Your 2025 Guide to Buying Condos In Kelowna BC

Trying to wrap your head around the Kelowna condo market can feel like you're caught in a whirlwind. One news report talks about interest rates, the next about inventory, and another about fluctuating prices. It’s enough to make anyone's head spin, and we get it. It’s a lot to take in.

But here's the thing: beneath all that noise, the market is showing some incredible resilience. We're seeing condo values hold strong, and the best-priced units are still getting snapped up quickly by buyers who know what they’re looking for.

Kelowna's Condo Market: A Current Snapshot

This is your no-nonsense guide to what's happening on the ground, right now. We'll cut through the jargon and break down the key numbers that matter for condos in Kelowna BC, like average prices and how long it's taking to sell. Think of it as your personal market briefing, designed to give you the clarity you need to make your next move.

Whether you're a first-time buyer dreaming of your own place, an investor scouting the next opportunity, or a downsizer ready for a new chapter, it all starts with understanding the data. The Okanagan real estate scene is always shifting, but our job is to show you exactly where the opportunities are.

The Numbers That Matter Most

It’s easy to get lost in the headlines. Let’s focus on the facts instead. The most recent data paints a really interesting picture of demand and strength in our local condo sector.

Even with some shifts in sales activity, the market has held strong. This is especially true for condos.

