Mortgage Broker vs. Bank Canada: Your 2025 Guide to Kelowna Home Financing

So, you’re getting ready to buy a home in the Okanagan, and the big money question comes up: should you go to your bank for a mortgage, or should you use a mortgage broker?

It’s a huge decision, and the path you choose can make a massive difference to your monthly payments and overall stress levels.

Here’s the simplest way to think about it: your bank can only offer you its own mortgage products. A mortgage broker, on the other hand, is like a personal shopper for mortgages—they search the entire market, including dozens of different lenders, to find the best deal for you.

Your choice really comes down to this: Do you prefer the familiarity of your own bank, or do you want the wider selection and expert guidance a broker brings to the table?

Your Guide to Mortgage Financing in Canada

Getting a mortgage is one of the biggest financial steps you’ll ever take. We know how challenging that can feel, especially here in the beautiful but competitive Okanagan real estate market. The whole process can seem overwhelming, but when you boil it down, you've got two main paths: going directly to a bank or partnering with a mortgage broker.

This choice is becoming more important than ever. In 2025, the Canadian mortgage broker market is valued at a strong $778.56 million and is expected to keep growing.

This trend is powered by rising home prices and a wave of first-time buyers who are turning to brokers for their expertise in finding competitive rates. In British Columbia, brokers now handle over 40% of deals involving non-standard products, especially in high-cost areas like Kelowna and Penticton.

This guide breaks down exactly what this choice means for you as a home buyer in Kelowna. Our goal at Vantage West Realty is to ensure you feel supported and confident, every step of the way.

Quick Comparison: Mortgage Broker vs. Bank

Here's a quick summary of the main differences between using a mortgage broker and a bank for your home financing in Canada.

Feature Mortgage Broker Bank

Product Variety | Access to dozens of lenders, including banks, credit unions, and alternative lenders. | Limited to the bank's own mortgage products and interest rates. |

Loyalty | Works for you, the client, to find the best possible mortgage fit. | Works for the bank and represents its interests. |

Cost to You | Typically free; the lender pays them a commission for bringing them the business. | No direct fee; mortgage specialists are salaried employees of the bank. |

Best For | Complex situations, first-time buyers, investors, or anyone wanting to shop the market. | Existing long-term clients with simple financial profiles who value convenience. |

How Rates and Product Options Compare

When you’re buying a home in Kelowna, the interest rate you get has a massive impact on your monthly payments. This is where the difference between walking into your bank and calling a mortgage broker becomes crystal clear.

Your bank can only offer you its own rates, which are tied to its limited menu of mortgage products. Think of it like walking into a single car dealership—you can only buy the models they have on the lot that day, at their sticker price.

A mortgage broker, on the other hand, shops your application around to dozens of different lenders all across Canada. This includes the big banks, credit unions, and other financial institutions you've probably never heard of. This creates competition for your business, which very often lands you a better rate than you’d get on your own.

Access to a Wider Range of Mortgage Products

Beyond just the rate, the real power of a broker is their access to a much wider array of mortgage products. This variety is a huge advantage for buyers in the diverse Okanagan real estate market.

A traditional bank often has rigid, one-size-fits-all criteria. If your financial situation doesn't fit perfectly into their box, you might just be out of luck.

Brokers have more tools in their toolkit. They work with lenders who specialize in different situations, giving you more paths to a "yes."

Key Takeaway: A broker’s value is finding the right product with a competitive rate for your specific life situation. This flexibility can be the difference between getting approved or being declined.

Real-World Scenarios in the Okanagan

Let's look at how this plays out for people buying homes right here in our community.

The Self-Employed Professional in West Kelowna: Lots of successful entrepreneurs and contractors in the Okanagan have income that doesn't look "standard" on paper. A major bank might struggle with that, but a broker knows exactly which lenders specialize in stated-income or business-for-self programs.

The First-Time Home Buyer in Vernon: Saving a down payment is tough. A broker can connect you with lenders offering flexible down payment options, cash-back mortgages, or programs designed specifically to help new buyers get into the market.

