing, you’ll save $250 each month on your mortgage payment.

$4,000 ÷ $250 = 16 months

In this scenario, it would take you 16 months to recoup the upfront costs. If you plan on staying in your home for longer than that, every month after is pure savings. This simple math makes it easy to see if the move is financially sound for your timeline.

As a rule of thumb, homeowners often start seriously looking at refinancing when interest rates drop by at least 0.5%. This is typically enough of a change to make the process worthwhile, especially in high-value areas like the Okanagan where even small rate shifts have a big impact. If you want to dive deeper into how market trends affect rates, check out this informative mortgage rate analysis.

Knowing your break-even point turns a complex decision into a clear, straightforward choice. It empowers you to move forward knowing you're making a great long-term financial play.

Choosing the Right Type of Refinance for Your Goals

Refinancing is a strategic move that should align perfectly with what you want to achieve. The right choice depends entirely on your personal goals, whether you’re looking to save money, fund a new project, or simplify your finances.

Let’s break down the most common options we see homeowners in the Okanagan take. Understanding these different paths is the key to making your home’s equity work for you. It’s about picking the right tool for the job.

Rate-and-Term Refinance for Lower Payments

This is the most straightforward and popular type of refinance. A rate-and-term refinance is exactly what it sounds like: you’re swapping your old mortgage for a new one with a better interest rate, a different loan term, or both.

If interest rates have dropped since you bought your home in Kelowna, this is your chance to lock in a lower payment and reduce the total interest you’ll pay over the long run. It's a simple, powerful way to improve your monthly cash flow.

Alternatively, you could shorten your loan’s term. We’ve seen many ambitious homeowners switch from a 30-year mortgage to a 15-year one. While your monthly payment might go up slightly, you'll pay off your home twice as fast and save a huge amount in interest. This strategy is fantastic for building equity at an accelerated pace, setting you up for future real estate investments in the Okanagan market.

Cash-Out Refinance to Access Your Equity

Have you been dreaming of a major kitchen renovation for your West Kelowna home or need to fund your child’s university education? A cash-out refinance might be the perfect tool. This option lets you tap into the hard-earned equity you’ve built in your property.

Here’s how it works: you take out a new mortgage for more than what you currently owe. The difference is paid out to you as a lump sum of tax-free cash.

For example, if your home is valued at $900,000 and you owe $500,000, you might refinance for $600,000. After paying off the original mortgage, you'd receive $100,000 in cash to use however you see fit.

This is a popular move for homeowners who want to reinvest in their property, consolidate high-interest debts like credit cards, or seize another investment opportunity. It turns the paper wealth in your home into liquid cash you can use now.

Considering a Home Equity Line of Credit (HELOC)

A Home Equity Line of Credit (HELOC) is another way to access your home’s equity, but it functions more like a credit card than a traditional loan. Instead of getting a lump sum, you’re approved for a revolving credit limit that you can draw from as needed.

Flexibility: You only borrow what you need, when you need it, and you only pay interest on the amount you’ve used.

Variable Rates: Most HELOCs have variable interest rates, meaning your payments can fluctuate over time. This can be a drawback if rates are on the rise.

While a HELOC offers great flexibility for ongoing projects or unexpected expenses, its variable nature can create budget uncertainty. It’s important to weigh this against the stability of a fixed-rate cash-out refinance.

Deciding between a fixed or variable rate is a big part of any mortgage decision. To help you choose wisely, we've put together a detailed guide on the pros and cons of fixed vs. variable rate mortgages.

Ultimately, the best refinance option is the one that brings you closer to your financial goals. Talking it through with a trusted professional can provide the clarity you need to move forward with confidence.

Common Questions About Refinancing in Kelowna

Refinancing your mortgage is a big decision, and naturally, it comes with a lot of questions. You want to feel confident you're making the right move every step of the way, and we get that completely.

Here are the answers to some of the most common questions we hear from homeowners across the Okanagan—from Kelowna to Vernon—as they weigh their options.

Will Refinancing My Mortgage Hurt My Credit Score?

This is a great question and one we hear all the time. The short answer is: a little, but only temporarily.

When you apply to refinance, the lender runs what's called a "hard inquiry" on your credit report. This can cause a small, temporary dip in your score, usually just a few points. Think of it as a tiny speed bump.

Once your new mortgage is in place and you start making those consistent, on-time payments, your score typically bounces back quickly. Over the long haul, responsibly managing your new loan can actually strengthen your credit profile. The minor short-term dip is almost always worth the long-term financial win of a better mortgage.

Can I Refinance if I Just Bought My Home in Kelowna?

It’s a classic scenario: you buy your dream home, and then a few months later, interest rates take a nosedive. It's tempting to jump on a lower rate right away, but most lenders have what’s called a “seasoning” requirement.

This just means they like to see a track record of you making your mortgage payments on time, usually for about six to twelve months. It’s their way of seeing you’re a reliable borrower before they take on the new loan.

Even if you're a newer homeowner, it's always worth a conversation. A trusted mortgage professional can walk you through specific lender guidelines and help you figure out the best time to make your move.

If rates have dropped significantly right after you bought your property in the Kelowna real estate market, don’t just sit on it. Ask for advice—there might be an opportunity you can act on sooner than you think.

What Happens to My Property Taxes and Home Insurance?

This part of the process is surprisingly seamless. Your new lender will simply set up a brand-new escrow account (sometimes called an impound account) to manage your property taxes and homeowner’s insurance payments. It works exactly like your old one.

So, what about the money in your old account? Any funds left over will be refunded to you directly by your previous lender. This usually happens within a few weeks after your old loan is officially paid off.

Your new monthly mortgage payment will include a portion that goes into this new account, making sure your taxes and insurance are always paid on time without any disruption. It's all handled for you.

Should I Work with a Mortgage Broker or My Bank?

Both are excellent routes, and the best choice really comes down to your unique situation. Your current bank already knows your financial history, which can sometimes make the application process a bit quicker. You’ve already got that relationship built.

On the other hand, a mortgage broker doesn’t work for just one institution. They have relationships with many different lenders across the country. They can shop around on your behalf to find the most competitive rates and products out there, potentially uncovering options you’d never find on your own.

At Vantage West Realty, our advice is always to speak with a trusted, independent mortgage professional. They can provide unbiased guidance tailored specifically to your circumstances here in the Okanagan. They'll help you compare all your options clearly, ensuring you can make your next move with total confidence.

If you’re thinking about your next move in the Kelowna real estate market, the team at Vantage West Realty is here to help you navigate your options with clarity and confidence. Reach out today to get started.