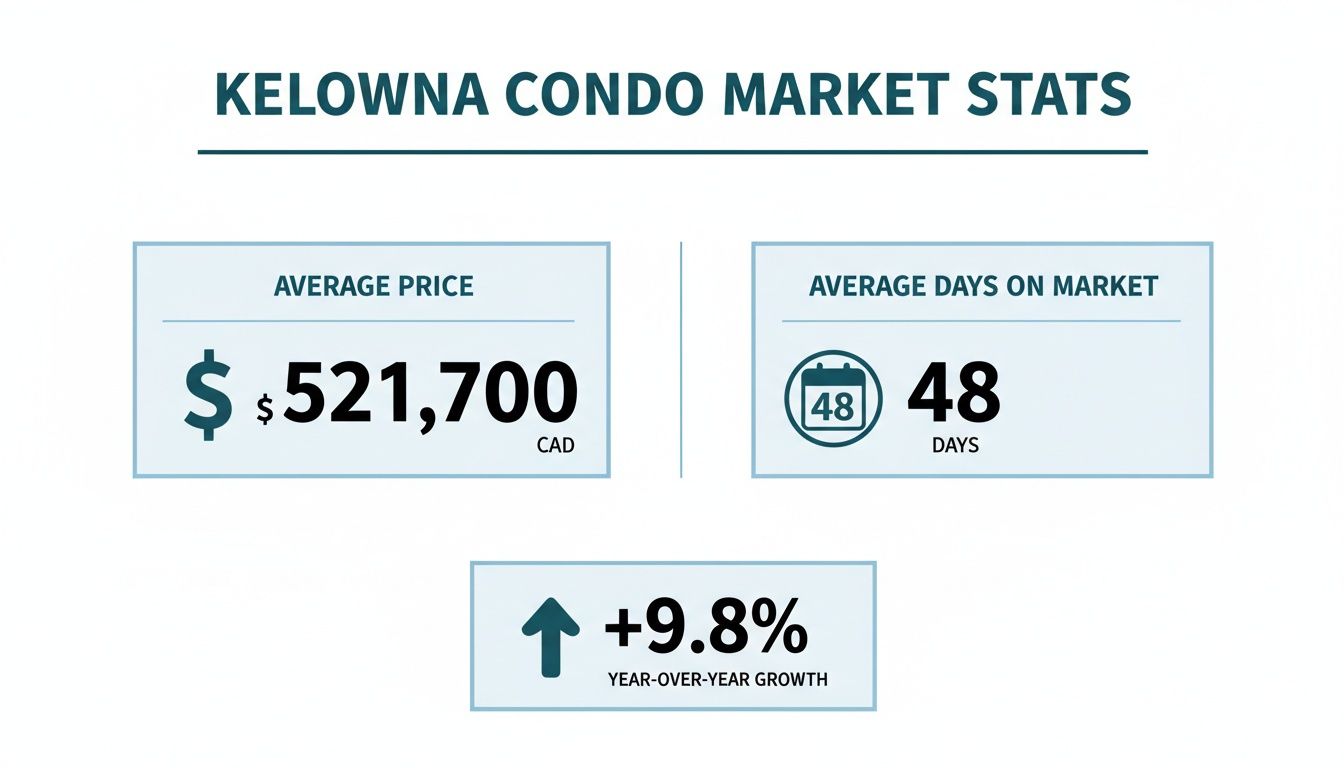

Kelowna Condo Market At a Glance Q2 2025

Here’s a quick summary of the key statistics for the Kelowna condo market. This table provides a clear snapshot of current conditions, giving both buyers and sellers a solid overview.

Metric Q2 2025 Figure Year-Over-Year Change

Median Sale Price | $521,700 | +9.8% |

Average Days on Market | 48 days | -3 days |

Sales Volume | 185 units | -4% |

Months of Inventory | 3.2 months | +0.5 months |

What these numbers really tell us is that despite a more balanced market, buyer demand is keeping condo values strong. This makes them a solid part of the Kelowna real estate landscape.

Drilling down a bit, market analysis from Q2 2025 shows that the median sale price for a condo jumped 9.8% year-over-year to $521,700. That’s an impressive climb, especially when you see it outpaced the overall market's 5% gain. At the same time, the average days on market actually tightened to just 48 days, which tells us that well-priced condos are not sitting around for long. Want to dive deeper? Check out our full Q2 2025 Kelowna real estate market report.

This helpful infographic brings those key stats to life:

What This Means For You

Okay, so what’s the real takeaway from all this data? It means there's a unique opportunity for every type of buyer out there.

For First-Time Buyers: A slight increase in inventory gives you more options to choose from and a bit more breathing room to make the right decision without feeling rushed.

For Investors: The solid price growth and the speed at which desirable units sell confirms that Kelowna condos are still a very smart place to park your capital.

For Downsizers: You can feel confident about the value of your current home while knowing there are some fantastic lock-and-leave options out there waiting to fit your new lifestyle.

At Vantage West Realty, our job is to translate these market statistics into a clear strategy for you. We look past the noise to find the path that helps you achieve your specific goals.

Exploring Kelowna's Top Condo Neighbourhoods

Finding the right condos in Kelowna BC is about so much more than just picking a unit—it’s really about choosing a lifestyle. Every neighbourhood in this city has its own distinct personality and rhythm. Are you someone who thrives on the buzz of walking to waterfront cafés and local boutiques? Or does the thought of a relaxed, beach-town vibe in a quieter corner of the city sound more like your speed?

Think of this as your insider’s tour of Kelowna's most sought-after condo communities. We’ll dig into the unique character of each one, giving you a genuine feel for what daily life is like. By the end, you'll have a much clearer picture of what to expect, from the style of the buildings to the kind of community you’ll be joining.

Downtown Kelowna: The Heart of Urban Living

If you crave that big-city energy and absolute convenience, Downtown Kelowna is where you want to be. This is the city's vibrant core, where sleek high-rises serve up breathtaking views of Okanagan Lake and the mountains. Living here means having restaurants, shops, craft breweries, and cultural hotspots literally right outside your front door.

Landmark developments are actively reshaping the skyline, bringing resort-style amenities and a new level of urban sophistication to the area. For anyone leading an active life, the easy access to the waterfront promenade, City Park, and the Kelowna Yacht Club is a massive plus.

Who it’s for: Young professionals, couples, and downsizers who want a truly walkable, car-optional lifestyle.

Building Style: Dominated by new and modern high-rise towers with premium amenities like pools, fitness centres, and concierge services.

Price Range: Generally sits at the higher end of Kelowna’s condo market, which reflects the prime location and luxury features.