The Real Estate Investor in Penticton: If you're building a portfolio of rental properties, you’ll quickly hit a wall with the big banks. A broker can bring you to investor-friendly lenders who understand your goals and have products built for scaling your investments.

This wider selection also applies to the type of mortgage you get. A broker can lay out a full spectrum of options, from short-term fixed rates to more complex variable-rate products. Getting your head around the nuances is key, which is why we put together a detailed guide to help you choose between fixed vs. variable rate mortgages that’s perfect for Kelowna home buyers.

Ultimately, a broker’s network means they are far more likely to find a solution when a bank's rigid rules might have been a dead end. They simply bring more options to the table, increasing your chances of securing the financing you need for your Okanagan dream home.

Service and Advice: Who's Really on Your Team?

Getting a mortgage isn't just about crunching numbers; it's about having a trusted guide who can give you straight answers when you're making one of the biggest financial decisions of your life. This is where the experience with a bank versus a mortgage broker can feel like night and day, especially when you’re navigating the fast-paced Kelowna real estate market.

A mortgage specialist at a bank is an employee. They know their bank's products inside and out, which is great, but their advice and product menu stops right there.

Mortgage brokers, on the other hand, are independent. Their loyalty isn't to a single bank; it's to you, the home buyer. Their entire business is built on shopping the market to find the best possible mortgage for your situation, not just pushing one set of products.

Your Situation Isn't One-Size-Fits-All

Let's be honest, the motivation is completely different. A bank specialist is there to sell you their bank's mortgage. A broker is there to solve your specific financial puzzle, regardless of which lender's name is on the final paperwork.

This changes the entire conversation. For instance, if you're self-employed in West Kelowna or an investor eyeing properties in Penticton, your financial situation probably doesn't fit into the tidy little box a big bank prefers.

A broker’s job is to hear your story—your income, your goals, your unique challenges—and find a lender who gets it. They become your advocate, championing your application to the lenders who are most likely to say "yes."

This kind of personalized service is a huge advantage. It’s about building a relationship for the long haul, not just closing a deal. A good broker keeps in touch, flagging when it’s time to renew or if a market shift opens up an opportunity to refinance and save some serious cash.

The Numbers Don't Lie: More Canadians Are Choosing Brokers

The way Canadians secure their mortgages is changing, and the trend is clear: people are moving toward the personalized, market-wide approach that brokers bring to the table.

A recent report for 2025 is pretty revealing, showing that two-thirds of Canadians—about 66%—are now likely to consider using a mortgage broker for their next home loan. Brokers are outperforming banks in every service category, from initial satisfaction (49% vs. 33%) to the overall experience (43% vs. 38%). You can read the full 2025 housing market report to see the detailed breakdown.

This data lines up perfectly with what we see every day at Vantage West Realty. Our clients consistently tell us how much they value the clarity, choice, and dedicated support they get when they partner with an independent mortgage expert.

Having a True Expert in Your Corner

Ultimately, the choice between a mortgage broker vs bank in Canada often boils down to the type of support you want on your side.

Bank: You get an expert on that specific bank's products. This can work just fine if your finances are straightforward and you have a solid, long-standing relationship with them already.

Broker: You get an expert on the entire mortgage market. They work for you, offering unbiased advice and making lenders compete for your business, which almost always works in your favour.

For many people buying a home in the Okanagan, the broker’s approach delivers a much greater sense of confidence. They’re your guide through the fine print, comparing things like prepayment penalties and ensuring the mortgage you sign today still makes sense for your financial goals five years from now. That’s the kind of client-first service that turns a stressful process into a successful one.

How Costs and Lender Relationships Work

One of the first questions we always get from home buyers in Kelowna is, "So, how exactly does a mortgage broker get paid?" It's a great question, and the answer gets right to the heart of the difference between these two paths. Understanding how the money flows is key to figuring out who is truly working for you.

For the most part, a mortgage broker’s service is completely free to you, the borrower. The lender who ultimately gets your business pays the broker a commission for bringing them a new, qualified client. Think of it as a finder's fee. This setup is designed to put your interests first—the broker is motivated to get your mortgage funded, period.