Downtown living is all about access. It’s for the person who loves the idea of leaving the car keys on the counter and diving right into the city’s pulse, whether it’s for a morning coffee or a night at the theatre.

Lower Mission: The Perfect Blend of Beach and Community

The Lower Mission has a more relaxed, community-focused feel, but you're not giving up any convenience. It's famous for its beautiful sandy beaches, like Gyro and Rotary, and its quiet, tree-lined streets. This area strikes a perfect balance between a laid-back "beach town" atmosphere and easy access to great schools, the H2O Adventure + Fitness Centre, and plenty of shopping.

Condo life in the Lower Mission typically means low-rise and mid-rise buildings. You'll find a mix of older, established properties alongside brand-new developments. It's an area that genuinely appeals to a wide range of people, from young families to retirees. For a deeper dive into this kind of lifestyle, you can check out our guide to Kelowna’s most walkable neighbourhoods.

Rutland: An Affordable and Evolving Hub

Rutland is one of Kelowna’s largest and most established neighbourhoods, and it offers some of the most accessible entry points into the real estate market. It’s a diverse, practical community with a strong local identity and its own town centre packed with shops, restaurants, and essential services.

The condo scene in Rutland is mostly made up of older, well-maintained low-rise buildings. This makes it a fantastic spot for first-time homebuyers and investors looking for solid rental potential. With ongoing revitalization projects and its close proximity to UBCO and the airport, Rutland's value is definitely on an upward trend.

Who it’s for: First-time buyers, students, and savvy investors.

Building Style: Mostly low-rise wood-frame buildings from the 80s and 90s, offering fantastic value.

Price Range: Typically the most affordable in Kelowna, providing a great opportunity to get into the market and build equity.

Glenmore: Family-Friendly and Centrally Located

Glenmore is a highly sought-after neighbourhood that manages to feel tucked away from the hustle while being incredibly central. From here, it’s just a quick drive to downtown, the university, the airport, and major shopping centres. Known for its excellent schools and family-friendly parks, Glenmore is a top choice for anyone with kids.

The condo options here are a healthy mix of newer mid-rise developments and established townhome complexes. It has a more suburban feel with lots of green space, walking trails, and a strong sense of community, making it a fantastic all-around choice for a wide variety of buyers.

Understanding Strata Fees and Bylaws

When you buy a condo, you’re buying more than just your unit—you're stepping into a shared community. That means you're also buying into a collective system of finances and rules, which can feel a little intimidating at first. Let's break it down.

Getting a firm handle on strata fees and bylaws is one of the most critical steps in buying condos in Kelowna BC. It’s what protects you from surprise costs and ensures the home you choose actually fits your lifestyle.

What Your Strata Fees Actually Cover

Think of strata fees as your monthly contribution to the building's shared operating budget. Every owner chips in to keep the property running smoothly and looking its best, which is a collective effort that protects the value of everyone's investment.

So, where does that money actually go? While the exact breakdown varies from one building to another, your fees typically cover essential costs that you'd otherwise be paying for on your own in a detached house.

These common expenses usually include:

Building Maintenance: This is the day-to-day upkeep of common areas like lobbies, hallways, elevators, and the building's exterior.

Landscaping and Snow Removal: Keeping the grounds beautiful in the summer and, more importantly, safe and clear in the winter.

Common Area Utilities: The cost to heat and light hallways, power the elevators, and run any shared amenities like a gym or pool.

Building Insurance: This policy covers the entire structure and common property. You’ll still need your own personal insurance for your unit’s contents and liability, though.

Contingency Reserve Fund (CRF) Contribution: This is the building’s savings account. A portion of your fees goes into the CRF to pay for major, infrequent repairs and replacements, like a new roof or boiler. A healthy CRF is a great sign of a well-managed building.

For a deeper dive into these costs, our guide on what is a strata fee offers a complete overview.

How to Read Strata Documents and Spot Red Flags

Before you write an offer, you get the chance to review the building's complete package of strata documents. This is your moment to look under the hood and see exactly how this community operates. It's a hefty stack of paper, but knowing what to look for makes all the difference.

A well-managed strata with healthy finances and clear, reasonable bylaws is a fundamental part of a good real estate investment. It protects your property’s value and ensures a peaceful living environment.

You'll want to focus on a few key documents:

Financial Statements: Check for a healthy operating budget and pay close attention to the Contingency Reserve Fund. If the CRF is low, it could be a major red flag that a special levy—a one-time cash call for a major repair—is looming.

Strata Meeting Minutes: Reading through the minutes from the past couple of years is like being a fly on the wall. You’ll discover recurring issues, debates among owners, and any big projects being discussed.

Bylaws and Rules: This is where you find the day-to-day rules of living in the community. Can you have pets, and are there size or breed restrictions? Are rentals allowed? What are the rules for using your BBQ or making renovations?

Getting clear answers upfront will save you from major headaches later. An experienced real estate advisor is invaluable here, as they can help you sift through the jargon and point out potential red flags you might otherwise miss.

Common Strata Bylaw Checklist For Kelowna Condo Buyers

When you're reviewing the strata documents, it's easy to get lost in the details. This table highlights some of the most important bylaws to check before you commit. Think of it as your quick-reference guide to avoid surprises.

Bylaw Category Key Questions to Ask Why It Matters

Pet Policies | Are pets allowed? Any restrictions on number, size, or breed? | A "no pets" policy is a deal-breaker for animal lovers. Unexpected restrictions can cause major heartache. |

Rental Restrictions | Are long-term or short-term (e.g., Airbnb) rentals permitted? Is there a rental cap? | Affects your ability to use the condo as an investment property and can impact the building's overall community feel. |

Age Restrictions | Is the building restricted to certain age groups (e.g., 55+)? | This determines who can legally live in the unit and significantly influences the lifestyle and atmosphere of the building. |

Renovation Rules | What is the process for approving renovations? Are there restrictions on flooring, plumbing, or structural changes? | Understanding this prevents conflicts and ensures your planned upgrades are even possible. Some buildings have strict rules. |

Noise & Nuisance | What are the quiet hours? Are there rules about parties, musical instruments, or balcony usage (e.g., BBQs, smokers)? | These bylaws directly impact your day-to-day quality of life and enjoyment of your home. |

Parking & Storage | How are parking stalls and storage lockers assigned? Are there rules for visitor parking? | Clarifies what you're getting and avoids future disputes over these valuable, often limited, resources. |

Asking these questions is a crucial part of your due diligence. It ensures the condo you’re considering isn’t just a great space, but a community where you—and your lifestyle—will truly fit in.

Financing Your Kelowna Condo Purchase

Getting a mortgage for a condo isn't quite the same as for a detached house. It’s not just your personal finances that are under the microscope; lenders also take a very close look at the financial health and overall management of the entire strata corporation.

You can think of it like this: the bank wants to know that the whole building is a solid investment, not just your individual unit. This extra layer of due diligence is there to protect both you and them, and a well-run building makes your mortgage approval process a whole lot smoother.

What Lenders Look For in a Condo Building

When you apply for a condo mortgage, your lender will ask to see all those strata documents we talked about earlier. They're hunting for specific green flags that signal a low-risk, stable investment. A strong application really comes down to two things: your personal financial picture and the building's stability.

Here’s what’s on their checklist:

A Healthy Contingency Reserve Fund (CRF): Lenders need to see a robust savings account set aside for future repairs and maintenance. If the CRF is too low, it’s a sign the building isn't prepared for a major expense, which could lead to a special levy that puts a strain on your ability to pay the mortgage.

No Ongoing Lawsuits: Active litigation against the strata corporation is a major red flag for lenders. This can make financing incredibly difficult—or even impossible—until the legal issues are fully resolved.

Reasonable Owner-to-Renter Ratio: Some lenders have internal guidelines about the percentage of units that are rented out versus occupied by the owners. A very high number of renters can sometimes be a cause for concern.