Bank mortgage specialists, on the other hand, are salaried employees. Their paycheque comes directly from the bank, not from a competitor. This creates a fundamentally different dynamic.

The Cost Breakdown

It’s helpful to see how these two payment structures can shape your experience:

Mortgage Broker: Since their commission comes from the lender, their main goal is to find a deal that works for you and get it across the finish line. This often means they’ll fight harder to find a creative solution, especially if your situation is complex—like having self-employed income, which is common here in the Okanagan.

Bank Specialist: As an employee, their job is to sell you one of their bank's specific products. While there's no direct fee for their time, your choices are walled off within that single institution.

There are some rare exceptions. For highly complex deals, like private lending for a unique property or a commercial mortgage, a broker might charge a fee. But for the vast majority of residential mortgages for homes in Kelowna or Penticton, you won’t pay them a single dime. This is always disclosed upfront, so there are never any surprises.

The Power of Relationships

The other huge difference lies in the relationships you gain access to. When you get a mortgage from your bank, your relationship is with that one institution. All your eggs are in one basket. It can feel simple, but it's also incredibly limiting.

A mortgage broker, however, opens up their entire network to you. They've spent years building solid relationships with dozens of lenders—from the big banks to smaller credit unions and trust companies you might not even know exist. For a better sense of the options out there, our guide on the best mortgage lenders in Canada offers some great context.

This network is a powerful asset. A good broker knows each lender's specific appetite—who is friendly to rental property investors, who has the best rates for insured mortgages right now, and who is most flexible with contract workers or recent graduates.

This inside knowledge can save you an incredible amount of time, money, and frustration. Instead of you applying at multiple banks and racking up hits on your credit score, a broker shops the market for you with a single application. They become your personal finance ambassador, matching your unique needs to the lender best equipped to say "yes."

For real estate investors in the Okanagan looking to scale their portfolio, this kind of access isn't just a convenience—it's a critical strategic advantage.

Deciding Which Is Right for Your Real Estate Goals

So, how do you choose the right path for your real estate goals here in the Okanagan? The best choice between a mortgage broker and a bank really boils down to your specific circumstances. There’s no single right answer, but by looking at different real-world scenarios we see every day at Vantage West Realty, you can get a clearer picture of which approach fits you best.

Think of this decision as choosing the right strategic partner for your journey. A first-time home buyer in Vernon who's feeling a bit overwhelmed will find a broker's guidance and access to multiple lenders invaluable. On the other hand, a long-time bank customer in Penticton with a straightforward financial profile might feel more comfortable going direct.

The financial landscape in Canada shows both paths are popular for a reason. In 2025, Canada's Big 6 banks are projected to command 59% market share of new mortgage originations, with credit unions holding another 18%. But don't count brokers out—they capture a vital niche, especially in high-priced markets like BC where they handle a huge number of deals using non-traditional products. You can learn more about these 2025 Canadian mortgage insights and see just how brokers thrive in competitive markets.