Adequate Insurance Coverage: The lender will want to verify that the strata corporation’s insurance policy is comprehensive enough to cover a total loss of the property.

A building with a strong financial track record and proactive management is easier to get a mortgage for and a more secure long-term investment. It shows that the owners are collectively protecting their shared asset.

Getting Pre-Approved and Shopping with Confidence

Getting a mortgage pre-approval is, without a doubt, the most important first step you can take. It’s a straightforward process where a lender assesses your finances—your income, debts, and credit score—to figure out exactly how much you can realistically afford to borrow.

In Kelowna’s condo market, showing up with a pre-approval letter tells sellers you're a serious, qualified buyer. It gives you the power to put in a firm, confident offer the second you find the right place.

Understanding how lenders apply criteria like the mortgage stress test is also crucial for setting a realistic budget. For more details, you can learn how the stress test impacts your mortgage approval in our detailed guide.

Walking into an open house with your financing already sorted out gives you a huge advantage. It lets you focus on what really matters: finding the perfect condo that fits your life.

The Investor's Guide to Kelowna Condos

Kelowna's condo market has long been a smart play for real estate investors. With a steady stream of new residents and huge rental demand, it's a proven path for building long-term wealth here in the Okanagan. A successful investment is about making a strategic, informed decision that pays off for years to come.

This guide is for anyone looking to build a profitable real estate portfolio in Kelowna. We'll break down the key metrics that separate a great investment from a potential headache, giving you the tools you need to move forward with confidence.

Identifying High-Potential Investment Properties

A smart investment always starts with thinking like a renter. In Kelowna, tenants consistently prioritize location, convenience, and modern amenities. Properties that nail these three things will always command higher rents and suffer fewer vacancies.

Keep an eye out for condos in neighbourhoods with strong fundamentals:

Proximity to Major Hubs: Any unit near UBC Okanagan, Kelowna General Hospital, or the downtown core is gold. You'll have a built-in pool of students and professionals who need to be close to work or school.

Walkability and Transit: Being able to walk to grocery stores, cafes, and public transit stops is a massive draw. It opens up your property to a much wider pool of quality tenants who value convenience.

Lifestyle Amenities: Don't underestimate the power of a good gym, a pool, or even just secure bike storage. These perks often justify higher rental rates and attract tenants who stick around longer.

And here's a pro tip from our team: a one-bedroom plus den can be a fantastic investment. That extra space offers flexibility for tenants who need a home office, which is a huge selling point in today's work-from-home culture.

Analyzing the Numbers: Cash Flow and Cap Rates

Once you've zeroed in on a promising property, it's time to crunch the numbers. For any investor, the two most important metrics are cash flow and capitalization rate (cap rate).

Cash flow is straightforward: it's the money you have left in your pocket each month after covering the mortgage, strata fees, property taxes, and insurance. If it's positive, the property is paying for itself and then some.

The cap rate is your tool for comparing apples to apples. It gives you a quick snapshot of a property's potential return, calculated by dividing its net annual income (rent minus all operating expenses) by the purchase price. A "good" cap rate can shift with the market, but it’s the best way to standardize and compare the profitability of different investment options.

A truly successful investment property works for you on two levels: it generates monthly income through positive cash flow while its value grows over time through market appreciation.

Understanding the Current Market Dynamics for Investors

The Kelowna real estate scene is always in motion, but right now, it's offering a unique window of opportunity for savvy investors. After a few years of frenzied activity, the market has settled into a more balanced, predictable state.

This shift is a powerful advantage for investors. With more properties to choose from and far less competition, you have more leverage to negotiate on both price and terms. It's the perfect climate to secure a great property without the stress of a bidding war, setting yourself up for much stronger long-term returns.

Finding the Right Partner: Your Kelowna Condo Specialist

Let's be honest, navigating the Kelowna condo market is more than just scrolling through listings online. To do it right, you need a local expert on the ground—someone you can actually trust to have your back. At Vantage West Realty, we live and breathe this market, and we're here to guide you every step of the way.