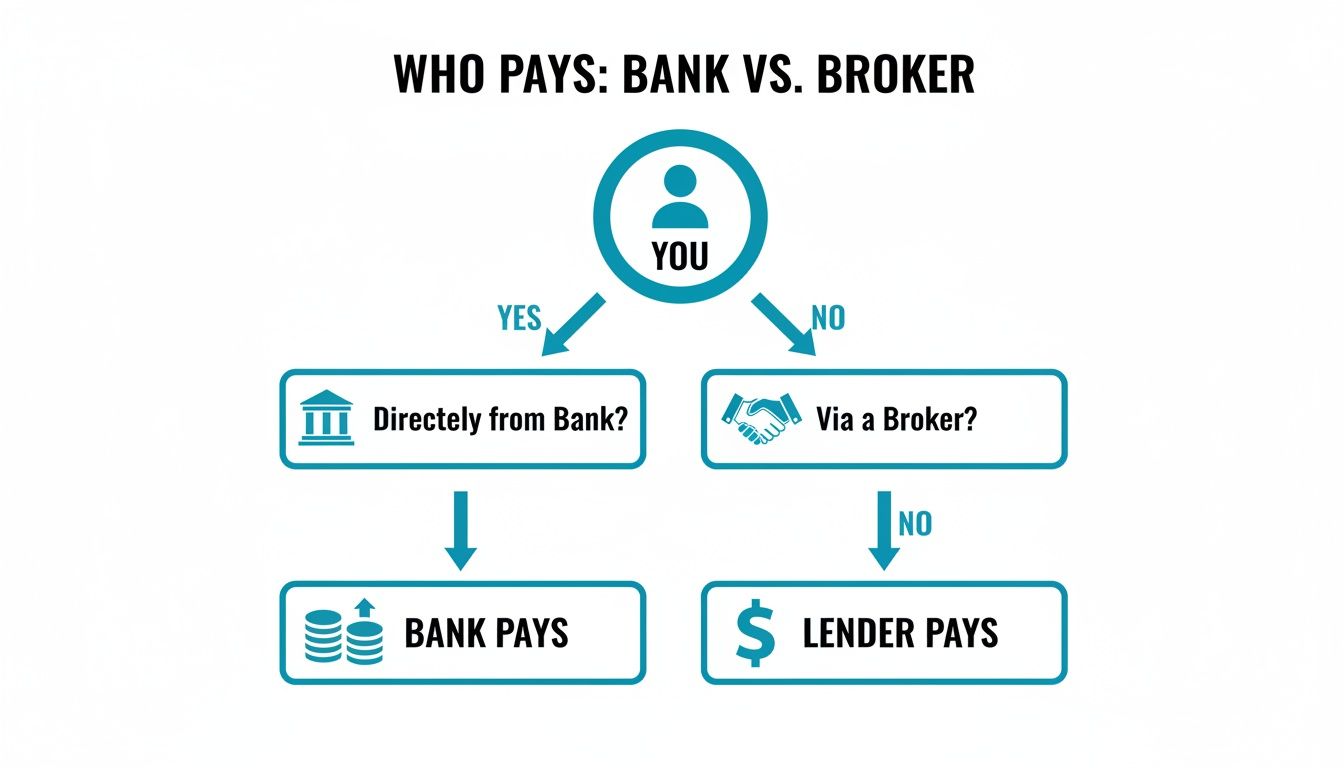

The diagram below breaks down the fundamental payment flow, showing who pays for the service in each case.

As you can see, when you work with a broker, their commission is typically paid by the lender who funds your mortgage, not directly by you.

Deciding between a broker and a bank depends entirely on your financial profile, your goals, and how much legwork you want to do yourself. The table below outlines some common buyer profiles we see in the Okanagan to help guide your decision.

Best Fit Scenarios: Broker vs. Bank

Buyer Profile Often a Better Fit With a Broker Often a Better Fit With a Bank

First-Time Home Buyer | Yes. A broker provides education, compares multiple lenders, and finds programs tailored to new buyers, simplifying a complex process. | Maybe. A good option if you have a strong, long-standing relationship with your bank and a very straightforward application. |

Self-Employed / Contractor | Absolutely. Brokers have access to lenders specializing in non-traditional income verification, which is crucial for Okanagan entrepreneurs. | Rarely. Big banks often have rigid income requirements that don't easily accommodate self-employed individuals. |

Real Estate Investor | Essential. Brokers can access investor-friendly lenders, structure financing for multiple properties, and find creative solutions to scale a portfolio. | Unlikely. Most banks have strict limits on the number of rental properties they will finance for a single individual. |

Credit Challenges | Yes. Brokers can connect you with B-lenders or credit unions that are more flexible with credit scores and financial history. | No. Major banks typically have strict credit score cutoffs and are less flexible for borrowers with bruised credit. |

Simple, Strong Profile | Still a great option. A broker can validate that your bank's offer is truly competitive by shopping it against the market. | Yes. If you have a stable T4 income, great credit, and a standard down payment, your bank can likely process your application efficiently. |

Seeking Loyalty Perks | N/A. Brokers focus on finding the best market rate, not relationship-based discounts from a single institution. | Potentially. If you have significant investments or business accounts, your bank may offer a preferred rate as a loyalty incentive. |

Ultimately, the goal is to secure the right mortgage with terms that support your financial well-being. Whether it's the wide-net approach of a broker or the familiar path of your own bank, understanding which one aligns with your specific needs is the first step toward successfully financing your home in the Okanagan real estate market.

Your Next Steps to Securing Financing in Kelowna

Feeling more confident about the mortgage broker vs. bank debate? Good. Now it’s time to put that knowledge into action.

No matter which path you take for your Kelowna home financing—be it a bank or a broker—the groundwork you need to lay is pretty much the same.

Your first move? Get your financial ducks in a row. This is the foundation of your mortgage application, and trust me, it will make the entire journey that much smoother.

Prepare Your Financial Toolkit

Before you even sit down with a lender or broker, start gathering the essential paperwork. Having everything ready to go from the start shows you’re a serious, organized buyer.

Proof of Income: Typically, this means your last two years of T4s and a recent pay stub. If you’re self-employed, you'll need the last two years of your Notices of Assessment from the CRA.

Down Payment Proof: Lenders need to see where your down payment is coming from. Get ready to provide three months of bank statements showing the funds sitting in your account.

Existing Debts: Jot down a clear list of all your monthly debt payments. This includes car loans, student loans, credit card balances—everything.

Get Pre-Approved

Once your documents are organized, the next logical step is getting pre-approved. In the Kelowna real estate market, a pre-approval is your golden ticket.

A pre-approval gives you a clear, realistic budget to work with and shows sellers you have the financial backing to make a serious offer. In a competitive market, this can be the edge you need.

This process also involves a credit check and a hard look at the mortgage stress test. Understanding how the stress test works is vital, as it directly shapes how much you can actually borrow. You can learn more about how the stress test impacts your mortgage approval in our detailed guide.

Partnering with an expert Vantage West Realty agent right from the beginning ensures your financing strategy aligns perfectly with your property search from day one.

Your Questions, Answered

Going through the mortgage process always kicks up a few questions. Here are some of the most common ones we hear from home buyers in the Okanagan when they're weighing their options between a mortgage broker and their bank.

Are Mortgage Broker Rates Always Better Than Bank Rates?

Not always, but brokers usually have the upper hand. Since brokers get lenders to compete for your business, they often tap into wholesale rates that are lower than the advertised retail rates you'd find walking into a bank branch.

That said, if you have a long and really positive history with your bank, they might just come to the table with a competitive loyalty rate to keep you. The broker’s real advantage, though, is their ability to scan the entire market, making sure the rate you get is one of the best available for your unique financial picture.

Is It Faster to Get a Mortgage Through a Bank or a Broker?

This one really depends. If your financial situation is clean and straightforward, your own bank can sometimes push a simple application through pretty quickly since they already have your accounts.

But if there’s any kind of complexity involved—like being self-employed or having a unique property—a broker can often pull ahead. They know exactly which lenders are a good fit for your file and can get ahead of underwriting questions, cutting down on delays. In a hot market like Kelowna’s, a sharp broker’s efficiency is a massive asset.

Can I Use a Mortgage Broker if I Have Bad Credit?

Absolutely, and this is where a broker can be a true game-changer. The big banks usually have rigid credit score rules and are quick to say no to anyone who doesn't fit their perfect mould.

Mortgage brokers, on the other hand, have a much wider network. This includes 'B-lenders' and other alternative lenders who specialize in helping people with bruised credit. A good broker won't just find you a lender who will say yes; they’ll also give you solid advice on how to get your credit back on track.

Does It Cost Money to Use a Mortgage Broker in Kelowna?

For the vast majority of residential mortgages, the broker's service costs you nothing. Their commission is paid by the lender that ends up funding your mortgage once everything is finalized.

In more complex deals, like securing private lending for a one-of-a-kind property or some commercial financing, a fee might come into play. If that’s the case, it will be disclosed to you clearly and upfront. It’s always smart to ask about their payment structure in your first chat, just so there are no surprises down the road.

If you’re thinking about buying or selling in Kelowna, Vantage West Realty can help you make your next move with confidence. Reach out today.