We've earned our reputation by giving real, data-backed advice that gets our clients where they want to go. With over 1,000 five-star reviews, we've shown time and again we deliver results. We know the unique hurdles buyers and investors face in the Okanagan, and our entire approach is designed to give you clarity and confidence.

A Proven Process That Puts You First

Our team, led by AJ Hazzi, takes a strategic, data-driven approach to every single deal. We’re not here to just unlock doors; we're analyzing the market to give you a genuine competitive edge. This means helping you see the subtle shifts that others miss, so you can act with confidence.

Our commitment is simple: we're your partners, and we hold ourselves accountable. We provide clear advice and dependable service, making sure you feel supported and informed from our first chat to the day you get your keys.

Whether you’re a first-time buyer needing step-by-step support or an experienced investor looking to grow your portfolio, we’re ready to help you succeed. Our team's deep knowledge of Kelowna's neighbourhoods, buildings, and strata corporations allows us to find the perfect match for your goals.

Buying or selling a condo should feel empowering, not overwhelming. Our process is built to give you the clarity you deserve, backed by a team that’s 100% committed to your real estate ambitions.

Got Questions About Buying a Condo?

Buying a condo, especially your first one, is a big step, and it’s natural to have a lot of questions. We hear them all the time from our clients looking at condos in Kelowna, BC. To help clear things up, we've put together some straightforward answers to the most common questions we get.

What's a Realistic Down Payment For a Condo In Kelowna?

In Canada, the minimum down payment is structured in tiers. You'll need at least 5% for the first $500,000 of the purchase price, and then 10% for any amount above that, up to $999,999.

Let's break it down with a real-world example. For a $600,000 condo, your minimum down payment would be $35,000. That’s $25,000 (5% of $500k) plus another $10,000 (10% of the remaining $100k).

If you’re looking at properties priced at $1 million or more, the rules change: a 20% down payment becomes mandatory. Putting down 20% or more on any purchase price also lets you sidestep CMHC mortgage insurance. My best advice? Always have a chat with a mortgage professional. They can map out your financial options and help you figure out what makes the most sense for your situation.

Is It Better To Invest in a New Build or a Resale Condo?

This is a classic question, and honestly, there's no single "better" option. It all boils down to your personal goals, your timeline, and what level of risk you're comfortable with.

New Construction: The appeal here is obvious—you get modern finishes, shiny new appliances, and the peace of mind that comes with a home warranty. The trade-offs? You'll have to pay GST on the purchase, and there's always the potential for construction delays that could mess with your move-in date.

Resale Condos: These units are in established buildings, often in fantastic, mature neighbourhoods. You don't have to worry about GST, and you get a massive advantage: a paper trail. Years of strata documents give you a clear window into how the building is managed and its financial health.

Ultimately, you have to decide what you value more. Is it the allure of a brand-new, untouched space, or the stability and proven track record of an existing community?

The key is to weigh the pros and cons based on your personal situation. An investor focused on immediate rental income might lean toward a resale unit, while a buyer planning for the future might prefer a pre-sale condo.

Do I Really Need a Home Inspection For a Condo?

Yes. Absolutely. I can't stress this enough. There's a common myth that inspections are less critical for condos, but that couldn't be further from the truth. A good inspector will go through your specific unit with a fine-tooth comb, checking everything from the plumbing and electrical systems to the heating and appliances to make sure you're not walking into any hidden problems.

But the physical inspection is only half the battle. The other crucial part is a deep dive into the strata documents. This "paper inspection" involves a professional, detailed review of the strata minutes, financials, engineering reports, and the depreciation report. This is where you get the full story on the building's overall health and management style.

Combining a thorough unit inspection with a professional document review is the only way to truly protect your investment and ensure there are no expensive surprises waiting for you down the road.

If you’re thinking about buying or selling a condo in Kelowna, Vantage West Realty can help you make your next move with confidence. Reach out today.